Ethereum price poised for greatness as on-chain metrics suggest move to $2,000 is approaching

- Ethereum price has been underperforming again in the past two weeks.

- The digital asset has not been able to keep up with Bitcoin.

- On-chain metrics remain in favor of Ethereum and continue to strengthen.

On January 14, Ethereum price had a significant spike and started to outperform Bitcoin for the first time since July 2020. However, the trend didn’t last long and ETH started to fade away in February despite Bitcoin price also falling.

Ethereum price could still jump to $2,000 thanks to on-chain metrics

One of the main strengths of Ethereum is the fact that a significant number of coins are locked away from exchanges. The Eth2 deposit contract holds over 3.35 million ETH and the total sum of Ethereum locked in DeFi protocols and projects exceeds 8.45 million which means that 11.8 million ETH are not on exchanges.

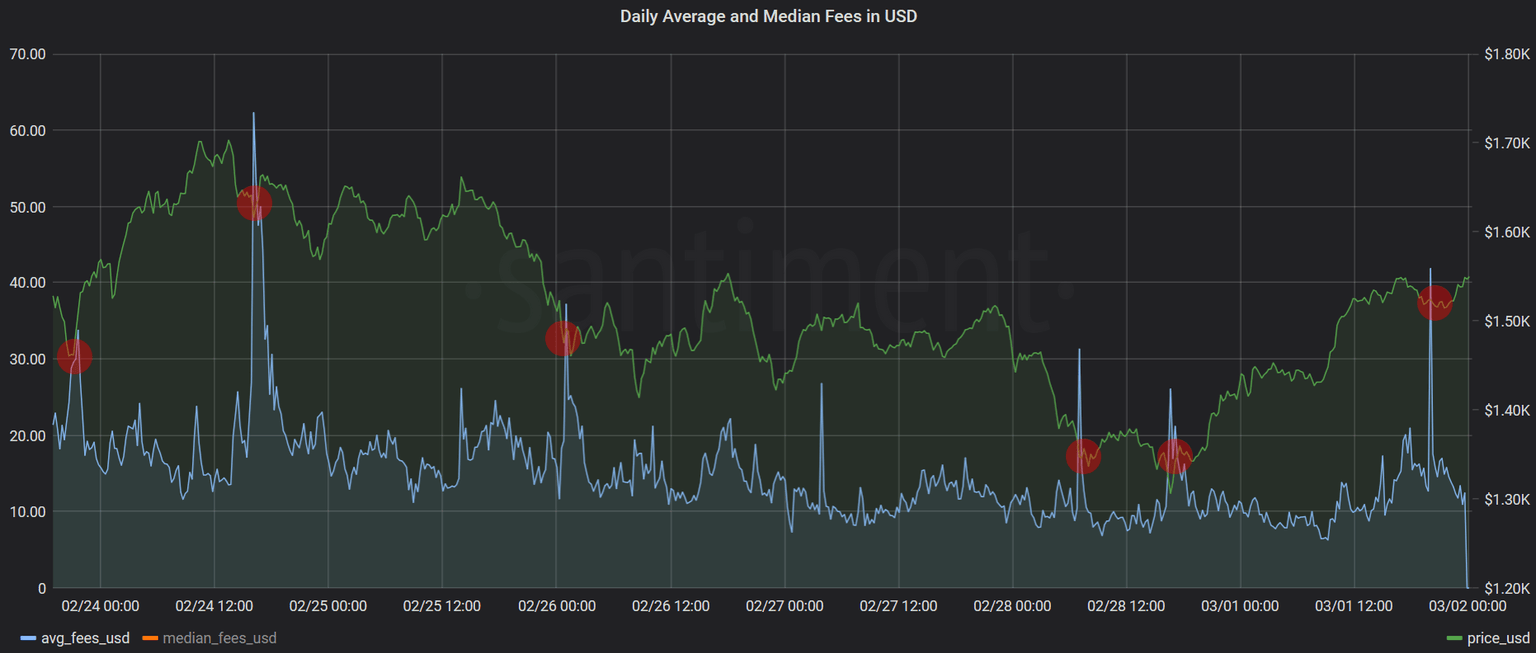

ETH fees chart

According to a recent report by Santiment, spikes in Ethereum fees can often represent local bottoms. Ethereum just had a significant spike in fee prices, which indicates that perhaps the digital asset is ready for a bounce.

Eth supply not moved

Even more interesting, is the fact that about 20% of the circulating supply of Ethereum has not moved on-chain in over 3 years. This indicates that many investors are not interested in selling just yet despite Ethereum price hitting new all-time highs.

