Elon Musk gives Dogecoin another life but DOGE is bent on triggering a 50% crash

- Dogecoin price is at an inflection point at $0.16 and a nudge could trigger a catastrophic correction.

- Although Elon Musk’s tweet alleviated the short-term bearish outlook, a steep sell-off to $0.086 seems likely.

- A break above the $0.215 hurdle will invalidate the bearish thesis for DOGE.

Dogecoin price is hovering around a crucial support floor that will make or break the meme coin’s future. If price pierces below this level it could trigger a massive downtrend. There is a small chance buyers might sidestep this bearish fate if they can push DOGE to produce a higher high and flip the narrative to bullish.

Dogecoin price at crossroads

Dogecoin price is at a crucial point in its journey and the decision it takes now will determine where the coin is heading in the near future. The result could be an eye-popping 50% correction or a bullish outlook.

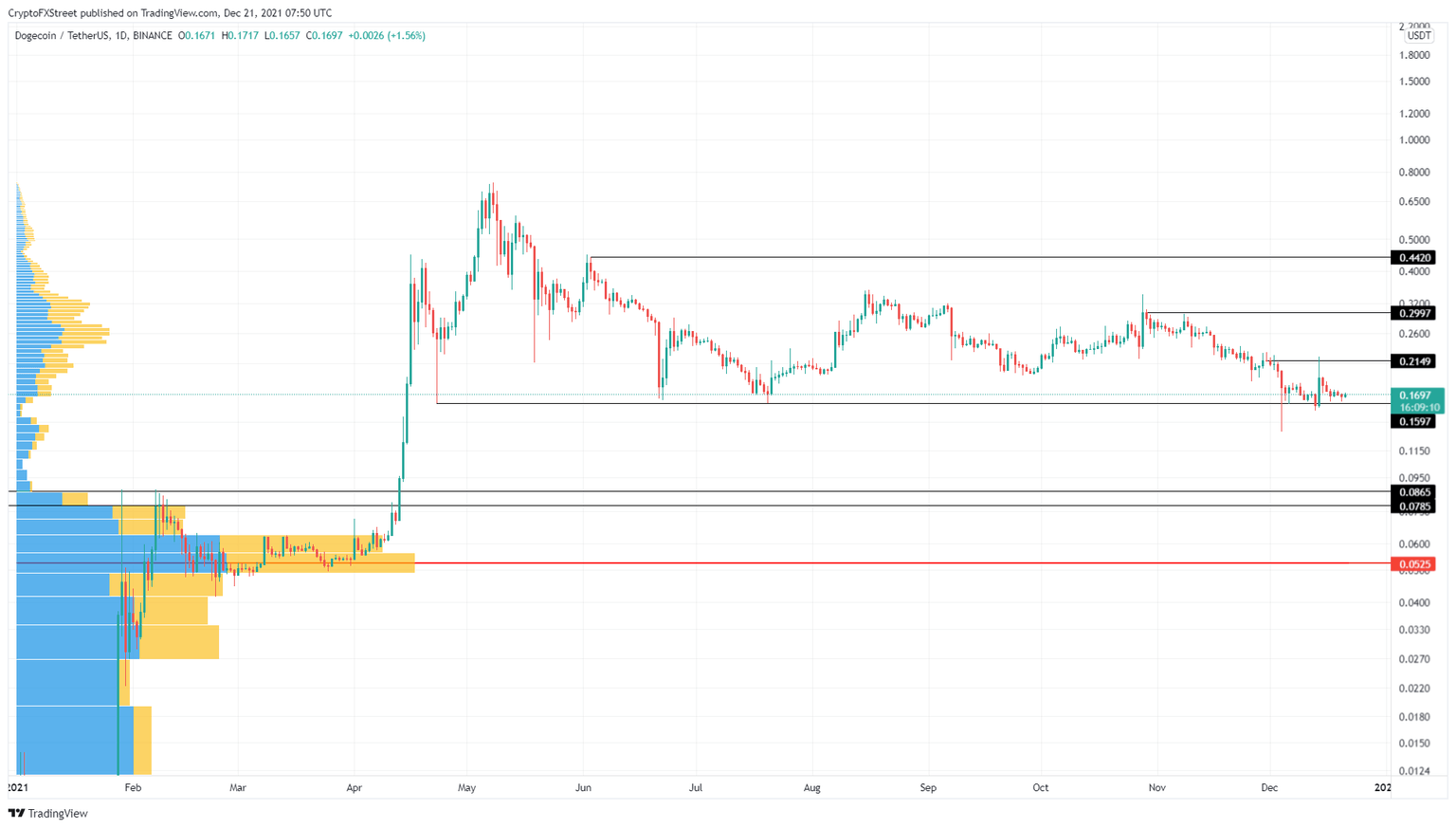

As explained, the $0.16 support level is vital to DOGE since it prevented the crash not once but four times over the past eight months. As the Dogecoin price retests this level again, investors need to exercise caution because penetration could trigger a 50% correction to $0.078.

