Forecasting a 36% meltdown in Ethereum Classic price

- Ethereum Classic price is on the verge of extending its two-month retracement to $15.00.

- Multiple sell signals rule out an immediate rebound for ETC price.

- Traders can consider $19.50 and $15.00 as potential take profit targets.

Ethereum Classic price selloff woes seem far from over and may even escalate if support at $23.50 breaks. The original Ethereum blockchain token has not been able to circumvent declines after peaking at $45.82 a few weeks after the Merge software upgrade.

For about four weeks, ETC price enjoyed the attention of miners exiting the Ethereum blockchain (before the transition to become a proof-of-stake consensus token) for alternative proof-of-work mining protocols.

Read more: Ethereum Classic Price Prediction: How to position yourself as ETC bleeds

Ethereum Classic price is at a crucial juncture

All eyes are fixated on the Ethereum price’s ability to hold onto the support, highlighted at $23.50 firmly. If it can respect this demand zone, short sellers can forget about ETC price, prolonging the down leg 36.20% below the breakout point to $15.00.

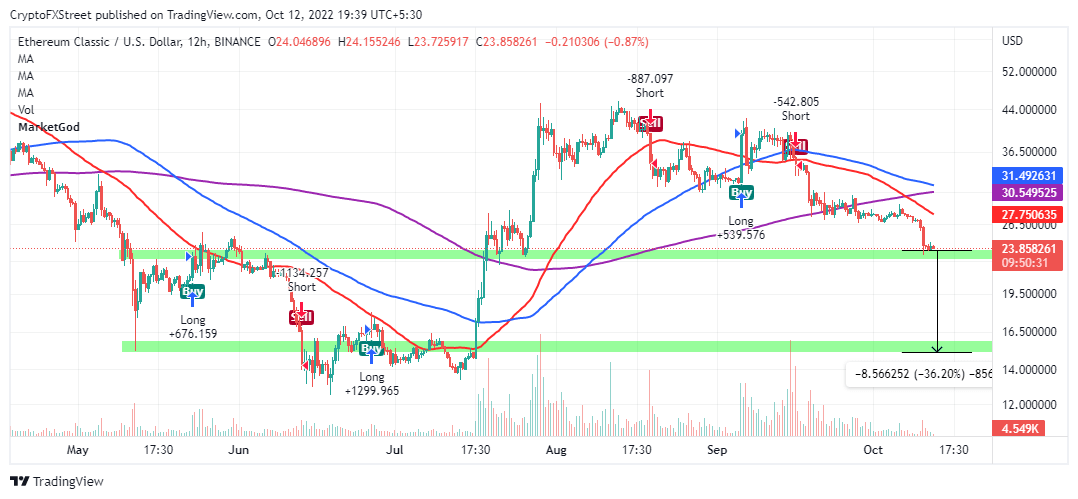

ETC/USD 12-hour chart

With the 50-day SMA (Simple Moving Average), red, crossing below the 200-day SMA, purple, further declines are imminent. Ethereum Classic price is yet to come out of a sell signal presented on September 16 by the MarketGod indicator. Traders using this indicator have the freedom to modify – and develop trading strategies.

The lack of solid support below $23.50 increases the risk of ETC price sliding to $15.00. If push comes to shove, investors should expect the price to tag June lows at $13.50.

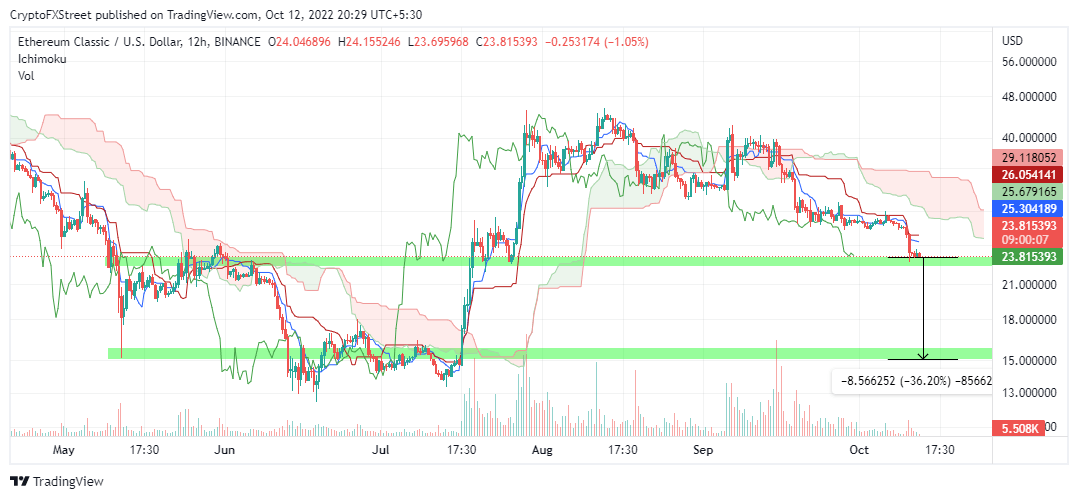

ETC/USD 12-hour chart

The Ichimoku Cloud indicator on the same four-hour reinforces the bearish grip on Ethereum Classic price. As long ETC stays below the ‘cloud,’ overhead pressure will mount on Ethereum Classic price. The Ichimoku Cloud also shows areas of support and resistance. Now, Ethereum Classic price will likely prolong the downtrend, with the $15.00 support level being within reach.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren