Dogecoin Price Prediction: DOGE primed for a 90% bull run

- Dogecoin price awaits a breakout from a consolidation pattern that could catapult it by 90%.

- Only one significant supply barrier sits ahead of DOGE.

- But if it closes above $0.059, prices will rise to $0.12.

Dogecoin price has seen many pumps this month at the hands of manipulative traders, celebrities, and so on. For instance, Tesla’s Elon Musk continues talking about it while rapper Snoop Dogg recently tweeted “Snoop Doge,” fueling the mounting speculation around.

Although DOGE is regarded as a meme token, it may be poised for higher highs.

Dogecoin price faces stiff resistance

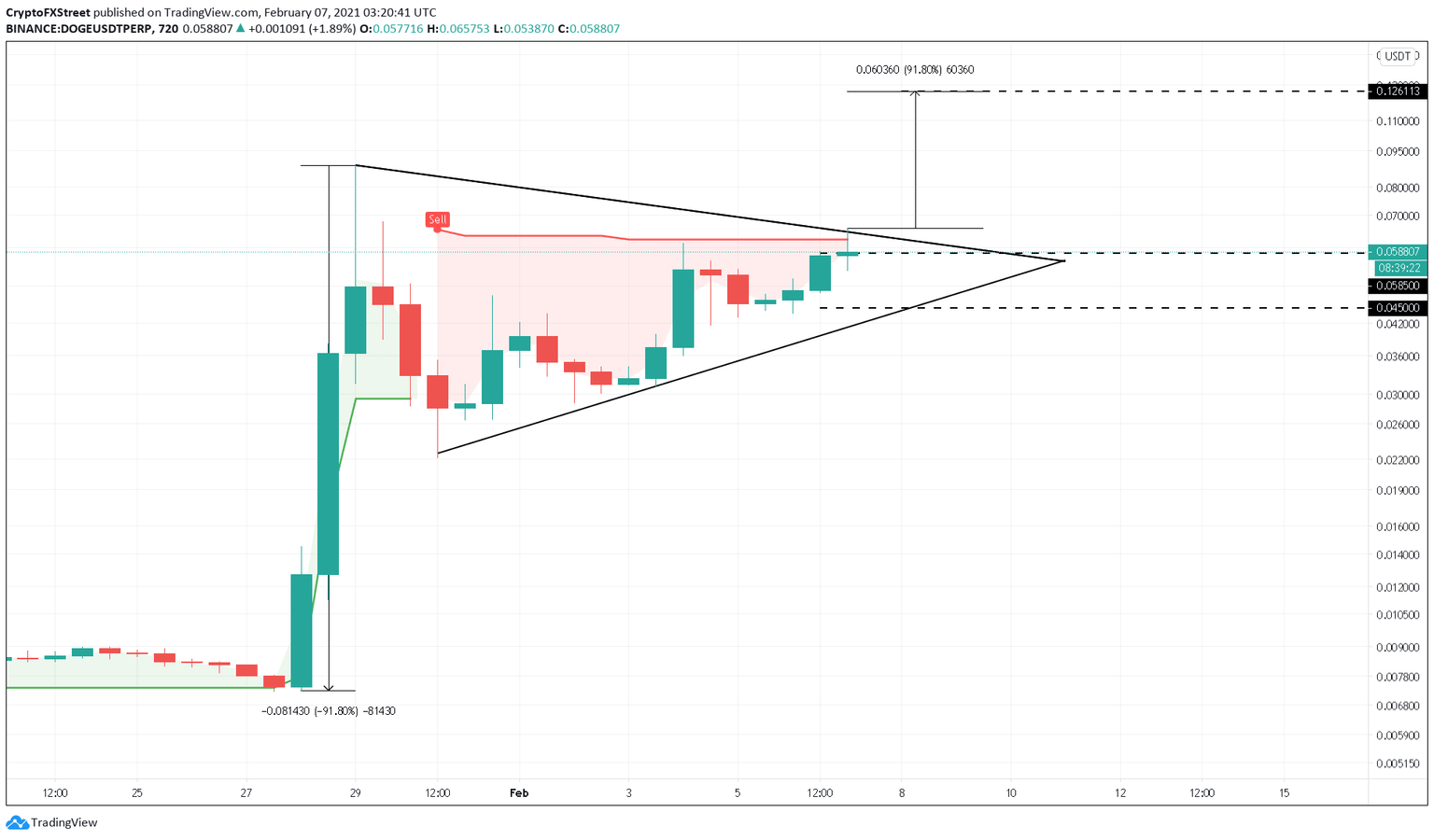

DOGE is consolidating in a bull pennant after surging 1,150% between January 28 and January 29. This type of technical formation is considered a continuation pattern that may lead to a significant price increase.

By measuring the flagpole’s height and adding it to the breakout point, the bull pennant forecasts a 90% target, which puts DOGE at $0.126.

A decisive 12-hour candlestick close above the pennant’s upper trans line could push Dogecoin price into another massive bull rally.

DOGE/USDT 12-hour chart

Dogecoin price will face stiff resistance at $0.058 on its way up.

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, around 5,200 addresses purchased nearly 2.70 billion DOGE around this price level. Thus, this cryptocurrency’s ascent will not be a cakewalk. Only a decisive close above the $0.058 level is crucial for starting a new uptrend to $0.125.

Dogecoin IOMAP chart

Despite the high probability of further price appreciation, Dogecoin is not a stranger to manipulation. A sudden spike in selling pressure should not come as a surprise any more than a pump would.

Slicing through the $0.045 support level could be catastrophic as a significant number of holders will be forced to sell their tokens to avoid substantial losses. If this were to happen, Dogecoin price might retrace all the way down to $0.0090.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.