The 2021 volume profile for DOGE shows that there is a gaping hole or gap that extends from $0.16 to $0.086 and $0.078. The point of control (POC) is present at $0.052, is a place where Dogecoin traded volume was the highest.

Hence, the forecast for the meme coin is not just supported by the volume profile but also from a technical point of view.

Elon Musk’s tweet on December 14, caused a sudden uptick in buying pressure, resulting in a 40% upswing at one point. While this upthrust in DOGE price prevented the collapse for a brief period, the bulls failed to sustain it. As a result, Dogecoin retraced and is currently trading close to $0.16.

Tesla will make some merch buyable with Doge & see how it goes

— Elon Musk (@elonmusk) December 14, 2021

A daily close below $0.16 will confirm the start of a bearish regime and lead to a crash to $0.12. A failure to hold above this barrier will knock DOGE down to $0.085 or $0.078, representing a 50% sell-off.

DOGE/USDT 1-day chart

On-chain metrics paint a similar picture

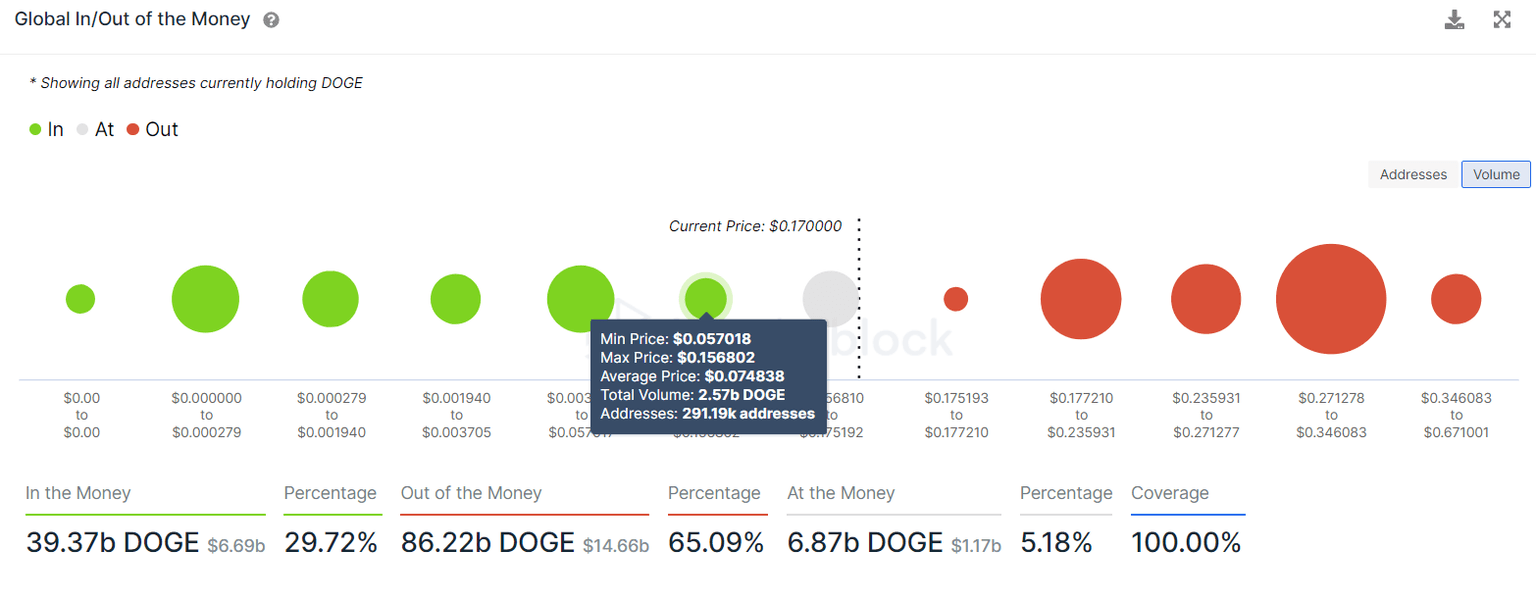

IntoTheBlock’s Global In/Out of the Money (GIOM) model also shows that the support level thins down up to $0.074, which is considerably lower than the target predicted from a technical perspective.

