Dogecoin Price Prediction: DOGE pauses before continuing 35% ascent

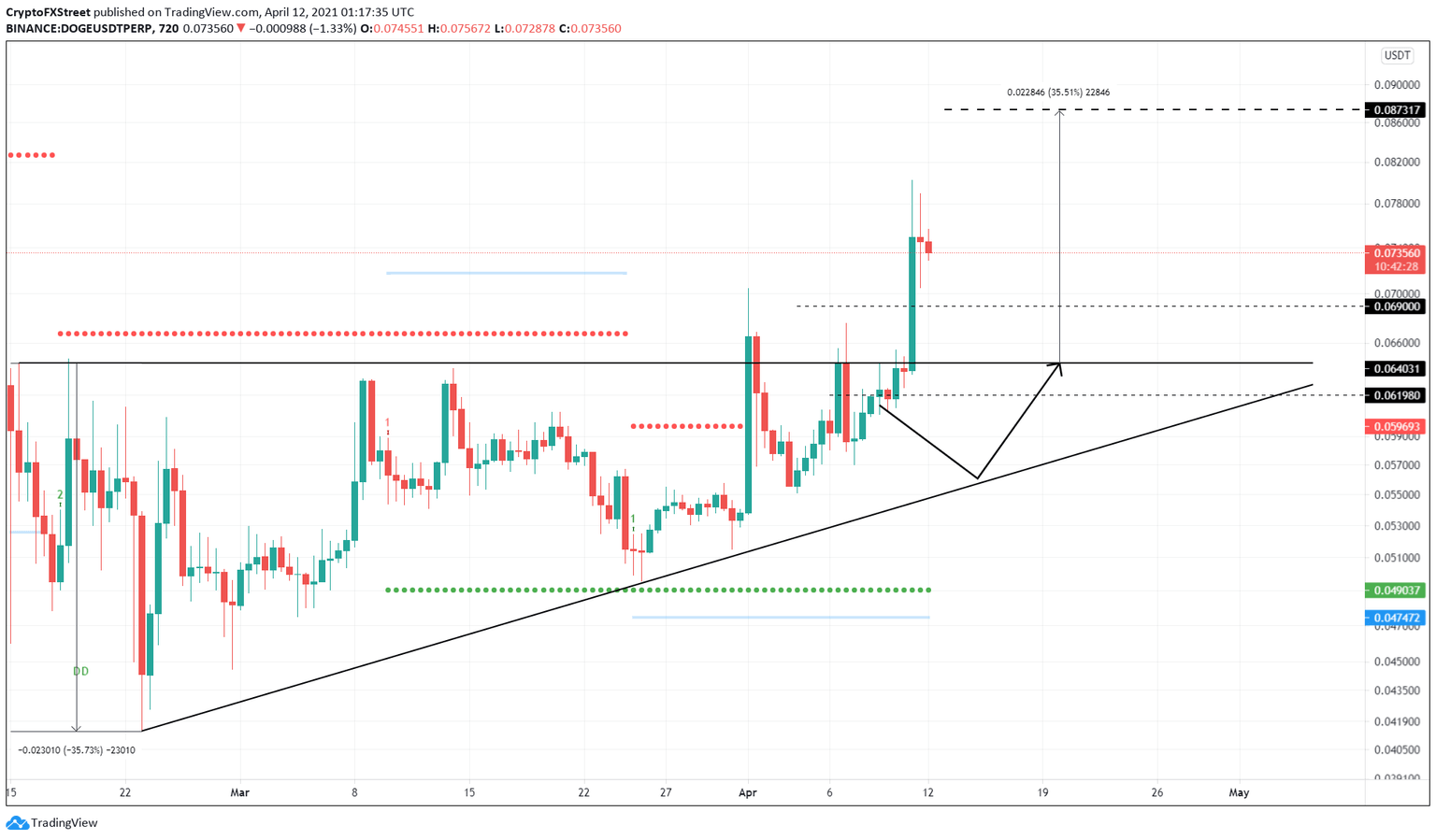

- Dogecoin price breached an ascending triangle pattern on April 11, triggering a bull run.

- DOGE spiked nearly 17% in a single candle on the 12-hour chart, hitting $0.080.

- Now, a retracement to the immediate support level at $0.071 seems likely before it starts to climb again.

Dogecoin price shows the exhaustion of buying pressure resulting in a pause of the uptrend.

Dogecoin price at inflection point

Dogecoin price produced an ascending triangle pattern obtained when the series of highs and swing lows are connected using trend lines. Such a price action shows aggressive buying pressure, and so the breakout tends to be a bullish one.

A decisive close above the triangle’s base at $0.064 will signal the start of a 35% upward trend to $0.087. This target is determined by adding the distance between the first swing high and low to the horizontal supply barrier at $0.064.

On April 11, DOGE buyers pushed the meme coin price from $0.063 to $0.080 in a single candlestick on a 12-hour chart. This 26% upswing caused Dogecoin price to shatter major supply zones at $0.069 and $0.071.

A minor retracement seems to have begun, which has resulted in a 9% correction as of this writing. The immediate support level at $0.071, created by the Momentum Reversal Indicator’s (MRI) breakout line, appears to be an obvious choice.

Therefore, investors can expect Dogecoin price to begin its second leg from here. The resistance level at $0.080 and $0.082 might deter the upswing. Hence, slicing through these levels is imperative for the meme coin to reach its target at $0.087.

DOGE/USDT 12-hour chart

However, if the correction slices through the breakout line at $0.071, the Dogecoin price might be in trouble. Such a move would likely produce a 4% retracement to $0.069 or a 7% pullback to $0.066.

The bullish thesis’s invalidation will occur if DOGE pierces the ascending triangle’s base at $0.064 and trades under this level for an extended period.

In such a case, the dogecoin price could slide to $0.061 or 0.059.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.