Ethereum price in free fall after FTX exchange implosion, here’s what to expect

- Ethereum price is crumbling under strong selling pressure after FTX collapse and the subsequent hack.

- Exploiter who attacked bankrupt FTX exchange is now 36th largest Ethereum holder with 200,735 ETH in their wallet.

- Analysts are bearish on Ethereum and set target levels to stack in its decline, first bid level is $1,015.

Ethereum (ETH) price suffered a meltdown in the aftermath of the FTX exchange collapse and hack. The hacker of the now bankrupt crypto exchange, FTX, still holds 200,735 ETH tokens. Analysts have predicted further decline in Ethereum and set $840 as the last bid for Dollar Cost Averaging.

Also read: Ethereum whales scoop up the altcoin as ETH price hits the $1,200 level

Ethereum price hit by bloodbath and aftermath of FTX exchange hack

Ethereum and altcoin prices started free fall after Samuel Bankman-Fried’s FTX exchange implosion. An attacker exploited the bankrupt exchange and siphoned off upwards of $600 million in customer funds from FTX. Crypto traders are watching every move of the FTX exchange exploiter, the 36th largest holder of Ethereum.

FTX exchange exploiter is the 36th largest ETH holder

The wallet address of the exploiter holds 200,735 ETH tokens. Based on on-chain analysis of the wallet, the exploiter is rapidly swapping Ethereum for renBTC (Bitcoin on other blockchains) and attempting to cash out the funds. Blockchain security expert PeckShield shared details of the swap in a tweet.

#PeckShieldAlert FTX Accounts Drainer 1 currently holds 200,735.1 $ETH (~$235.5M) & drops to the 37th largest holder of $ETH (from 27th)

— PeckShieldAlert (@PeckShieldAlert) November 20, 2022

FTX Accounts Drainer 1 has transffered 50k $ETH (~$58.5M) to 0x866E, then 0x866E swapped these $ETH for ~3,517 $renBTC and bridged out pic.twitter.com/Qokr8bQrvg

Ethereum price crumbled under massive selling pressure and yielded 8% overnight losses for holders, following recent developments. ETHUSD shed close to 30% of its value in November as traders watched the FTX saga unravel.

Is the FTX exchange attacker influencing Ethereum price?

The exploiter behind the now bankrupt FTX exchange hack is one of the largest Ethereum holders in the world. The hacker converted stolen stablecoins to Ether before swapping the largest altcoin for renBTC.

Experts believe that if the attacker sells 200,735 (wallet balance of the exploiter) Ether tokens in the open market, the second-largest cryptocurrency could bleed aggressively. The selling pressure could result in Ethereum’s carnage. However, it remains to be seen whether the hacker sells ETH on exchanges or swaps it for other cryptocurrencies before cashing out the stolen funds.

Analysts eye these levels for capitulation in Ethereum

0xStacker, a pseudonymous crypto analyst, shared the key levels to watch out for as Ethereum price consolidates. The expert’s first bid level is $1,015, the bottom of the summer consolidation range.

ETHUSDT price chart

If bears are in control of Ethereum price, 0xStacker expects ETH to nosedive under the $900 level. The altcoin could swing low to the $882 level and the last line of defense is $840. The technical analyst believes this is the optimal time for aggressive Dollar Cost Averaging in Ethereum.