Here, nearly 291,000 addresses that purchased roughly 2.51 billion DOGE are “In the Money” and are likely to accumulate more if the price reaches that level, by absorbing the incoming selling pressure, in an attempt to defend it.

Although unlikely, if the demand area mentioned above fails, Dogecoin price will retest the meaningful support level at $0.025, where roughly 470,000 addresses purchased 11.83 billion DOGE.

DOGE GIOM

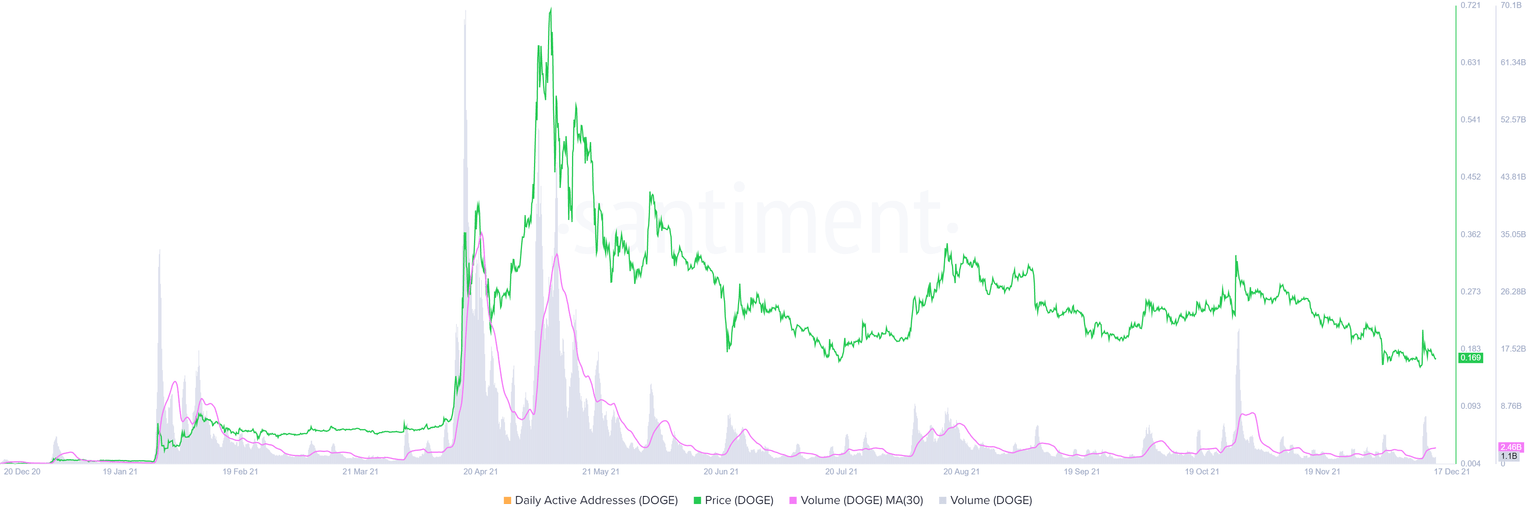

Further supporting the bearish thesis is the reduced on-chain volume on the Dogecoin blockchain. From 33.7 billion DOGE on April 20, the 30-day average on-chain volume has dried up to 2.46 billion DOGE as of December 17.

This 92.7% decline paints a picture of the waning interest in the original meme coin. Perhaps, the eruption of meme coins like Shiba Inu, Solana Doge, Swole Doge, etc., is one of the main reasons for this dramatic downtick.

Either way, the lack of on-chain interest suggests that a potential surge in Dogecoin price that prevents it from collapsing is unlikely.

DOGE on-chain volume

On the contrary, if the Dogecoin price manages to bounce off the $0.16 support floor, there is a chance for DOGE to sidestep this massively bearish outlook. To successfully invalidate the pessimistic outlook, buyers need to propel the Dogecoin price to produce a swing high above $0.215. This move will set up a higher high, indicating a potential shift in trend favoring bulls.

However, it is better to wait for a secondary confirmation, which will arrive after DOGE flips the $0.30 barrier into a support floor. In this situation, the Dogecoin price could continue heading higher and retest the $0.45 hurdle.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.