Dogecoin Price Prediction: DOGE is poised for a 75% move

- Dogecoin gets ready for a massive upswing to $0.09 despite the barrier at $0.05.

- The increased social buzz around Dogecoin could see investor sentiment grow.

- The IOMAP reveals that robust seller congestion may hinder the expected upsurge.

Dogecoin continues to stir interest across the cryptocurrency market. Speculation shoot up after a tweet by Elon Musk, the founder of Tesla. At the time of writing, DOGE is trading at $0.046 after hitting a barrier at $0.055. Support is needed to place the ‘Meme Coin’ back on the recovery trajectory eyeing $0.09.

Dogecoin must flip crucial resistance into support to sustain the uptrend

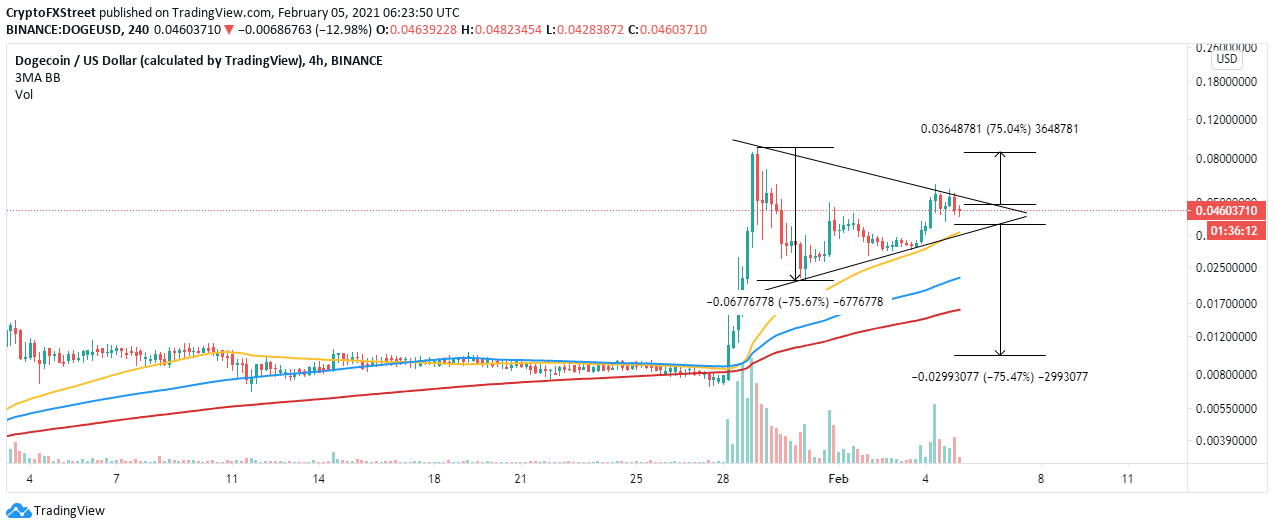

DOGE is dancing at the apex of a symmetrical triangle. The pattern is created by connecting a series of lower highs with a trendline. Similarly, the asset’s higher lows are linked using another trendline.

Traders usually lookout for breakouts or breakdowns from the triangle. A breakout occurs after the price slices through the upper trendline. In the case of Dogecoin, a 75% upswing may come into action if the price rises above the pattern. Triangles are essential in trend prediction because they have exact price targets measured from the highest to lowest points.

DOGE/USD 4-hour chart

According to the Santiment, Dogecoin’s social media-related mentions have started to increase consistently after falling massively early this week. An increase in social volume is a bullish signal and foresees a price rise. However, it is essential to watch out for the peak as it quickly turns bearish.

Dogecoin social volume

Looking at the other side of the fence

The IOMAP model by IntoTheBlock brings to light a strong resistance that could derail the upswing. This seller congestion zone runs from $0.046 to $0.048. Here, roughly 49,000 addresses had previously purchased nearly 9.4 billion DOGE. The investors in this range will be trying to come out of their positions, adding to the selling pressure.

Dogecoin IOMAP chart

On the downside, support exists but not as strong as the above resistance. Therefore, bulls must push for gains above $0.05 to avert potentially massive losses. Besides, the symmetrical triangle pattern suggests that a breakdown may extend to $0.0096.

The 50 Simple Moving Average, the 100 SMA, and the 200 SMA are in line to absorb the selling, thus preventing a sharp price drop.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B09.28.03%2C%252005%2520Feb%2C%25202021%5D-637481049176604851.png&w=1536&q=95)

-637481077047197338.png&w=1536&q=95)