Ethereum Classic Price Prediction: ETC retracement to continue as bulls flee

- Ethereum Classic price has seen a 35% decline after setting up a new high at $179.83 on May 6.

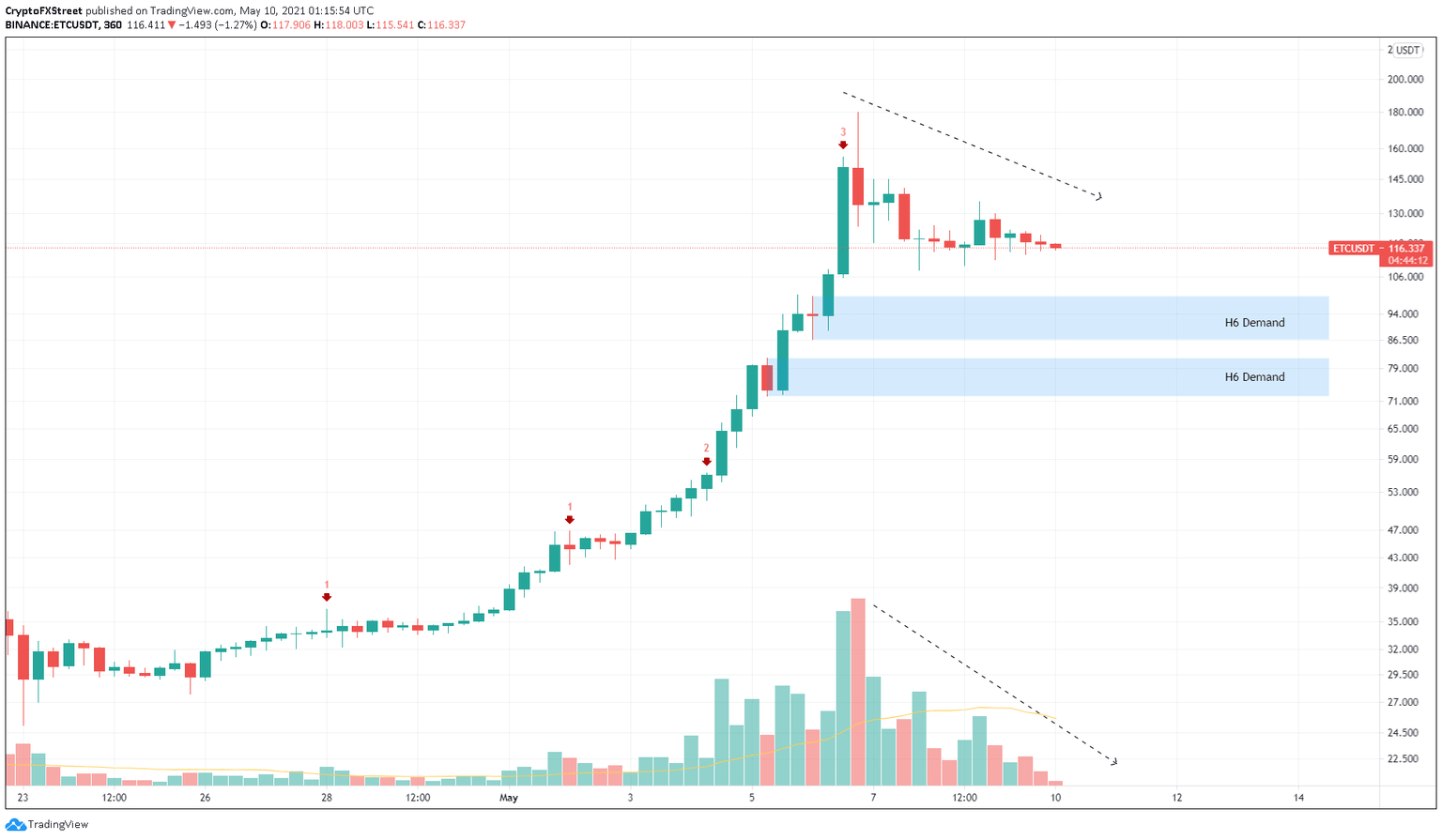

- This pullback is likely to continue until the immediate demand barrier extending from $86.62 to $99.50 is tagged.

- If the buyers scoop ETC at a discount here, an upswing might be possible.

Ethereum Classic price shows a correction that indicates exhaustion of bullish momentum. The retracement could eye a reversal at areas of interest mentioned above.

Ethereum Classic price shrinks, but awaits rebirth

Ethereum Classic price shows a full-blown reversal after setting up a new all-time high at $179.83 on May 6. The buying pressure that created these tops seemed to vanish quickly as the Momentum Reversal Indicator (MRI) flashed a cycle top signal in the form of a red ‘three’ candlestick.

This sign is an indication that the rally has been overextended and that the previous signals were overrun as bullish momentum piled up. This setup forecasts a one-to-four candlestick correction, which is already in play.

This downswing helps the buyers recuperate and allows them to purchase ETC at a discount. One such area is the demand zone that ranges from $86.62 to $99.50, which is roughly 15% away from the current price.

If sellers breach this level, ETC will drop to the next area of support that stretches from $72.31 to $81.67. Here, the buyers will have another opportunity to restart the bull run for Ethereum Classic price.

This drop isn’t bearish per se. It is a dip caused by investors booking profits. If most such market participants exit their positions, sidelined investors would likely scoop up Ethereum Classic at a discounted price. Therefore, assuming a bounce from the closest demand zone, ETC could surge 16% to tag the resistance level at $116.

If this wall is shattered, another 10% upswing could propel ETC price to $127.

ETC/USDT 6-hour chart

However, if the correction breaches $72.31, it would invalidate the bullish scenario. In such a case, Ethereum Classic price could drop 34% to test the resistance level at $47.10.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.