EOS Price Prediction: The bottom could be in for the OG crypto community

- EOS price has lost 93% of its market value since May 2021.

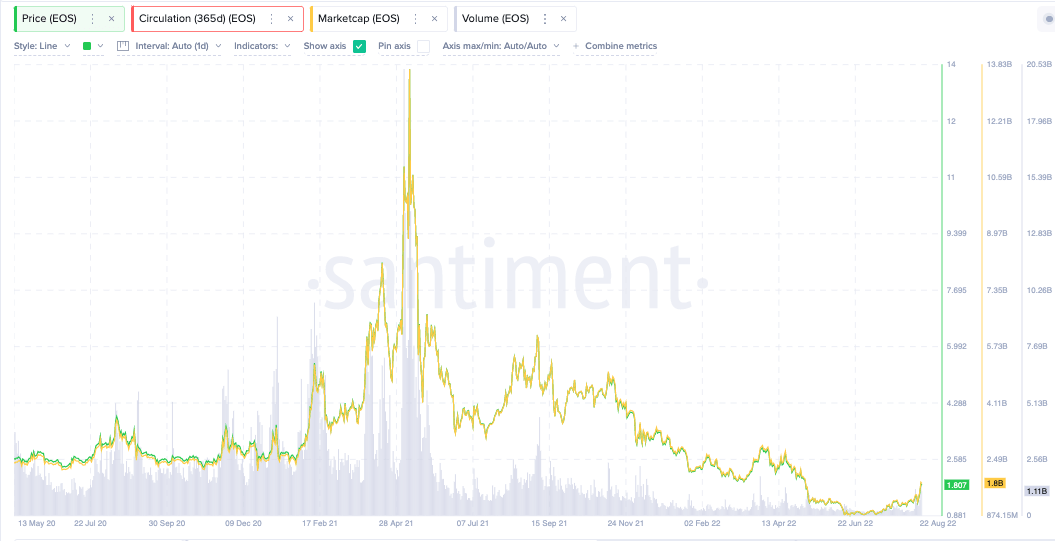

- Santiment's Volume Profile Indicator shows an uptick in volume amidst the countertrend rally.

- Invalidation of the bullish thesis is dependent on two factors detailed below.

EOS price has a few confounding factors, indicating a continuation of the countertrend rally.

EOS price looks better than most

EOS is one of the oldest crypto tokens with a strongly engaged community since 2018. At current time, the OG crypto shows subtle bullish signs that traders and investors should pay attention to. Since May 2021, the EOS price has lost 93% of its market value.

During the August Crypto rally, EOS price managed to rally an impressive 135% from the $0.81 low established on June 13. Aside from the incredible recovery rally, additional on-chain metrics suggest bullish strength in the market.

Santiment’s Price & Volume Profile Indicator

EOS price currently auctions at $1.38. EOS, the open source blockchain platform, is one of the only cryptocurrencies that has breached the previous consolidative zone dating until May 2022. This is a very bullish signal amongst Elliott Wave Practitioners.

Additionally, Santiment's Volume Profile Indicator shows a decent uptick in volume, which confounds the idea that there are high-cap bulls in the market aiming for higher targets.

EOS USDT

Combining these factors, EOS price should be a token to take seriously. Bullish moves could rally as high as $2.50 in the short term to take out additional liquidity levels established this summer.

Invalidation of the bullish thesis is dependent on two factors. EOS should re-attempt the $1.90 high established in August. If this bullish occurrence occurs, the invalidation level can be placed at the new swing low at $0.81.

In the following video, our analysts deep-dive into Bitcoin's price action, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.