Ethereum Price Prediction: ETH bulls are back in the game

- Ethereum price is back in favor of the bulls after clawing back with two consecutive days of profit.

- A favorable tailwind is emerging in cryptocurrencies after the more dovish FOMC decision.

- Expect a return toward $4,000 in a matter of weeks for ETH.

Ethereum (ETH) was in a correction phase at the beginning of the week. As the dust settles on a few global issues though, favorable tailwinds are emerging and helping bulls make a full recovery of the past two weeks of losses. ETH could, in this case, head back to $4,000.

ETH bulls are in full charging mode to break every resistance in sight

Ethereum price is in full recovery mode for a second consecutive day, breaking the seven days of straight losses that occurred just before. Bulls did get some help from a few macro events that have turned into favorable tailwinds for ETH price action. There looks to be a solution for Evergrande with the Chinese government stepping in. On Wednesday evening, Powell sounded relatively dovish for the next quarter, which helped markets make new prints higher.

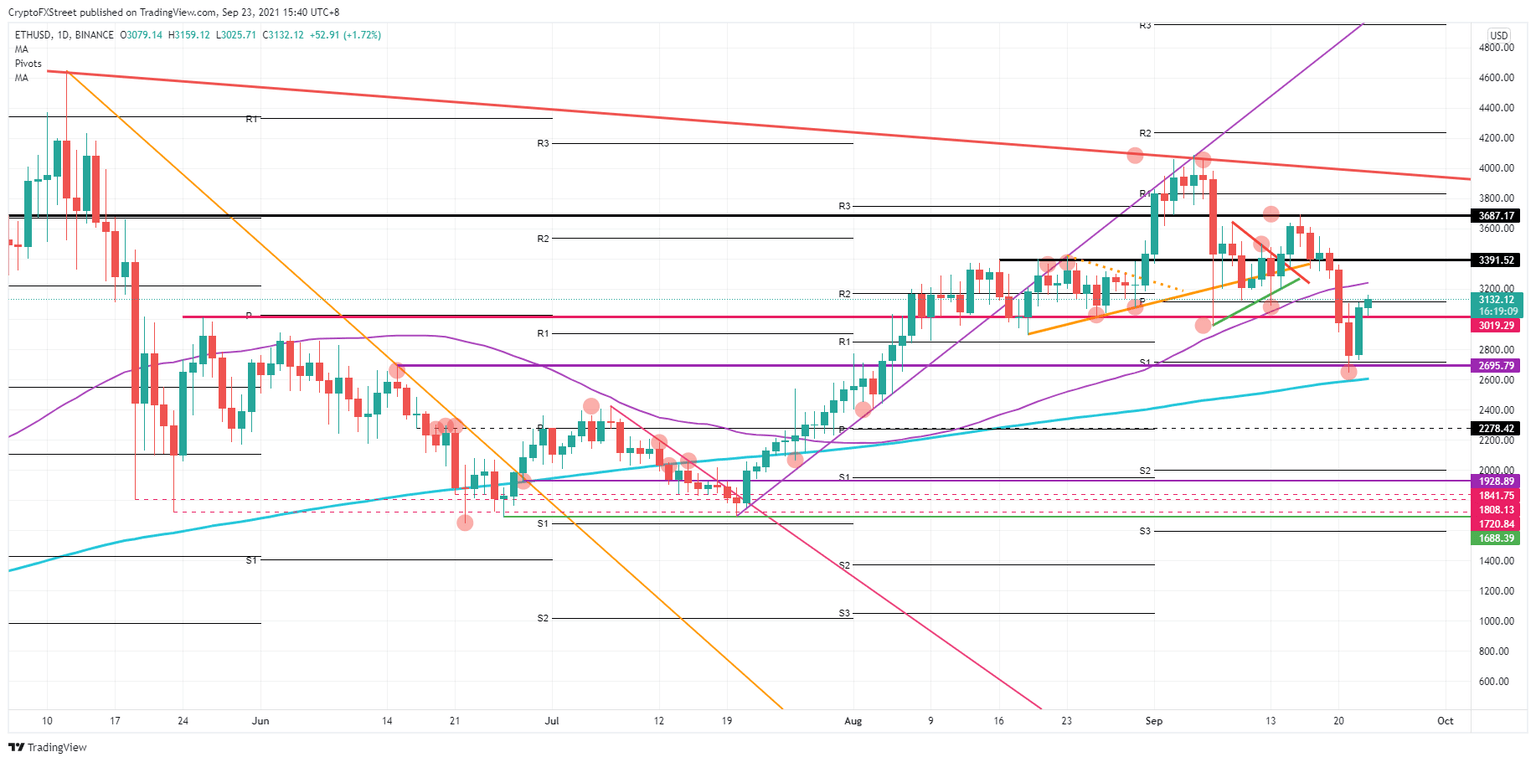

ETH price action is thus riding on a global risk-on wave, and bulls are enjoying it, with momentum in their favor. A short-term pivot at $3,140 is the first level that bulls need to overcome today. As long as the risk-on posture keeps dictating global sentiment, expect more rising price action toward $3,391. This level goes back to August 16 and holds some short-term importance.

ETH/USD daily chart

Ethereum bulls will need to watch any attempts from sellers to try and go for a bull trap. Certainly, a break above the monthly pivot at $3,391 should attract more buyers and add volume to favor more upside. Even with the positive tailwind fading, the Ethereum bulls should be able to stand on their own feet and run ETH prices higher.

If ETH bears can drag prices down again, expect a retest of $3,019, which will act as support. In case that does not do the trick, expect $2,695 to provide enough support to hold the line in Ethereum price action. That level falls in line with the monthly S1 support. Just below, ETH has the 55-day Simple Moving Average (SMA). A double-bottom formation from September 21 should attract plenty of buyers to use the opportunity to step in.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.