El Salvador proposes draft bill to regulate digital securities, looks to issue Bitcoin-backed “volcano bonds”

- El Salvador government seeks to approve a new bill that will establish the National Digital Assets Commission to regulate digital currency issuers.

- El Salvador began purchasing one Bitcoin per day last week to increase its holdings.

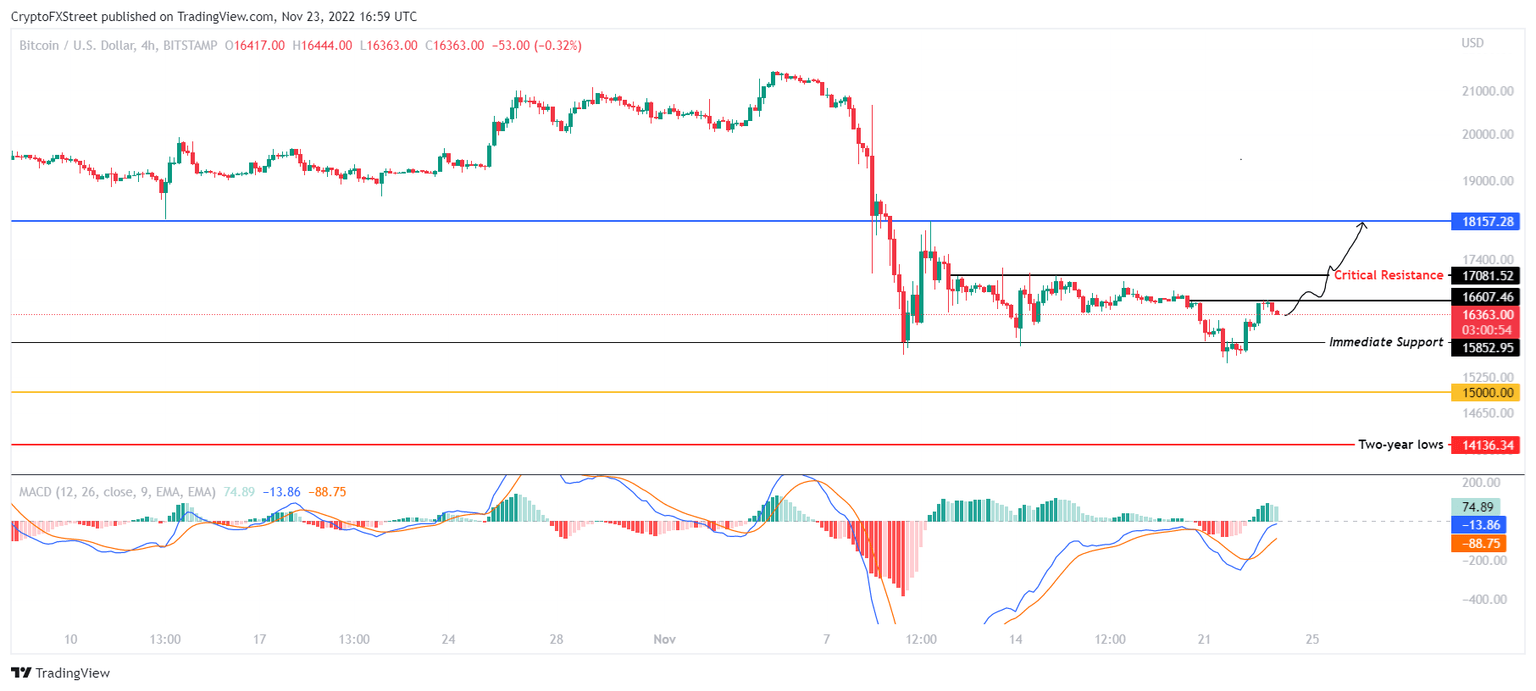

- Bitcoin price is nearing a breakout toward $17,081 to initiate a recovery rally targeting $18,157.

El Salvador pioneered the use of Bitcoin as a legal tender last year. Since then, the Central American country has been finding ways to make the most of the king coin as well as convert El Salvador into a Bitcoin hub.

El Salvador advances its Bitcoin plans

El Salvador is expected to vote on a bill that will decide the establishment of a regulator for digital currency’s operations in the country. The Minister of Economy Maria Luisa Hayem Breve presented the bill to the Legislative Assembly of the country on November 23.

The draft bill proposes establishing a National Digital Assets Commission (NDAC), which would be responsible for the regulation of digital asset issuers, crypto service providers, as well as other operations pertaining to digital assets.

In addition to the formation of the NDAC, the bill would also pave the way for the launch of El Salvador’s Bitcoin-backed “volcano bonds”. Announced this time last year, the country intended to issue $1 billion worth of bonds on the Liquid Network. The sale of these bonds would have been split in half and directed towards Bitcoin accumulation and building BTC mining and energy infrastructure.

If the bill receives the assembly’s approval and becomes a law, it would also mandate the creation of a Bitcoin Fund Management Agency. This agency would take care of the funds received from the public offerings of digital assets.

The bill proposal came to light merely a week after the president of El Salvador, Nayib Bukele, announced the country’s new Bitcoin accumulation policy. Bukele tweeted that starting November 17, El Salvador would purchase one BTC per day to increase its Bitcoin stash.

We are buying one #Bitcoin every day starting tomorrow.

— Nayib Bukele (@nayibbukele) November 17, 2022

As of November 17, the country held about 2,381 BTC, with the last purchase being registered on June 30, 2022. While the country invested over $103 million over the years purchasing at an average price of $43,357 per Bitcoin, at the current Bitcoin price, El Salvador holdings’ current value is around $38.9 million.

Bitcoin price preparing for a breakout

Bitcoin price noted an almost 4% increase over the last 48 hours after dipping to $15,690 on November 21. The king coin is trading at $16,342 at the time of writing and is nearing a breach of its immediate resistance at $16,607.

If Bitcoin price closes above this level, it would be able to initiate a recovery rally towards $18,157. To tag this price, BTC would need rise through the $17,081 mark, which acts as the critical resistance for the king coin.

This is attainable since, at the moment, the Moving Average Convergence Divergence (MACD) is exhibiting bullish signals. The indicator suggests whether the asset is heading into a bullish or bearish state, and the histogram signals the strength of the momentum.

At the moment, MACD is highlighting a bullish divergence with the indicator line (blue) crossing over the signal line (orange). The presence of green bars on the histogram also suggests some strength to the persisting bullishness.

BTC/USD 4-hour chart

However, if Bitcoin price was to lose its immediate support of $15,852 and decline to tag the psychological support level at $15,000, BTC price could face additional losses. Furthermore, a daily candlestick close below the $15,000 mark would invalidate the bullish thesis. This would result in the king coin tagging the two-year lows of $14,136.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.