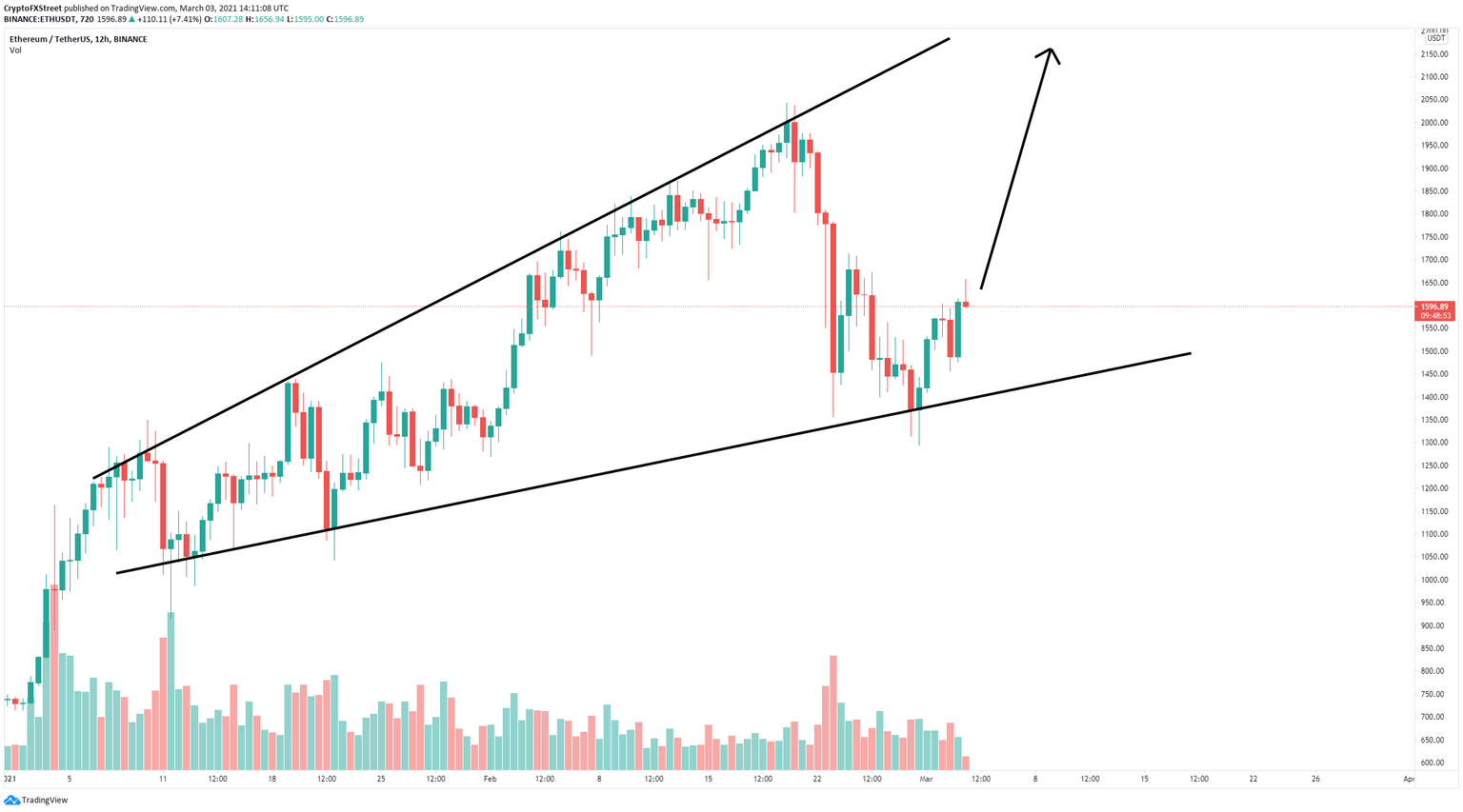

ETH/USD 12-hour chart

On the 12-hour chart, Ethereum has formed a huge expanding wedge pattern and defended its lower trendline support on February 28. A rebound from this point could quickly drive Ethereum price towards $2,100.

