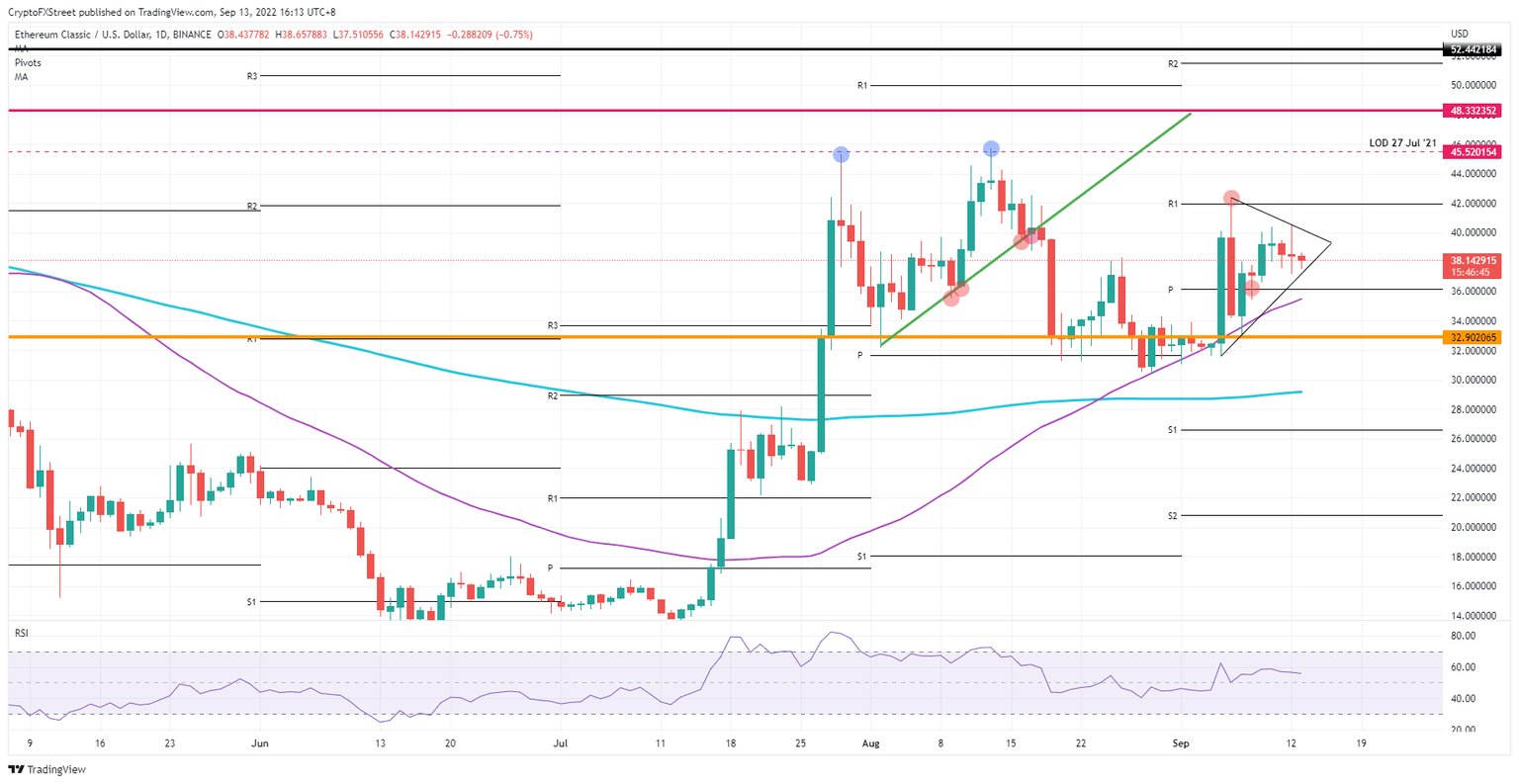

Ethereum Classic price will go nowhere as pennant formation locks up volatility

- Ethereum Classic price sees no pops higher after bulls fail to reach $42 as RSI fades to the downside.

- ETC price undergoes consolidation with lower highs and higher lows.

- A pennant breakout is due by the end of this week, possibly initiating a return to $33.

Ethereum Classic (ETC) price action is fluctuating without making any big waves as price action undergoes a consolidation with lower highs and higher lows for the month of September. ETC price sees bulls failing to raise their game as the Relative Strength Index (RSI) shows signs of a slowdown in the rally. Expect a pennant breakout by the end of this week with more downside.

ETC price set for bearish pennant breakout

Ethereum Classic price action is going nowhere for a fourth straight day as volumes slow down and the RSI starts to turn to the downside. It does not look like bulls will even get to touch $42 as they lose momentum. Although the dollar is still weakening, it does not look like ETC traders will be able to use that momentum for a final push higher.

ETC price looks to be preparing for a bearish breakout of a pennant price pattern, which would initially mean a drop to $36 with the monthly pivot there providing support. Should the dollar’s strength return, expect it to be enough to squeeze price action below and see it trading near $32.90, a previous historic pivotal level. With that squeeze, the 55-day Simple Moving Average would be broken again and lose its importance in underpinning price action.

ETC/USD Daily chart

Should the dollar weaken even more and see the EUR/USD pair trade near 1.05 (EUR/USD ), for example, expect that weakness in the dollar to be enough to see bulls finally hit $42. Of great importance will be seeing a daily close above that level, and a retest of support the day after that, before starting to consider the possibility of price reaching $45.52 or $48.33. Such gains would effectively mean that cryptocurrencies are gearing up for an uptrend, and the turnaround has started.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.