Shiba Inu whales scoop SHIB at discount, but is it enough to sidestep this bearish fate?

- Shiba Inu Coin (SHIB) accumulation by large wallet investors picked up pace, a whale scooped up 310.68 billion tokens in one transaction.

- The percentage of Shiba Inu holders that held SHIB for over a year increased to 52%, fueling a bullish sentiment among whales.

- Shiba Inu on-chain activity signals upcoming trend reversal in the Dogecoin-killer meme coin, Shiba Inu.

Shiba Inu price continued its decline for the fifth consecutive day since November 16, 2022. The meme coin has yielded 6% losses despite mass accumulation by whales and can be attributed to the larger bearish market sentiment.

Also read: Shiba Inu price is on the cusp of printing its worst performance for this year

Shiba Inu price could recover from its downtrend with help from whales

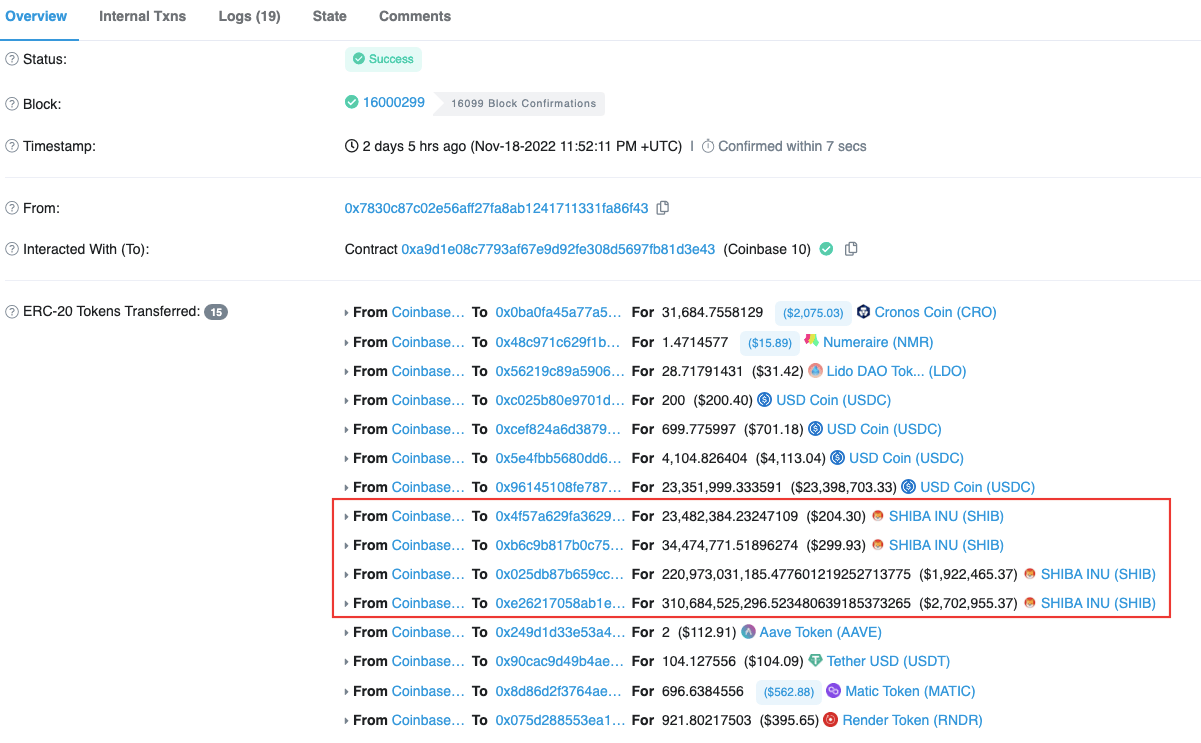

Shiba Inu price continued its downtrend despite the changing market conditions. On-chain activity suggestsa spike in accumulation by whales. A large wallet investor scooped up 310.68 billion SHIB tokens worth nearly $2.7 million in a single transaction on November 19.

This accumulation by long-term investors is considered a bullish indicator for the Shiba Inu price. SHIB whales typically accumulate the meme coin during its downtrend and profit-taking follows soon after.

Shiba Inu price has been in a prolonged downtrend for nearly a year now, slipping 90% below SHIB its all-time high of $0.000086. Based on data from Etherscan.io, another mysterious whale added 220.97 billion SHIB tokens to their wallet in a single transaction on November xx . The whale now holds a total of 546.86 Shiba Inu (SHIB), worth $4.99 million.

Shiba Inu accumulation

While the market outlook is bearish, these purchases by whales can be bullish for the Shiba Inu price in the long run.

SHIB holders confident in bullish future

Shiba Inu price decline failed to dampen the sentiment among SHIB token holders. 52% of the investors have held their SHIB tokens for longer than a year. Despite the recent crypto bloodbath and decline in Shiba Inu price, holders SHIB bags, signaling investor confidence.

