Ethereum price bullish breakout on the horizon, are investors ready for $2,000?

- Ethereum price is not out of the woods a week after implementing the Merge software upgrade.

- The TD Sequential indicator flaunts a crucial buy signal, but investors wait for more confirmation of the uptrend.

- Support at $1,200 will determine if Ethereum price will close the gap to $2,000 or revisit levels below $1,000.

Ethereum price is focused on returning positive results on Saturday. The largest smart contracts token has printed three bullish candles in a row to trade at $1,331. Excitement over the Merge event last week is still reverberating across the cryptocurrency market, but it's doing little to flip ETH's technical outlook bullish. The Merge took place on September 15 – ushering in a new dawn for Ethereum on a more energy-efficient proof-of-stake (PoS) consensus.

Is Ethereum price ready for $2,000?

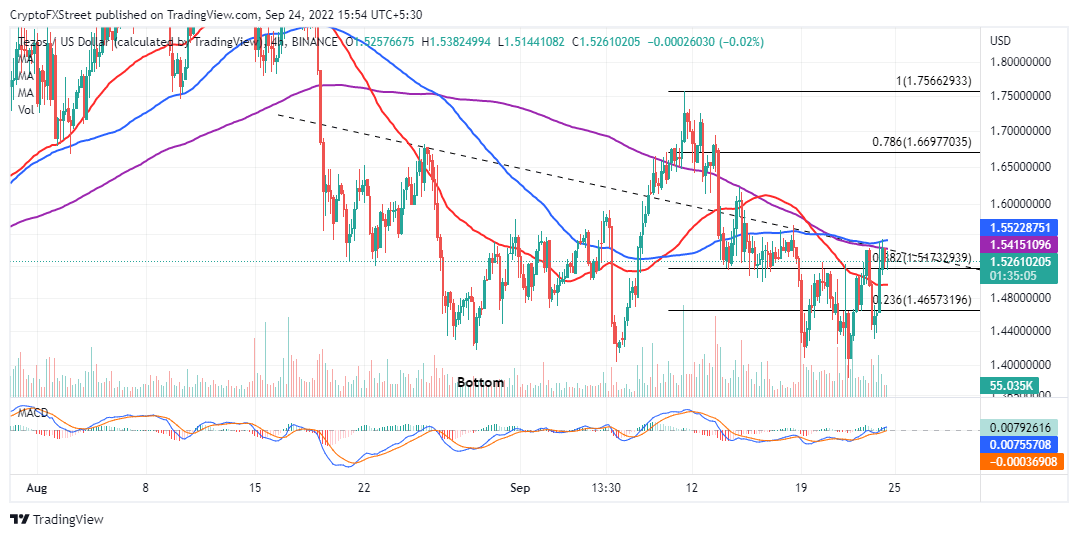

The daily chart's DMI (Directional Movement Index) indicates the gradually declining overhead pressure. Support at $1,200 allowed previously sidelined investors to hop onto the bandwagon ahead of an anticipated move to $2,000. Ethereum price would gain momentum as the –DI (red) crosses above the +DI (blue).

A buy signal from the TD Sequential indicators, which manifested in red nine candlestick, is affirmative of the improving technical picture. Traders may consider buy orders if the low of the sixth and seventh candles close below the low of the eighth and ninth bars.

ETH/USD daily chart

Meanwhile, higher buyer congestion is required, preferably at $1,300, to protect the progress made from $1,200. Big movements north will be limited due to the lack of strong demand for the token.

The global economy is expected to continue struggling in the foreseeable future amid efforts to combat rising inflation. Investors, especially institutional, will likely keep off risky asset classes such as crypto until the global economy returns to favorable levels.

Now, eyes are set on the Ethereum price's ability to step above $1,500 – a resistance level reinforced by the 100-day SMA (Simple Moving Average – blue). This move will confirm to investors that ETH has gathered the requisite liquidity to sustain an uptrend. However, Ethereum will only be safe from potential dips under $1,000 if it reclaims the position above $2,000.

It is worth mentioning that Ethereum price clustered between $1,500 and $1,700 for nearly two months (July 18 – September 16) before the most recent flash drop. In other words, the desired move to $2,000 might not be quickly achieved due to the seller congestion in this range. Traders should consider locking in early profits at the 100-day SMA and the hurdle at $1,700 to avoid losing accrued gains as Ethereum price recovers.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren