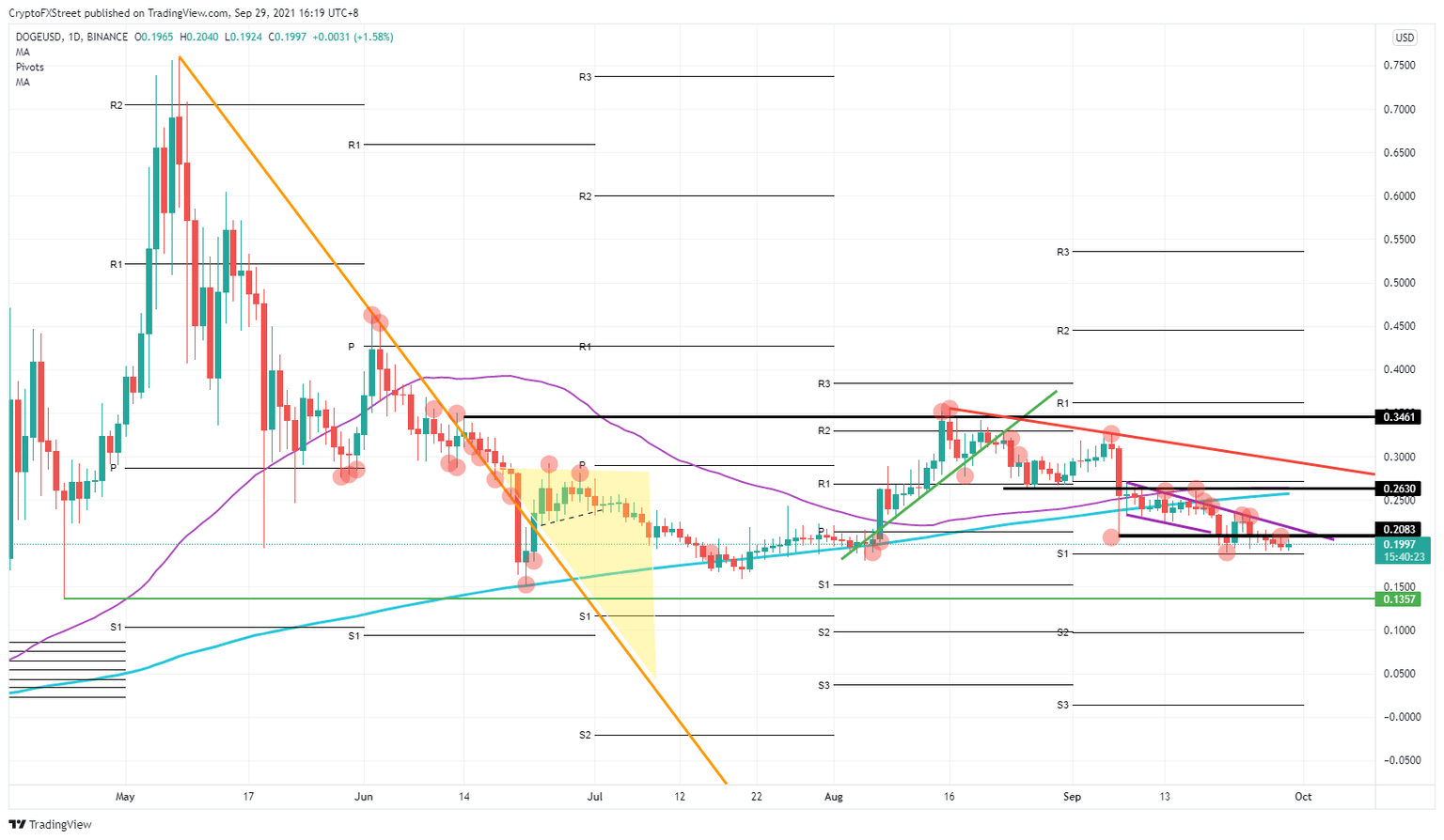

Dogecoin Price Prediction: DOGE stands to shed 30% of its value

- Dogecoin price action is in a downtrend, with DOGE price squeezed against the monthly S1 support level at $0.18.

- Bears will attempt to run toward $0.13 as the next profit level for them.

- If market sentiment continues its trend as on Tuesday, expect a possible test even at $0.10.

Dogecoin price (DOGE) action looks to fall further as it is shedding more of its value as bears attempt to squeeze against the bulls. For now, the S1 monthly support level is holding. A break below would spell 30% losses with a price target at $0.13.

Dogecoin price action is pushing bulls into a corner

The Dogecoin price favors the bears with a push of the price action against the monthly S1 pivot at $0.19. With that squeeze, bulls are standing to lose their ground and will expose their stops below the S1 monthly pivot. This will provide the bears a free lunch, and with not much resistance in the way, the road is paved toward $0.13.

DOGE price action might have some more tailwinds if markets fall into a repetition of the reaction markets had on Tuesday. With that, DOGE bulls will back off and will not be interested in picking up some Dogecoin or any other cryptocurrency for that matter. Expect a drop further toward $0.10, which holds the monthly S2 support level for the second month in a row.

DOGE/USD daily chart

DOGE bears will face quite a lot of bull buying at $0.10, as Dogecoin is marked at a very interesting discount around those levels. So bears should be, and will be, happy to lock in their profits and hand over the keys to the bulls.

Should market sentiment shift back to risk-on, expect bulls to try and break out of the purple descending trend line and look for a run back up toward $0.26. There the 200-day Simple Moving Average (SMA), a historical level and the monthly Pivot are all quite close to one another. Bulls will face quite some selling around that area that could halt them in their tracks quite prematurely.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.