Ethereum price at catch-22, pressed between this bullish outlook and a waning of momentum

- Amid increasing volatility, Ethereum price has filled up the pennant making a breakout imminent.

- While the outlook is bullish, less-than-sufficient buying momentum may delay the $2,000 dream for ETH bulls.

- Large transaction volume has dropped 25% between June 1-3.

- Buyers must increase participation to confirm the breakout above $1,949.

Ethereum (ETH) price is trading with a bullish bias, following Bitcoin's (BTC) heels. The Proof-of-Stake (PoS) token is up a staggering 60% in 2023, which is no mean feat considering the gloomy outlook in the market, characterized by the extended bear market, concerning macroeconomics and regulatory pressure. To put this into context, after the US Securities and Exchange Commission's (SEC) settlement with the Wahi brothers, the place of Ether in the eyes of the federal regulator has come into question. All these culminate into a FUD-infused market.

Also Read: Ethereum vs. SEC: Implications of Wahis' insider trading settlement on ETH

Ethereum price needs bulls to stop playing it safe

Ethereum (ETH) price has recorded a huge run since the year's onset, recording higher highs for the first four months of 2023. After breaking above the $2,000 level, profit-taking fueled a correction as investors hedged their holdings after breaking even from the May 2022 losses.

Accordingly, the resistance at $1,949 has come into play for the umpteenth time, preventing Ethereum price from recording further gains. This comes as investors' sell-stop orders lock in profits around that price. In layman's language, a sell-stop order is a stop order to sell at a market price after a stop price parameter has been reached.

The fortitude of the $1,949 hurdle comes amid waning buying momentum among bulls, which could see ETH retrace lower. This is likely, considering the Relative Strength Index (RSI) was pointing south, indicating a slump in buying pressure. Similarly, the Awesome Oscillators (AO) edged toward the bears, as indicated by the quick switch from green to red. Soon, this indicator could draw toward the midline and into the negative zone unless bulls recover.

The move could see Ethereum price lose the support confluence between the lower boundary of the pennant and the 50-day Exponential Moving Average (EMA) at $1,848. In the dire case, ETH could retest the 100- and 200-day EMA at $1,791 and $1,719, respectively.

ETH/USDT

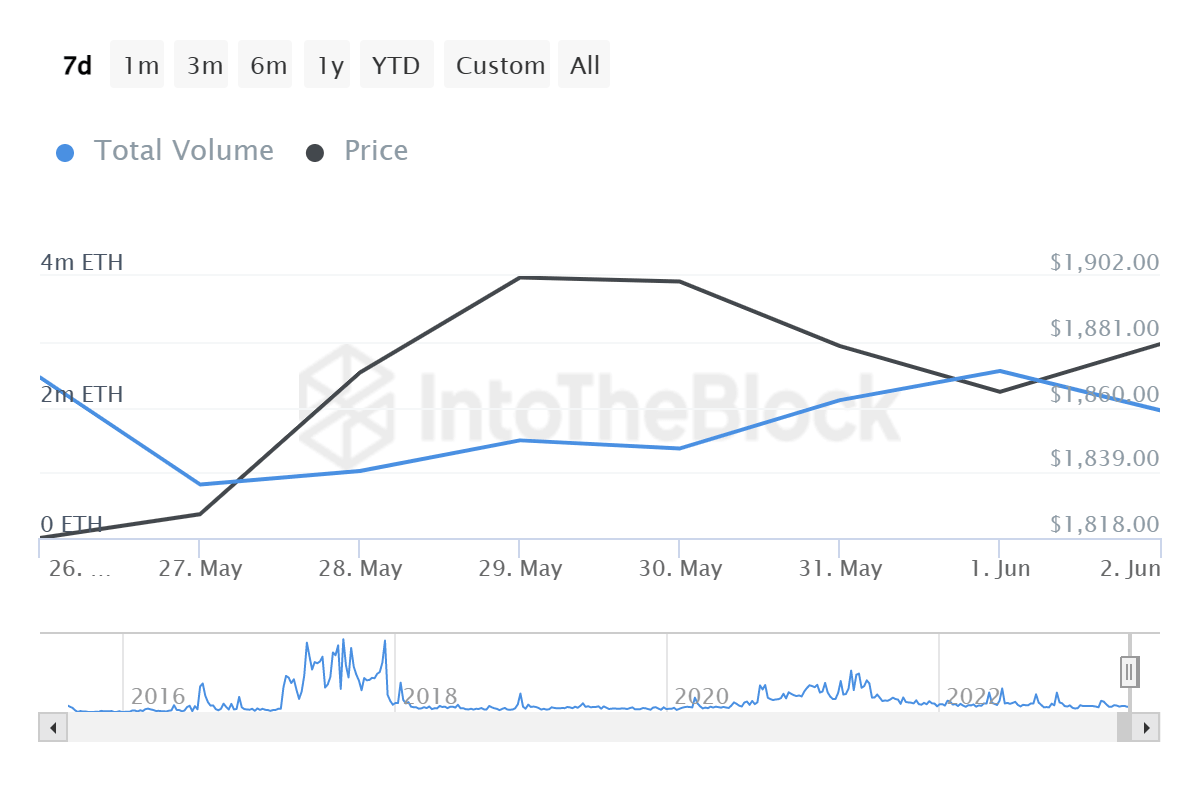

On-chain metric: Large transaction volume

On-chain metric from IntoTheBlock shows a fall in investor momentum. Specifically, the volume of large transactions has fallen by 25% in the month, moving from 2.55 million to 1.95 million as of June 3.

Conversely, if sidelined or late investors buy ETH at the current market value, the ensuing demand pressure could see Ethereum price break above the upper boundary of the pennant to confront the $1,949 hurdle. A decisive flip of this barricade into support would solidify the uptrend, but a tag of the psychological $2,200 would be the best-case scenario for ETH holders.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.