Ethereum Classic Price Prediction: ETC inching towards greatness?

- Ethereum Classic price is currently making stair-stepping price action in the mid-$20 range.

- ETC shows a 1-2-1-2 pattern forming, which could result in an explosive move toward $27.

- The uptrend potential would be reduced through a breach of the $19.41 swing low.

Ethereum Cassic price is consolidating before what appears to be the next move up. Risk management should be considered moving forward, as the ETC price will likely witness an influx of volatility.

Ethereum Classic price is poised for gains

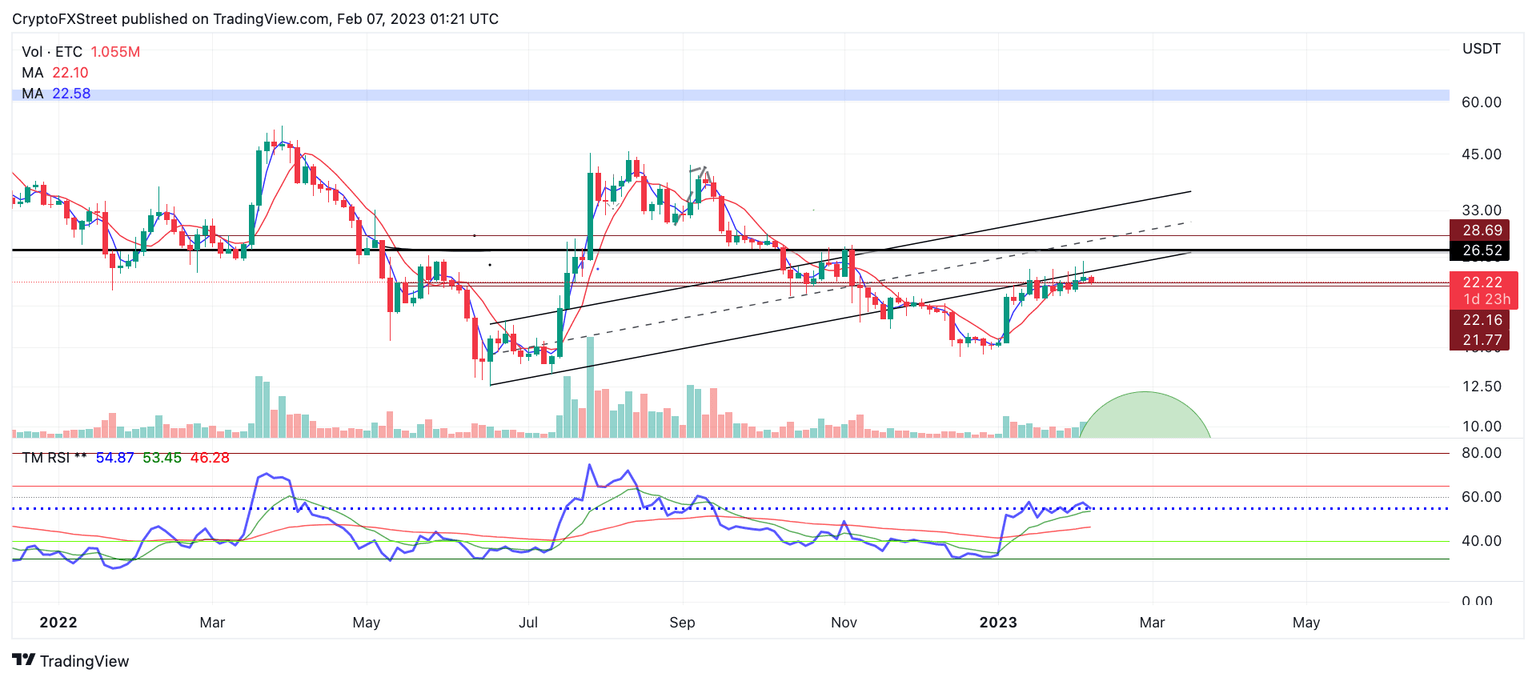

Ethereum Classic price has been making steady gains, producing stair-stepping price action in the mid-$20 zone. The current trend is forming a ramping 1-2-1-2 pattern, as ETC established a new high at $2495 before bears suppressed the price again. Cryptocurrencies have been notorious for displaying this back-and-forth price action before explosive slingshot rallies occur.

Ethereum Classic price currently auctions at $22.43. The strongest candle in the current uptrend since January 1 has yet to be retraced. The 8-day exponential moving average and 21-day simple moving average are dually in support of the stair-stepping price action. Considering these factors, the ETC price may be able to challenge liquidity levels from November's liquidation event. The bullish scenario creates the potential for a 20% incline as the bulls push the price toward the $27.23 swing high established on November 6.

However, the one caveat to the overall bullish technicals is that the Relative Strength Index has yet to break into overall positive conditions on the 3-day chart. Other digital assets like the Ocean Protocol token have already achieved a crucial factor for growth, which could draw more interest and potentially decrease demand for Ethereum Classic.. Still, the 1-2-1-2 pattern is an optimistic gesture as the pattern commonly forms near crucial resistance levels. Traders should continue to manage their risk accordingly as they attempt to catch the next volatile move.

ETC/USDT 3-Day Chart

Invalidation of the uptrend would occur from a breach below the consolidation swing point at $19.41. If this were to occur, the bears could forge a decline into the halfway mark of the largest thrust candle's body near $17.80, causing a 20% decline for ETC.

This video details how Bitcoin price moves could affect Ethereum Classic price

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.