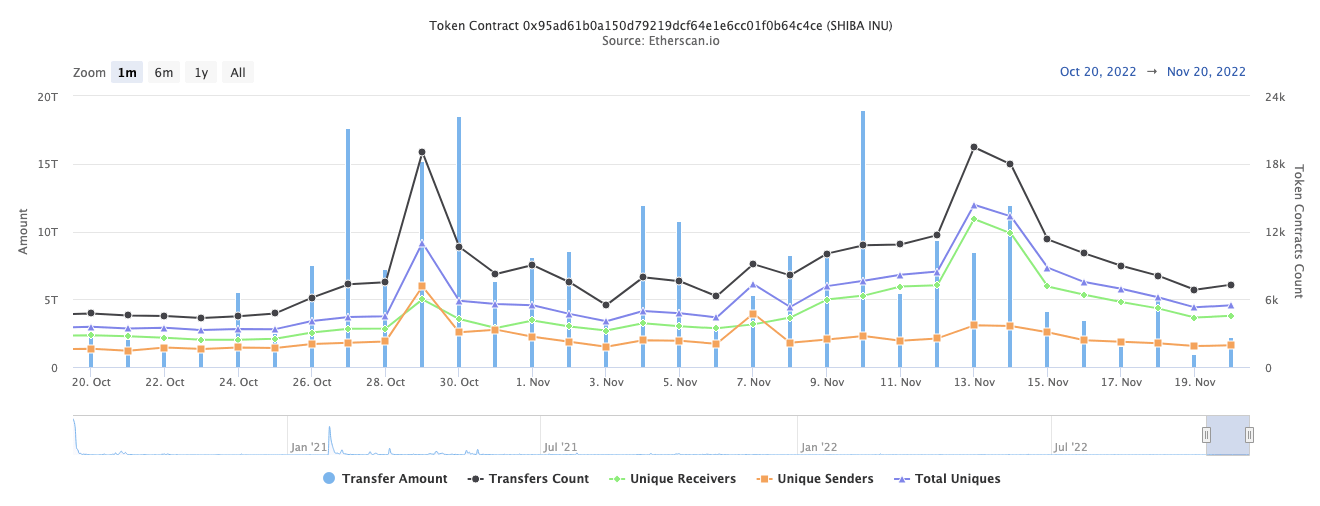

Shiba Inu token transfers for the past 30 days

What’s more there was a spike in transactions worth $100,000 or higher, in the Shiba Inu ecosystem. Whale movements are captured through this statistic, 38 high volume transactions fueled a spike in on-chain activity in Shiba Inu. Whales activity is an indicator of a

Bitcoin plays a major role in controling Shiba Inu price

Shiba Inu price is heavily correlated with Bitcoin. Based on data from IntoTheBlock, Shiba Inu’s correlation with Bitcoin is 0.9, which is not a good look for the meme coin.

A high correlation will put SHIB at the behest of Bitcoin price and its volatility. Since BTC is still reeling from FTX’s collapse the meme coin will likely continue to follow Bitcoin’s footsteps.

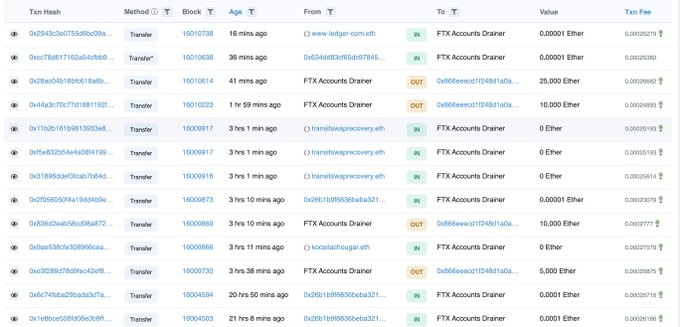

Additionally, Bitcoin price is in lockstep with the moves of the FTX hacker who siphoned $600 million from the bankrupt exchange FTX. As reported, this exploiter swapped his ETH for renBTC, triggering a market sell-off. RenBTC is essentially Bitcoin bridged to the Ethereum blockchain and is backed 1:1 by BTC.

FTX hacker swapped Ether for renBTC

The wallet address marked FTX accounts drainer swapped 30,990 Ether for 2197.5 renBTC in their latest move. The hackers' activity therefore directly influences Bitcoin price and Shiba Inu follows close.

Dogecoin-killer’s worst performance of 2022?

Shiba Inu price is 90% below its all-time high, after a prolonged downtrend. Filip L, a technical analyst at FXStreet argues that SHIB could soon print a multi-year low.

Shiba Inu price received a firm rejection at the psychological level of $0.000010, accelerating its decline. Filip believes Shiba Inu price could plummet to $0.00000507 as the crypto market recovers from 2022’s key events, the LUNA stablecoin debacle and FTX crash. Leading crypto broker Genesis halted repayments and withdrawals in the aftermath of FTX exchange’s bankruptcy, adding fuel to the fire.

SHIBUSD price chart

Filip’s bearish thesis is likely to be invalidated if the spread of the FTX contagion is contained, allowing Shiba Inu price a chance to recover above the S1 support level and hold above the $0.000010 psychological level. If successful, SHIB could climb higher.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.