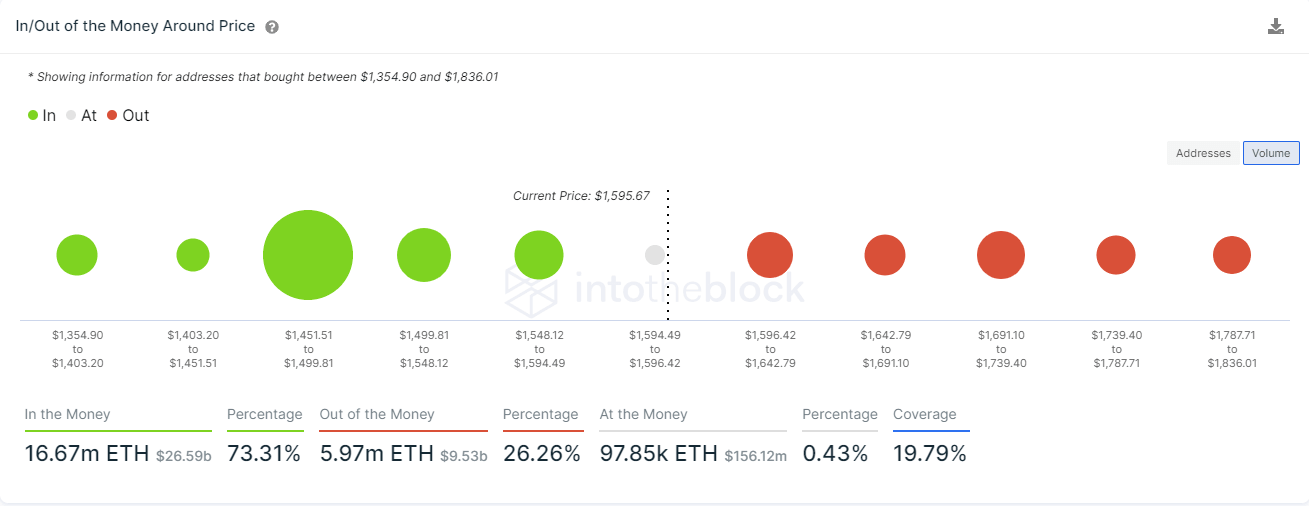

ETH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart adds credence to this outlook as it shows practically no strong resistance levels above $1,600. The most critical support level is located around $1,450.

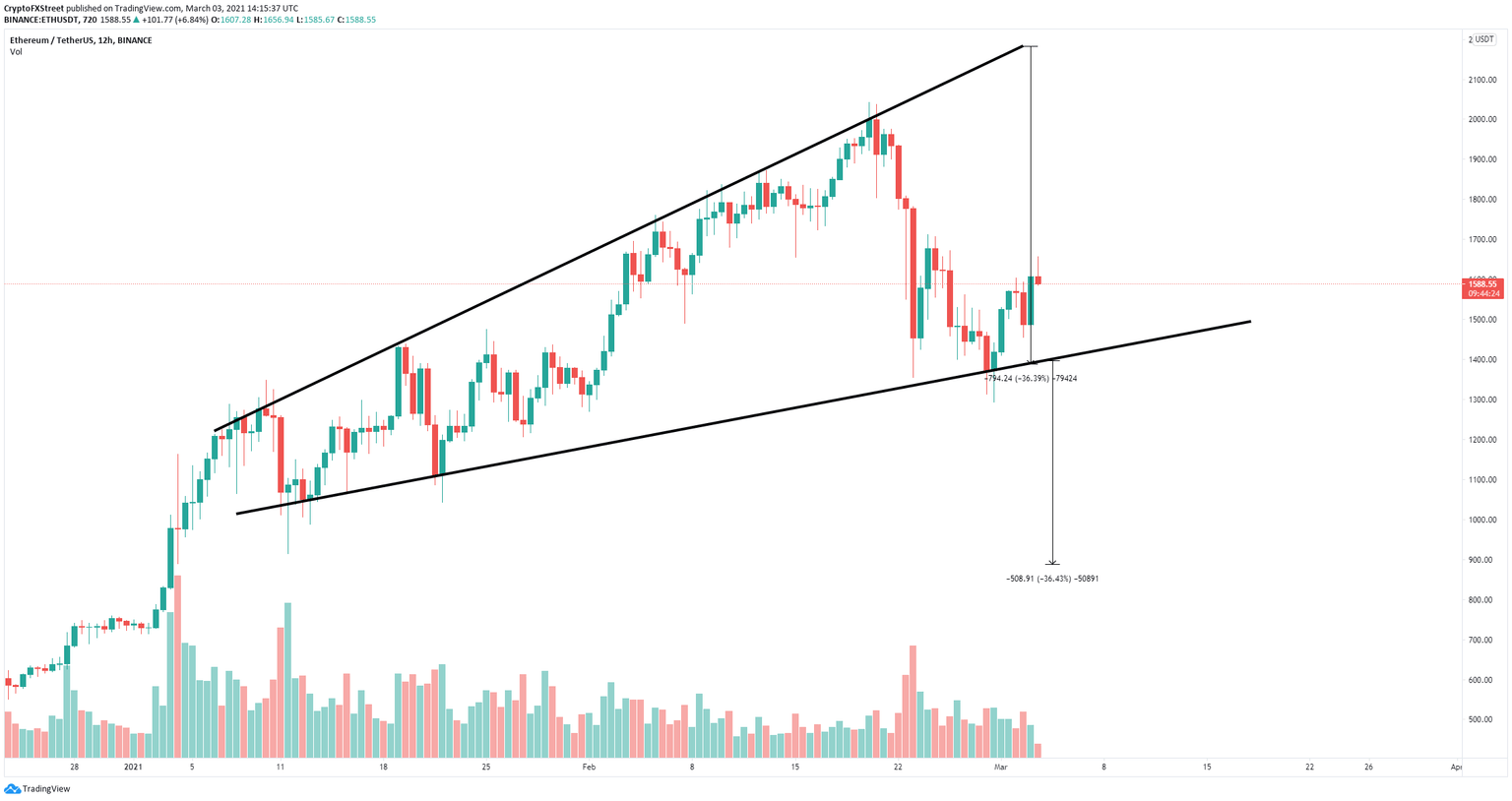

ETH 12-hour chart

The IOMAP also indicates that the area between $1,451 and $1,499 is robust. A breakdown below this point would have a bearish price target of about $885.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.