Dogecoin Price Forecast: DOGE defends critical support and heads towards $0.060

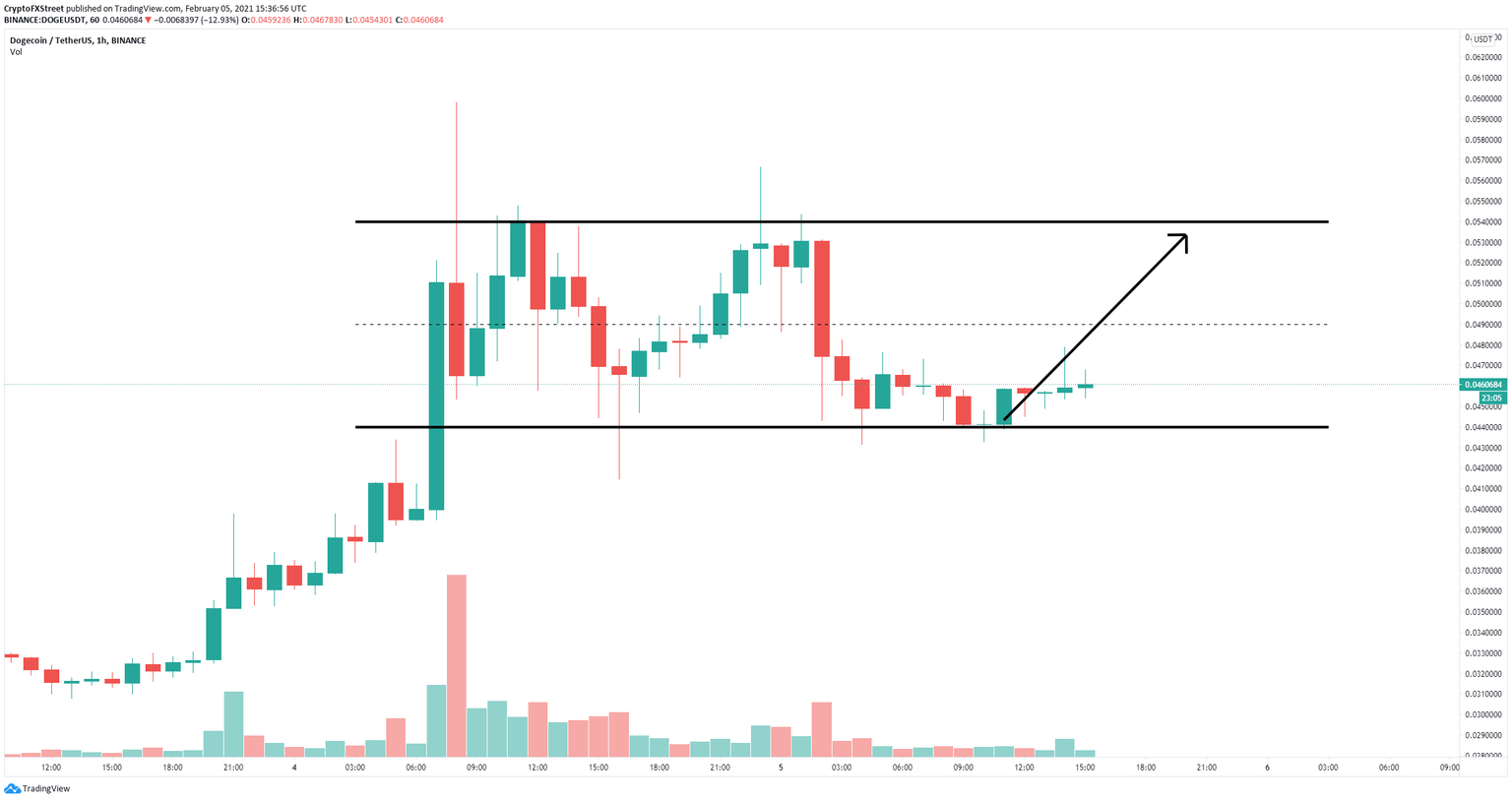

- Dogecoin price is trading inside a parallel channel on the 1-hour chart.

- DOGE bulls have defended the lower trendline support of the pattern and aim for a significant rebound.

- There is only one critical resistance level that Dogecoin needs to pass.

Dogecoin has been extremely volatile in the past week due to endorsements from Elon Musk and a massive pump orchestrated by the subreddit WallStreetBets which managed to successfully push the price of Gamestop stock, triggering a massive short squeeze.

Dogecoin price can jump to $0.054 if bulls can crack this level

On the 1-hour chart, Dogecoin has formed a parallel channel and bulls just defended the lower support trendline established at $0.044. DOGE aims for a nice rebound towards the upper boundary of the pattern at $0.0537.

DOGE/USD 1-hour chart

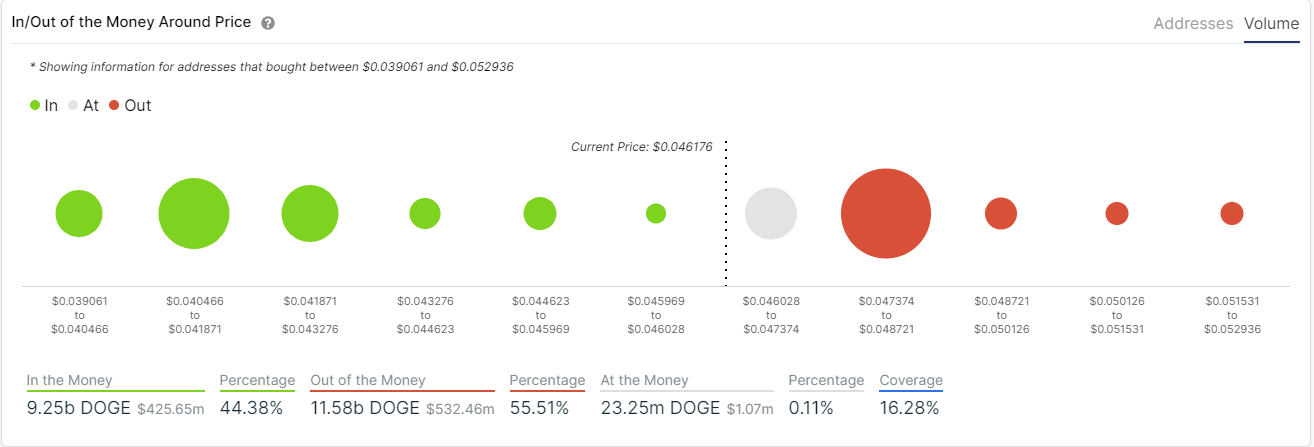

The In/Out of the Money Around Price (IOMAP) chart shows just one critical resistance area between $0.047 and $0.048 with 9.3 billion DOGE in volume and 49,000 addresses involved. A breakout above this point should easily drive Dogecoin price towards $0.054 as there are no other barriers ahead.

DOGE IOMAP chart

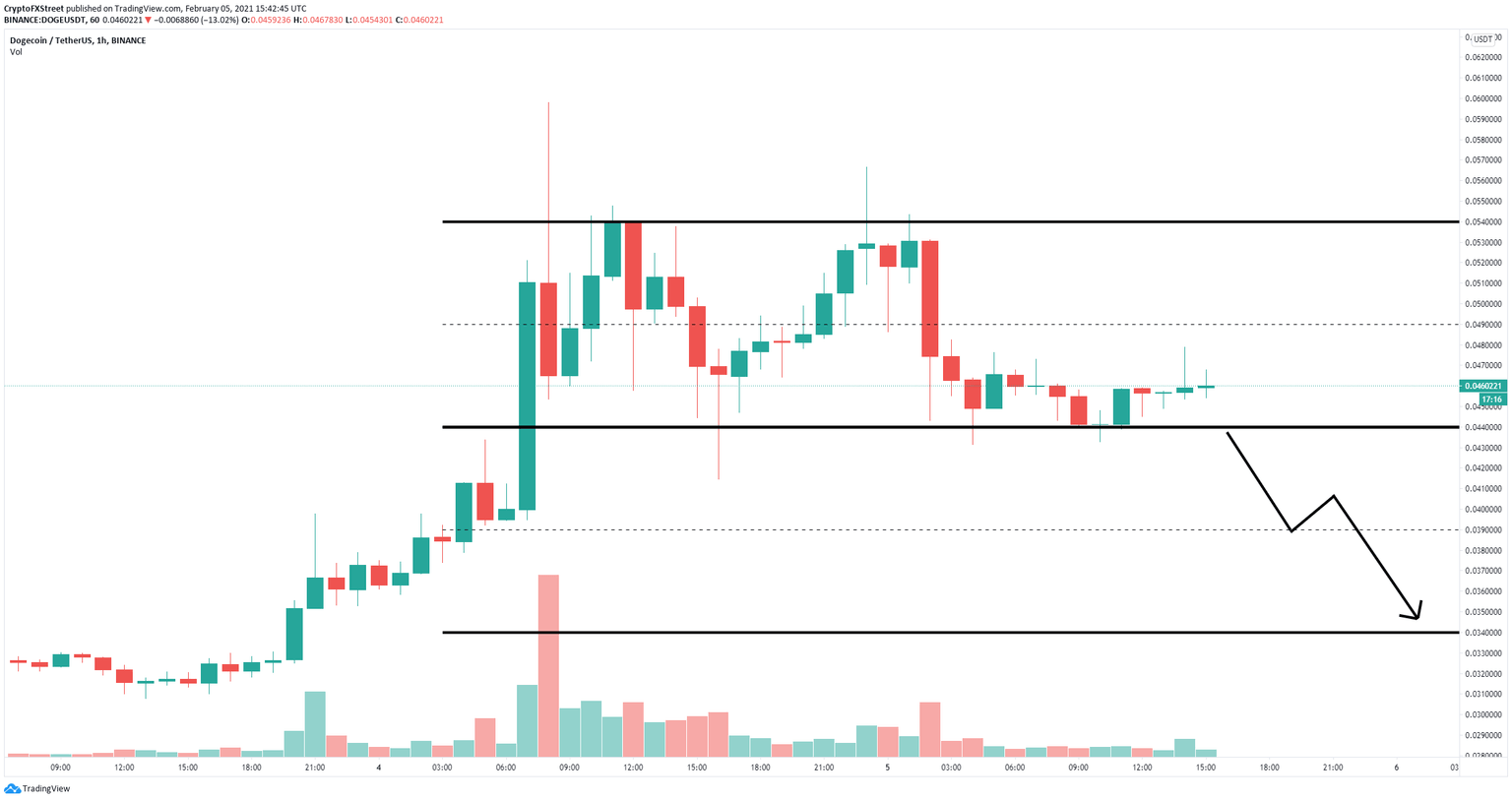

However, the IOMAP model also indicates that support below $0.046 is extremely weak in comparison. This indicates that Dogecoin could easily lose the crucial support level at $0.044 which would be bearish.

DOGE/USD 1-hour chart

A breakdown below $0.044 will drive Dogecoin price towards $0.039 at first and as low as $0.034 in the long-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.