ETHUSDT price chart

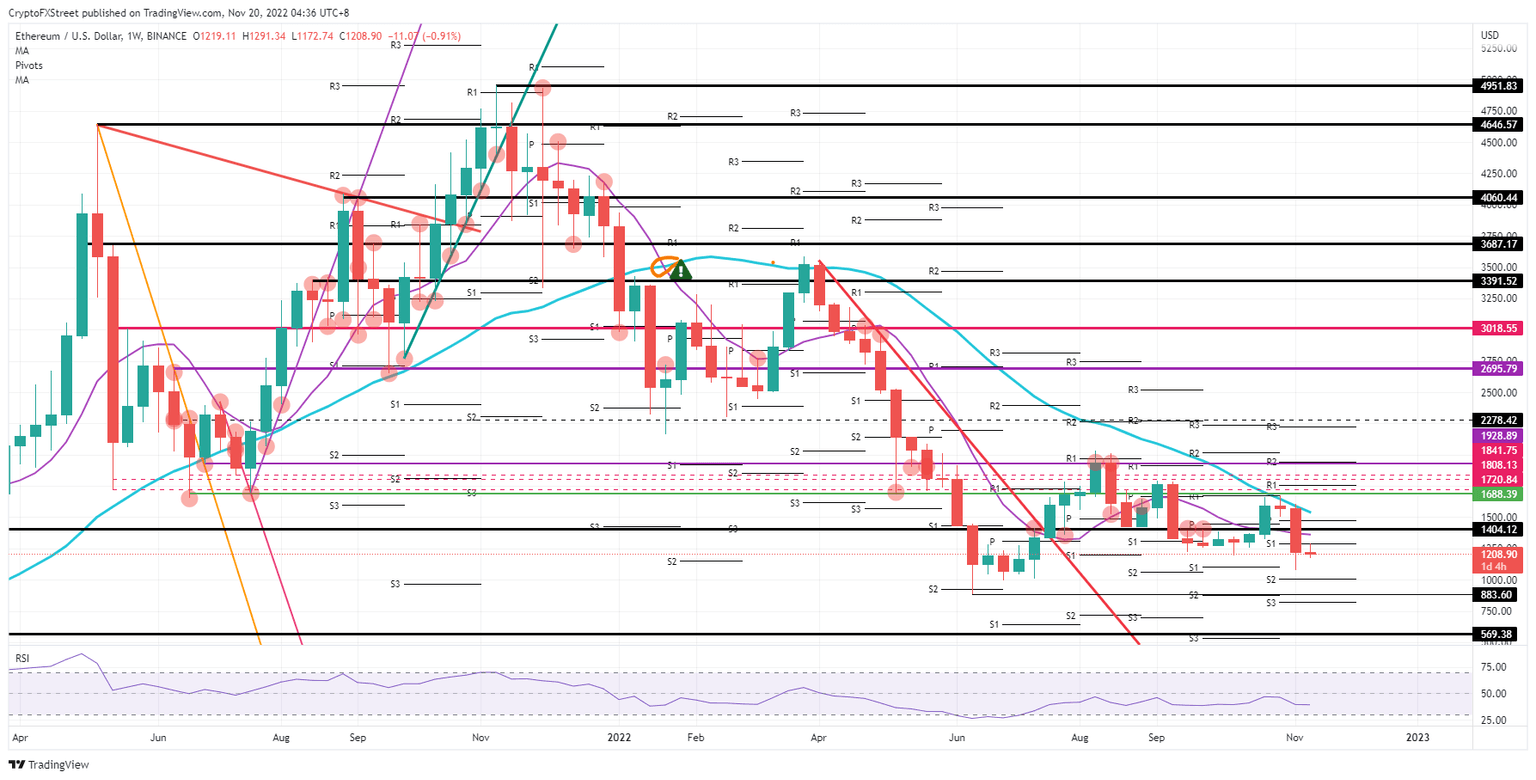

Ethereum gains capped at $1.404 argues analyst

Filip L, a technical analyst at FXStreet evaluated the bullish thesis for Ethereum. If ETH recovers from its decline, the altcoin’s gains are capped at $1,404. The expert believes that the 55-day Simple Moving Average (SMA) at $1,400 and 200-day SMA at $1,540 could act as barriers to Ethereum price in its climb.

ETHUSD price chart

The $1,000 level is key to Ethereum’s price trend. Filip believes a decline below $1,000 could help traders build up positions for a long strategy.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.