Ethereum Classic Price Prediction: ETC looks primed to retrace following 260% rally

- Ethereum Classic price displays a lack of bullish momentum as it consolidates below $96.94.

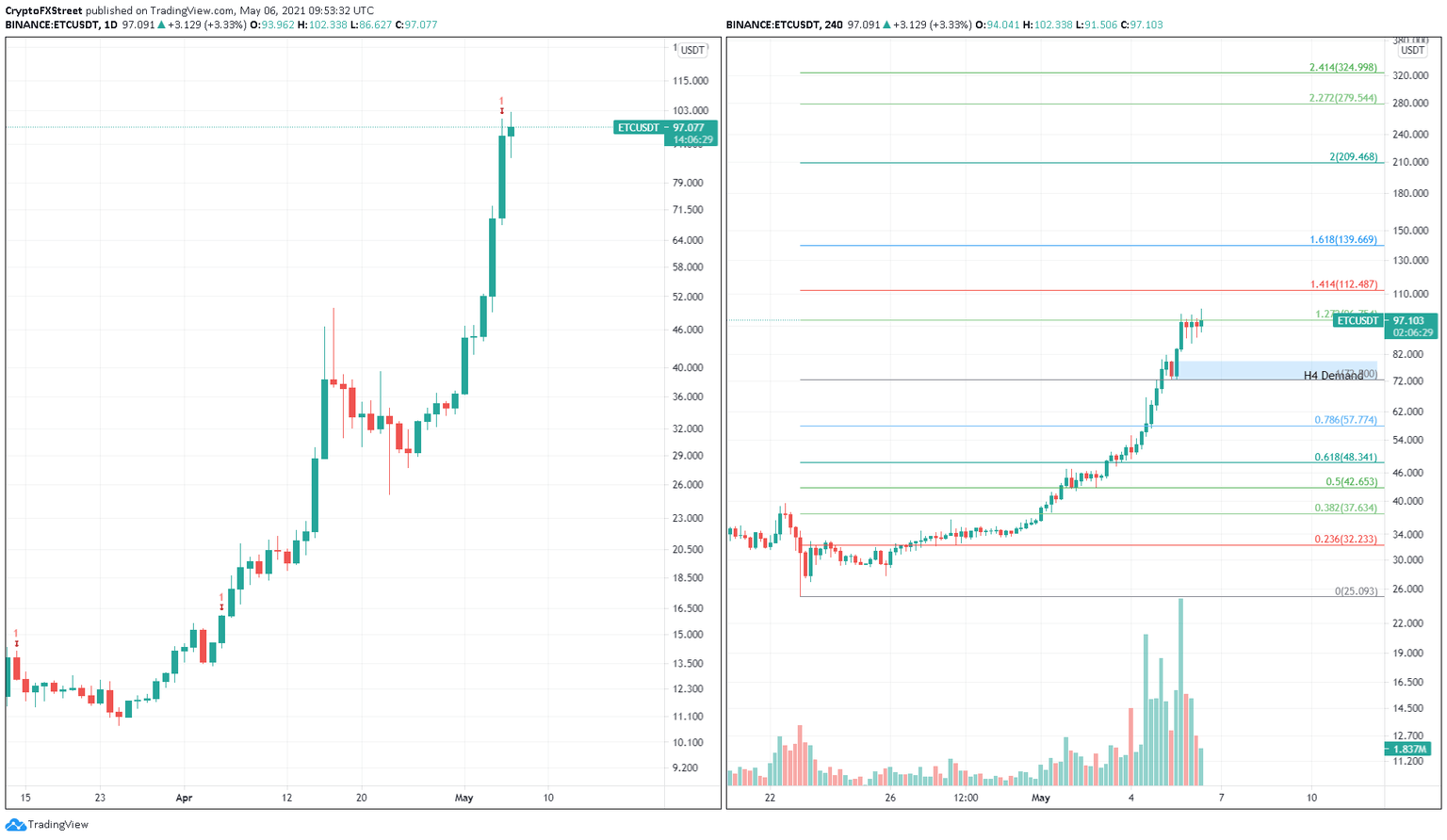

- A 15% pullback to the immediate demand zone that ranges from $72.23 to $79.37 seems likely.

- ETC will face a make-or-break point around this support barrier.

Ethereum Classic price seems to have hit a dead end as the buying pressure vanishes while sell signals pop up.

Ethereum Classic price needs to cool off

Ethereum Classic price favors the sellers on the daily chart, as the Momentum Reversal Indicator (MRI) has flashed a sell signal in the form of a red ‘one’ candlestick on May 5. This setup forecasts a one-to-four candlestick correction.

Although the bulls have set up a new all-time high on Thursday, investors should expect a short-term pullback.

The development of candlesticks with tiny bodies in lockstep on the 4-hour chart adds credence to the bearish scenario explained above. Such a formation indicates a tussle between the buyers and sellers and suggests that the bullish momentum has dried up.

A failure to push past the 127.2% Fibonacci retracement level at $96.94 will lead to a 15% retracement to the demand zone that stretches from $72.23 to $79.37.

This move will allow the short-term sellers to go extinct, allowing buyers to take ETC on another exponential rally to $112.74, which is a 42% upswing from the support barrier’s upper layer.

If this upswing continues, ETC might also tag the 161.8% Fibonacci extension level at $140.05.

ETC/USD 1-day, 4-hour chart

The short-term scenario for Ethereum Classic price seems to be bearish, but if bulls come to the rescue, ETC could retest its all-time high and even surge past it.

However, a breakdown of $72.23 will trigger a full-blown downtrend that could extend ETC’s descent by another 20% to $57.81, coinciding with the 78.6% Fibonacci retracement level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.