Elon Musk says recession likely if “Fed raises rates again next week”

- Elon Musk tweeted on December 9, highlighting his concerns about an incoming recession.

- Another hike in interest rate from the US Federal Reserve could kick-start a recession.

- Musk’s favorite crypto, Dogecoin, seems to be stuck trading in a range and does not show any signs of a breakout.

Tesla CEO Elon Musk tweeted on Friday voicing his concerns about a recession. He mentioned that the United States Federal Reserve could catalyze a recession if it raises interest rates in the next week.

Elon Musk and recession concerns

Elon Musk took to Twitter, his newly acquired company, to warn his followers that a recession is likely under one condition. He added that they could risk a recession if the Fed continues to hike the interest rates.

If the Fed raises rates again next week, the recession will be greatly amplified

— Elon Musk (@elonmusk) December 9, 2022

The US Federal Reserve has raised interest rates from 0% in early 2022 to roughly 4% as of December 9. The Fed will need to decide on the next rate hike on December 13, which is what Musk is referring to in his tweet.

The current consensus is that the Fed will stick to a 50 basis point hike, but if the actual rate exceeds the forecast and comes in at 75 bps, it would be vital for the US dollar and bad for the markets.

Musk further adds that if the recession is triggered, it could extend to the second quarter of 2024.

Dogecoin price and Elon Musk

Elon Musk is well-known for being the Tesla CEO, but in the crypto community, he is the self-proclaimed “dogefather.” He is an avid supporter of Dogecoin, which is a dog-themed cryptocurrency.

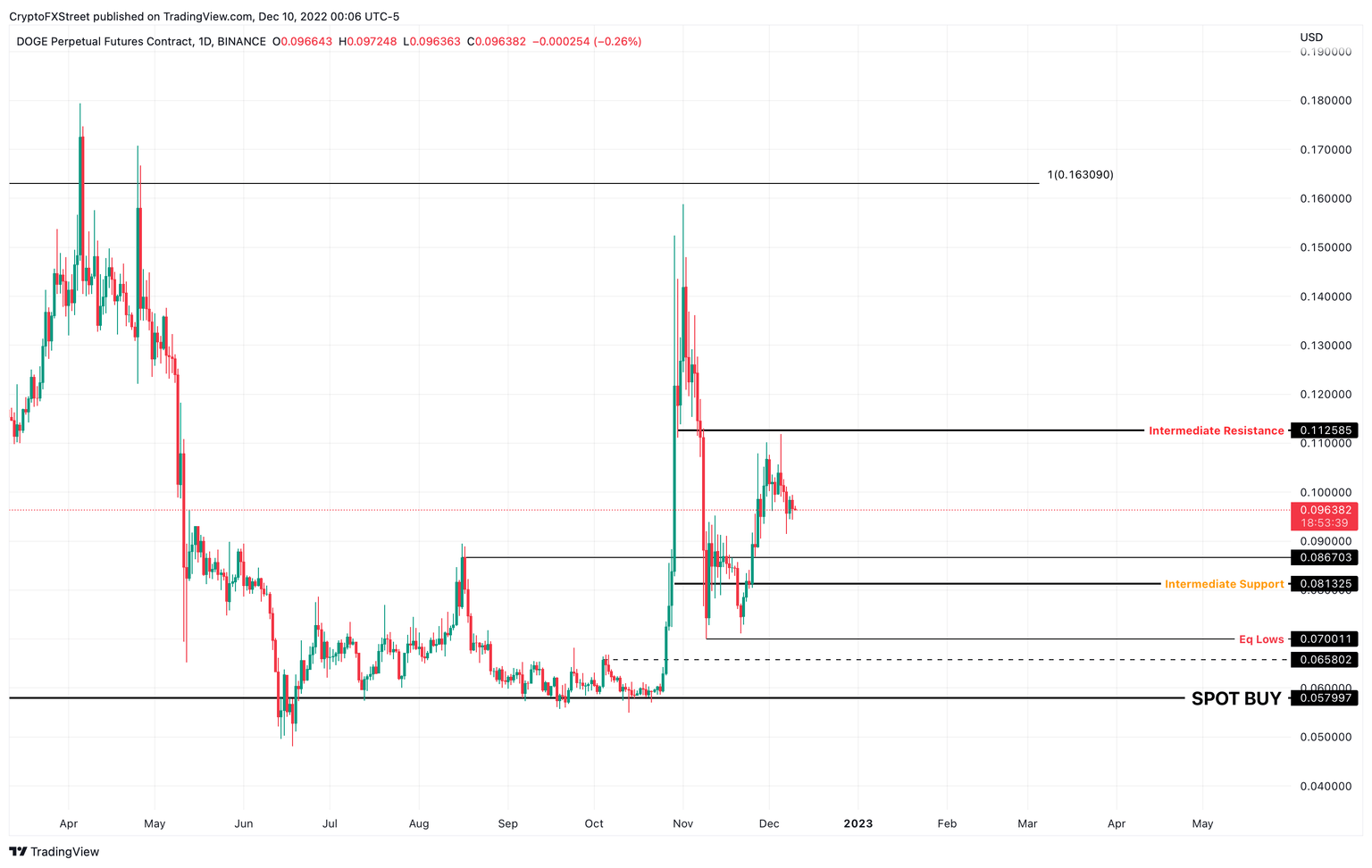

Dogecoin price currently auctions at $0.096 and is stuck trading between the $0.0813 support level and the $0.112 resistance barrier. As long as DOGE hovers between these two trend lines, things will remain boring.

However, if Musk were to tweet about Dogecoin, it could induce volatility, triggering the altcoin to attempt a breakout above $0.112. If successful, DOGE could retest the $0.163 hurdle.

DOGE/USDT 1-day chart

However, a breakdown of the $0.0813 support level could cause the Dogecoin price to revisit the $0.0700 foothold.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.