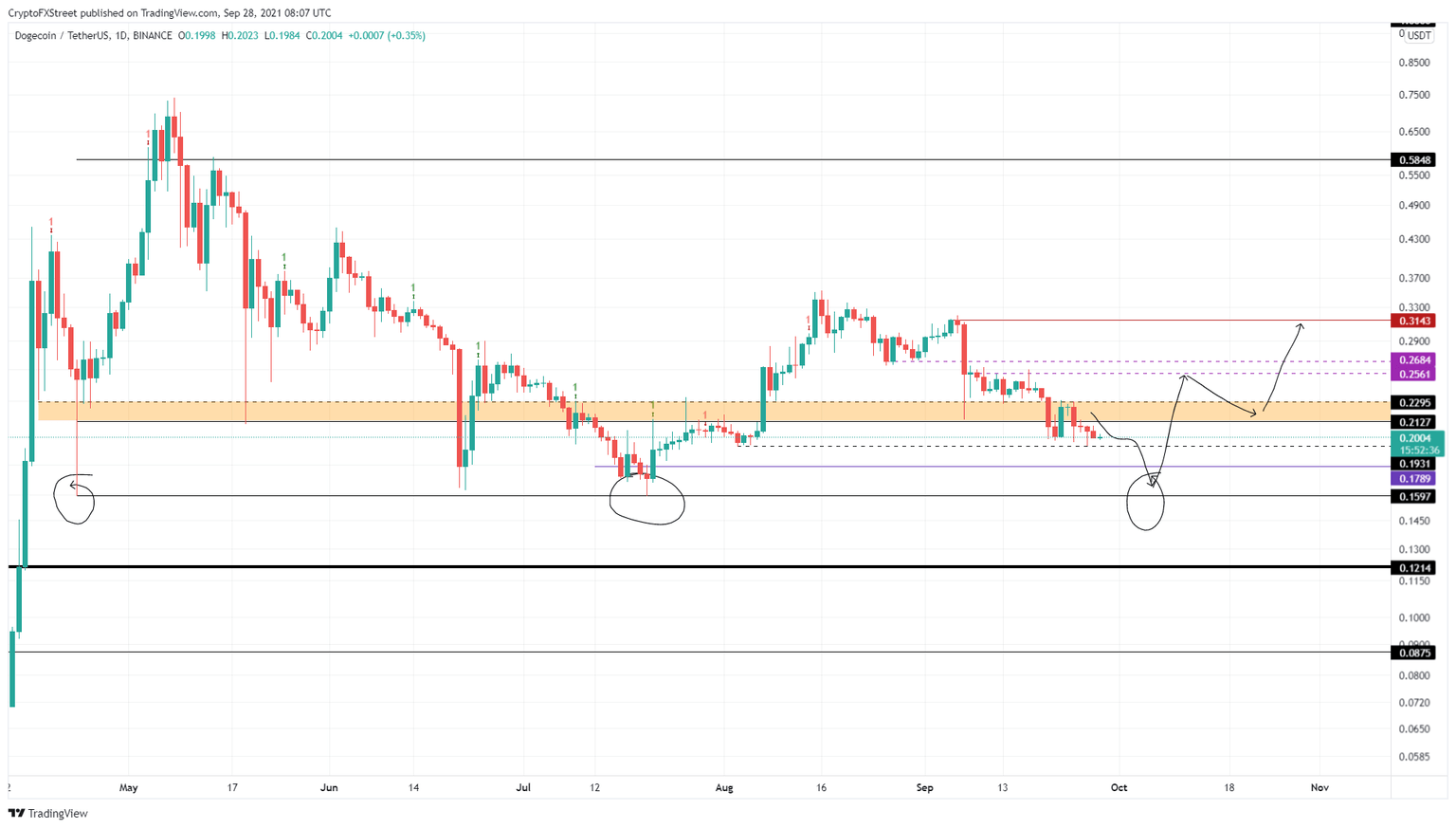

Dogecoin price needs to retrace before DOGE can advance 50%

- Dogecoin price is struggling to slice through a support area extending from $0.213 to $0.230.

- A retracement to $0.179 or $0.160 will form a triple-bottom setup and potentially trigger a run-up to $0.268.

- If DOGE produces a lower low below $0.160, it will invalidate the bullish thesis.

Dogecoin price is retracing after getting rejected at a stiff resistance level. While this correction could extend lower, it will be in search of a launching pad that will propel DOGE higher.

Dogecoin price to form bottom reversal pattern

Dogecoin price dropped 38% from September 7 to where it currently stands, $0.201. This downtrend sliced through the demand zone ranging from $0.213 to $0.230. Attempts to reclaim this failed as buying pressure fell short.

Now DOGE is hovering above the $0.193 support floor in hopes of taking another jab at the resistance barrier mentioned above. A potential spike in buying pressure that clears this hurdle could potentially kick-start an uptrend.

Dogecoin price will first encounter the resistance levels at $0.256 and $0.268. This ascent from $0.179 to $0.268 would constitute a 50% ascent. While overcoming these blockades will not be easy, doing so will allow the meme coin to scale higher and tag $0.314.

DOGE/USDT 1-day chart

Although a retracement to the $0.179 or $0.160 support floors is expected, investors should be mindful of the selling pressure that knocks Dogecoin’s price to produce a swing low below $0.160. Such a development will invalidate the bullish thesis as it would be a lower low.

However, there is a chance this swing low could be manipulation from the market makers to collect the sell stop liquidity resting below $0.160. In which case, a new bull rally could kick-start, pushing DOGE to resistance levels like $0.213, $0.23 or $0.268.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.