Ethereum co-founder Vitalik Buterin has advocated for a “modest” gas limit increase to potentially improve network throughput.

During a Reddit ask-me-anything (AMA) organized by the Ethereum Foundation’s research team on Jan. 10, Buterin noted that the gas limit has not been increased for nearly three years, the longest time ever in the protocol’s history.

“Honestly, I think doing a modest gas limit increase even today is reasonable,” said Buterin during the research team’s 11th AMA.

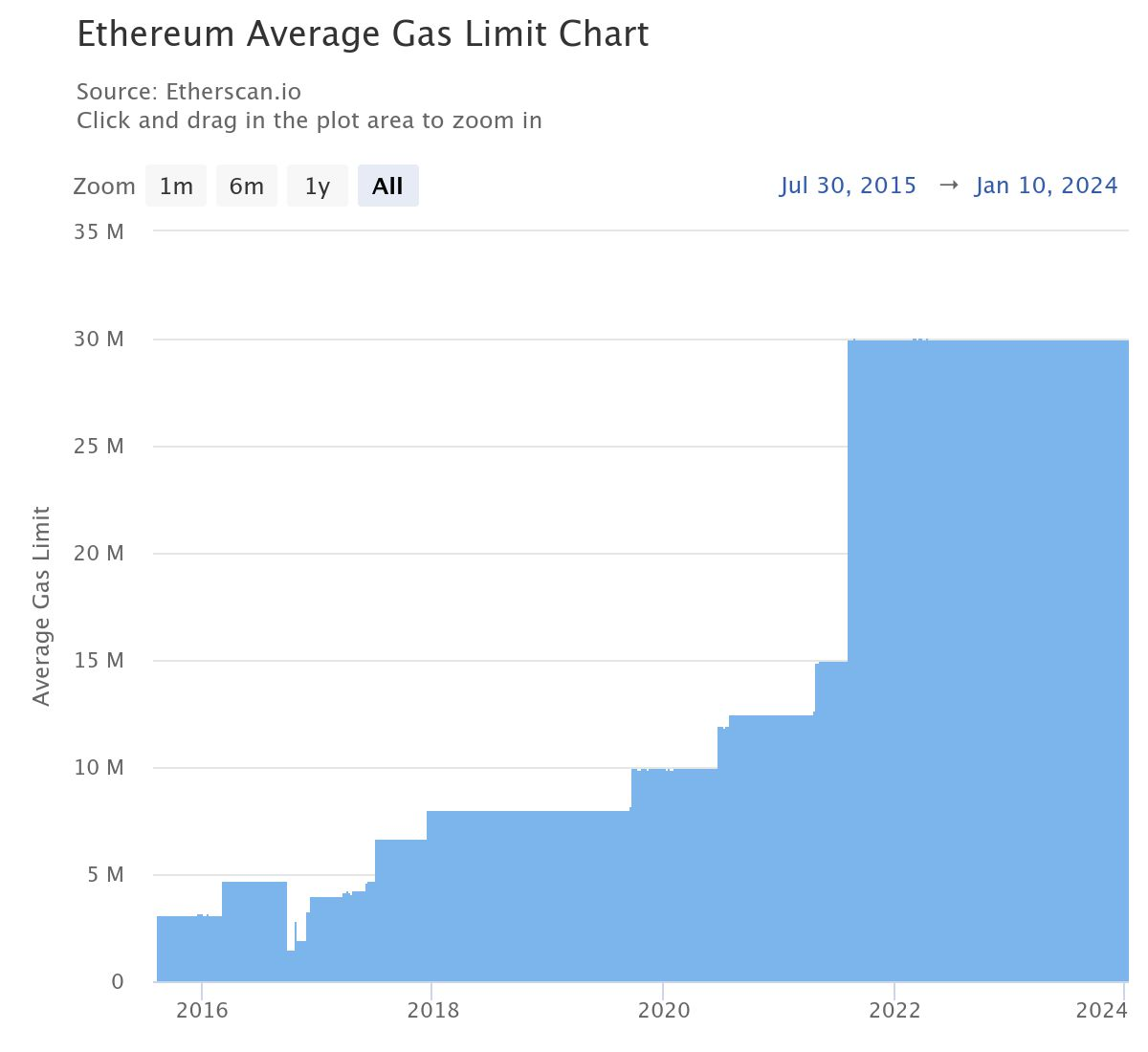

Buterin also made some brief calculations, saying this would imply an increase to around 40 million. The current gas limit is 30 million, according to Etherscan, so Buterin suggests an increase of 33%.

Ethereum average gas limit over time. Source: Etherscan

The average gas limit just after Ethereum’s genesis in 2015 was around 3 million, which has increased over time along with network usage and adoption.

The Ethereum gas limit refers to the maximum amount of gas spent on executing transactions or smart contracts in each block. Gas is the fee required to conduct a transaction or execute a contract on the blockchain.

A gas limit is set to ensure that blocks are not too large, which would impact network performance and synchronization. Validators can also adjust the gas limit dynamically within specific parameters as they produce blocks.

Increasing the gas limit allows more transactions into each block, which theoretically increases the overall throughput and capacity of the network. However, it also increases loads on hardware and the potential risk of network spam and attacks.

Average gas prices, or the cost of transacting on Ethereum, are currently around 35 gwei or $1.89, according to Etherscan. However, they have increased since the beginning of 2024 and are much higher for complex smart contract operations.

Network gas fees spiked to a 2023 high of 150 gwei in May due to the inscriptions craze. A gwei is a denomination of Ethereum that represents one billionth of a single Ether (ETH $2,642). In November 2023, Ethereum and Bitcoin users reignited the scalability debate as fees surged amid another round of inscriptions hype.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Base attracts Lion’s share of Ethereum deposits among Layer 2 chains, beats Optimism in TVL

Base, Coinbase’s Ethereum Layer 2 chain, has noted a spike in inflows to its blockchain this week. Nearly $20 million in Ether flowed into Base since Monday, nearly two times that of Arbitrum and five times as much as Optimism, its competitors in the scaling ecosystem.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple lawsuit develops further as redacted version of SEC filing goes public. Ripple, SEC and related parties will file motions to seal material from the remedies-related filings by May 13.

FET suffers 2% decline as whales deposit Fetch.AI tokens to exchanges

Fetch.AI (FET) token will be the reserve currency of the Superintelligence Alliance (ASI), a merge of three Artificial Intelligence (AI) projects: Fetch.AI, Ocean protocol and SingularityNET.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Grayscale has withdrawn its 19b-4 application for an Ethereum futures ETF. SEC Chair Gensler says several crypto assets are securities as he waives off ETH classification question.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.