Ethereum Classic Price Prediction: Missed a big move and it hurts

- Ethereum classic price abolished the short-term bearish scenario.

- Ethereum price has outperformed most cryptocurrencies this week, rallying 75% in just two days.

- The uptrend scenario looks healthy and strong enough to rally towards $65.

Ethereum Classic bull run recap

Ethereum classic price blew past the short-term bearish scenario issued this week. The daily chart's bearish volume, which was thought to be a sign of concern, ended up being a Smart Money sand-in-the-eye meant to keep traders from entering an imminent bull run.

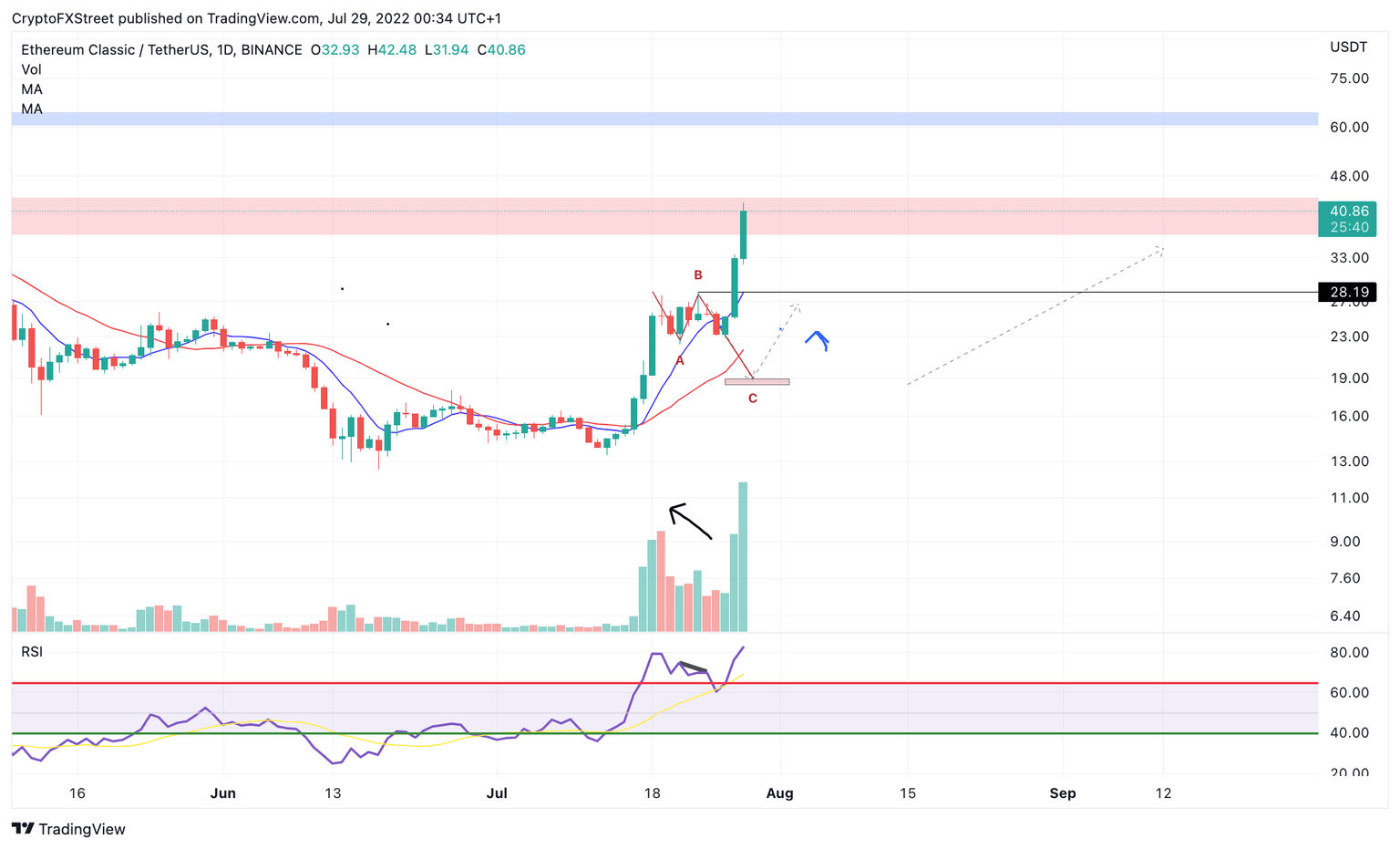

Although the invalidation point was issued at the top of $28.19, no alternative scenario was forecasted. ETC price set up a classic 2-1 bullish trade setup in opposite direction of the bearish thesis . In hindsight the bullrun seems like an obvious scenario to identify.

ETC/USDT 1-Day Chart

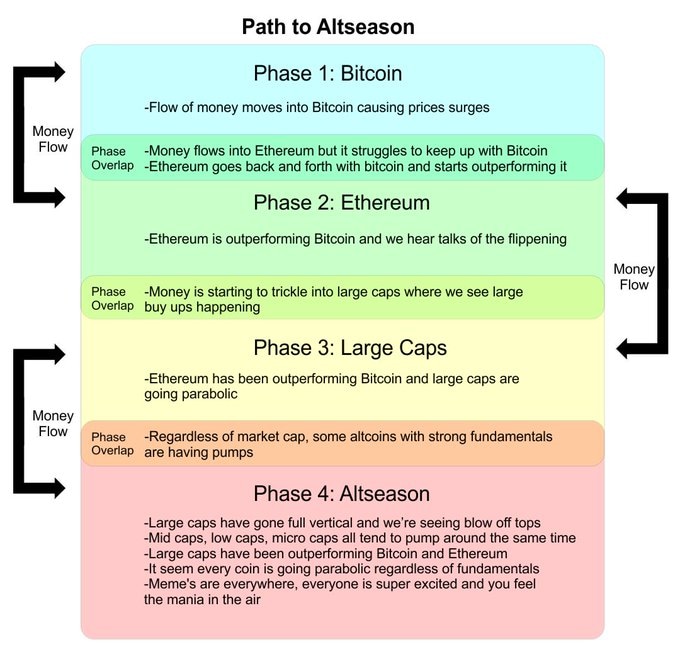

Crypto Season usually witnesses a liquidity rotation throughout the Alt Coins. In previous seasons traders would see the top market cap coins like Bitcoin and Ethereum XRP rally.

Eventually, smart money begins pumping the mid-caps and smaller coins until ultimate FOMO reaches the notorious meme coins.

The Path to Crypto Season

The bullish display of Ethereum Classic certainly provokes the idea that we are indeed in an "early bull market" more at a conservative "scalpers market". The bear market, which has been ongoing for several months, may have paralyzed many traders into pure speculation.

Overtrading when times finally get exciting can also cause errors in chart analysis. This month the market has provided trade setups worth taking for those willing to engage. Still, the task of a crypto trader is to "identify the best moving assets that will make the most amount of money in the least amount of time". - Nas FF

In summary

Moves like the Ethereum Classic Bullrun should have been spotted. It may be time to consider a new approach moving forward.

As far as Ethereum Classic price, the uptrend scenario looks healthy and strong enough to rally towards $65. The Relative Strength Index has pierced new highs past the initial Wave 1 reading. The Volume profile is robust with bullish momentum. Heineken Aishi mode may be a useful approach for scalpers looking to enter the market whom are late to the party.

In the following video, our analysts deep dive into the price action of Ethereum, analyzing key levels of inerest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.