Dogecoin price to return to $0.09 as DOGE enters bear market

- Dogecoin price remains down nearly 80% from its all-time high.

- As Dogecoin enters an extreme bearish Ichimoku condition, a little reprieve is in sight.

- The only relief for bulls is a mean reversion setup within the Ichimoku Kinko Hyo system.

Dogecoin price continues to face significant weakness. A double whammy of low participation due to seasonality and a bearish outlook has leaned heavily on any near-term positive movement for DOGE.

Dogecoin price likely to return to below $0.10 trading conditions

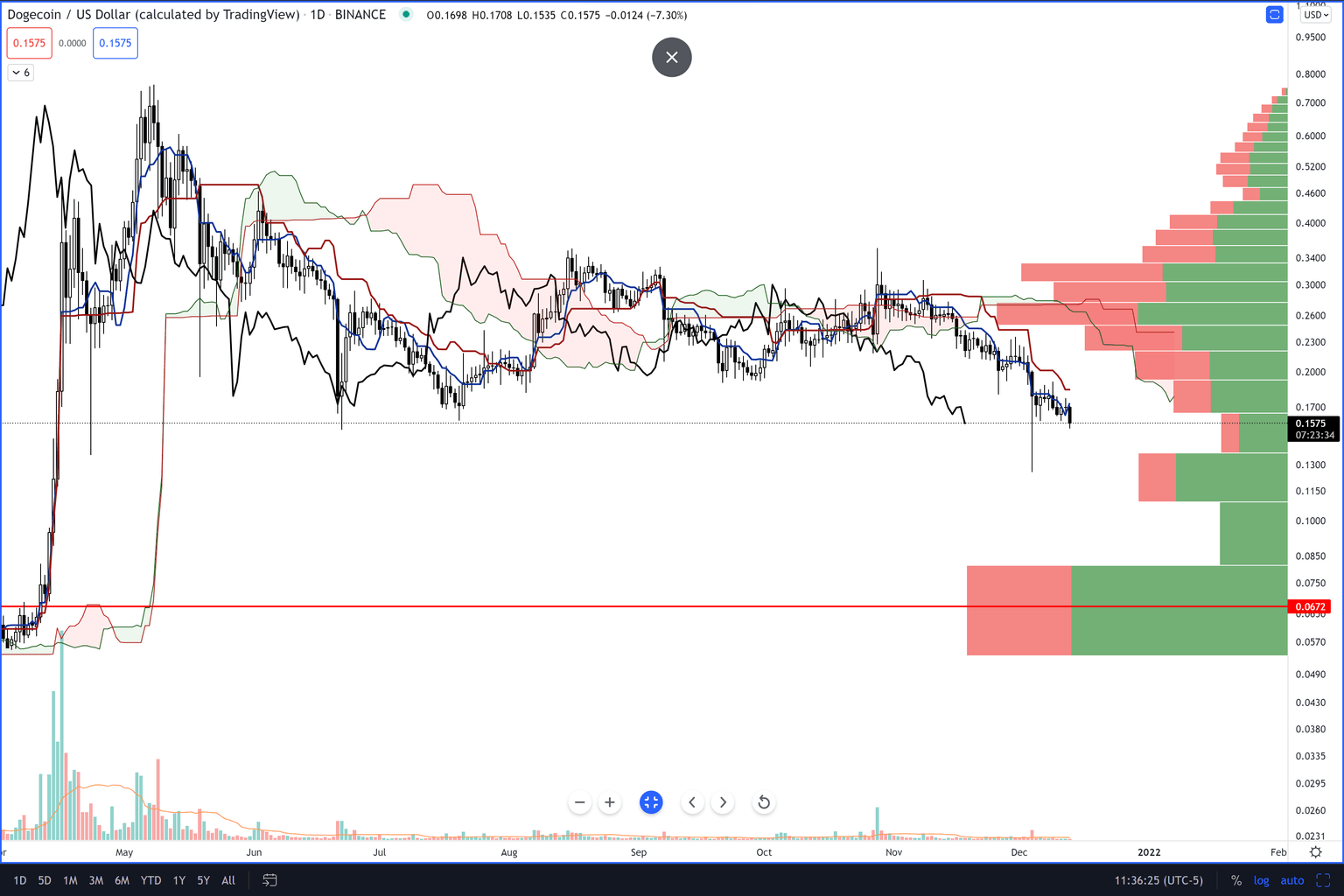

Dogecoin price has completed one of the most sought-after long-term bearish signals within the Ichimoku Kinko Hyo system: the Ideal Bearish Ichimoku Breakout. The rules for this are as follows:

- Future Senkou Span A is below Future Senkou Span B

- If Future Senkou Span A is above Future Senkou Span B, then Future Senkou Span A must be pointing down, and Future Senkou Span B must be flat or pointing up.

- The Tenkan-Sen is below the Kijun-Sen

- The current close is below the Tenkan-Sen and Kijun-Sen.

- The current close is below the Cloud (below Senkou Span A and Senkou Span B).

- The Chikou Span is below the candlesticks and in open space.

- Open space is a condition where the current Chikou Span would not intercept the body of any candlestick over the next five to ten periods.

All of the above conditions are currently true for Dogecoin price. As a result, a solid and sustained downside move is now likely for Dogecoin, with an initial support zone that may not appear until the $0.09 value area. After that, the volume profile becomes thinner, the lower DOGE falls, and the speed of the descent also increases.

The ultimate support for Dogecoin may not appear until the 2021 Volume Point Of Control at $0.05 – but that would represent a clear capitulation move as Dogecoin will have lost over 93% of its value from the all-time high established in May.

DOGE/USDT Daily Ichimoku Chart

The only near-term relief that bulls may find is an incoming mean reversion setup on the weekly chart. The gaps between the bodies of the weekly candlesticks and the Tenkan-Sen continue to widen. A return to test the Tenken-Sen at $0.24 is increasingly more probable the longer that Dogecoin spends away from that level.

To deny any further bearish bias, Dogecoin would need to have a weekly close at or above the $0.25 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.