Dutch central bank warns Binance operating illegally without required registration

- The Dutch central bank has warned Binance that it has not been following compliance guidelines in the country.

- It stated that the crypto firm is operating without a proper license and illegally operating in the Netherlands.

- Binance responded that it would work with the regulator and apply for the required registration.

The Dutch central bank has issued a notice stating that Binance is illegally offering cryptocurrency services in the country. In response, Binance stated that the firm is seeking to get licensed in the country and is in the process of applying for the required registration.

Binance regulatory woes continue

The central bank of the Netherlands, De Nederlandsche Bank (DNB), put out a warning to Binance Holdings Limited, asserting that the company’s entities have been providing crypto services to its citizens illegally.

In a statement, the Dutch central bank explained that Binance was not operating in compliance with the Netherlands’ anti-money laundering (AML) and anti-terrorist financing act. DNB further warned that customers of the crypto exchange could be at risk of becoming involved in money laundering or terrorist financing.

According to the central bank, the cryptocurrency firm is also illegally offering custodian wallets without the necessary registration in the country.

The warning from DNB comes after numerous regulators worldwide have taken action against the leading crypto exchange. In light of the recent turn of events, Binance CEO Changpeng Zhao stated that the firm plans to improve relations with regulators and get licensed wherever possible.

A spokesperson for Binance responded to the warning from the central bank, saying that the leading crypto exchange is in the process of filing an application for the registration needed. The digital asset company will also work with DNB for a positive update in the future.

Although Binance is not registered with DNB, the crypto exchange added that it takes compliance “very seriously,” and the platform has a robust compliance program with tools and procedures set for AML and combating terrorist financing.

Binance Coin price faces minor pullback

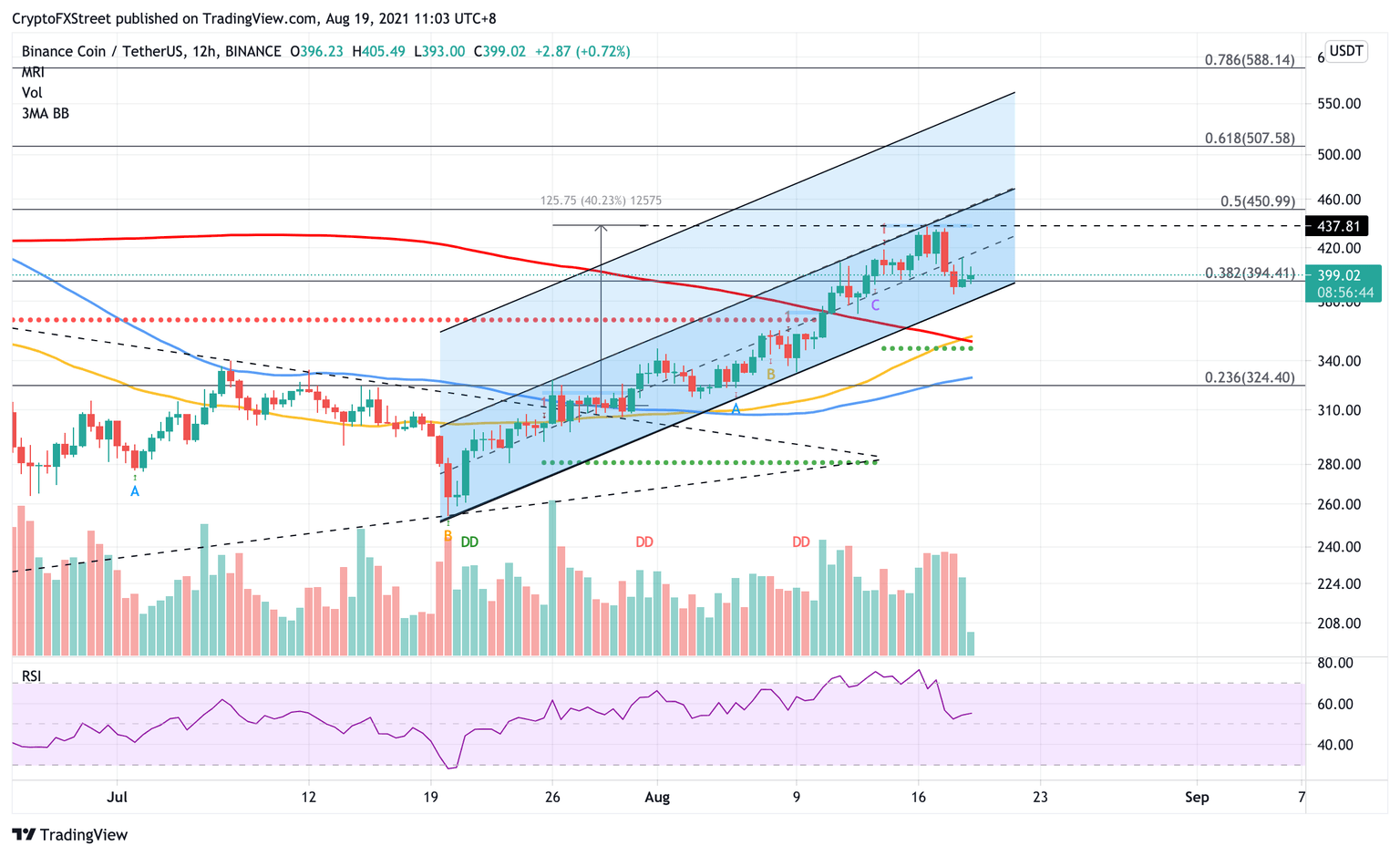

Binance Coin price has reached its target from the symmetrical triangle chart pattern with a surge of 40%, recording the local high at $437. Since July 19, BNB has been forming an ascending parallel channel, continuously setting higher highs and higher lows.

The prevailing chart pattern suggests a bullish outlook for Binance Coin price, but a target would only be achieved should BNB slice above the upper boundary of the parallel channel at $461.

Before the technical pattern’s aim of a 20% rally to the topside trend line of the channel can be expected, Binance Coin price must also conquer the hurdle at $437, the target level from the previous chart pattern coinciding with the breakout line given by the Momentum Reversal Indicator (MRI).

Further obstacles may arise should the rally be on bulls' radar, including the 50% Fibonacci extension level at $450 and the 61.8% Fibonacci extension level at $507, before the bullish target could be achieved.

BNB/USDT 12-hour chart

While Binance Coin price is facing a minor sell-off, BNB may find immediate support at the 38.2% Fibonacci extension level at $394, then at the lower boundary of the chart pattern at $382.

Should selling pressure further increase, pushing Binance Coin price lower, BNB may find meaningful support near the nexus of the 50 and 200 twelve-hour Simple Moving Averages (SMAs) at $353.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.