Dogecoin Price Forecast: DOGE eyes 13% drop

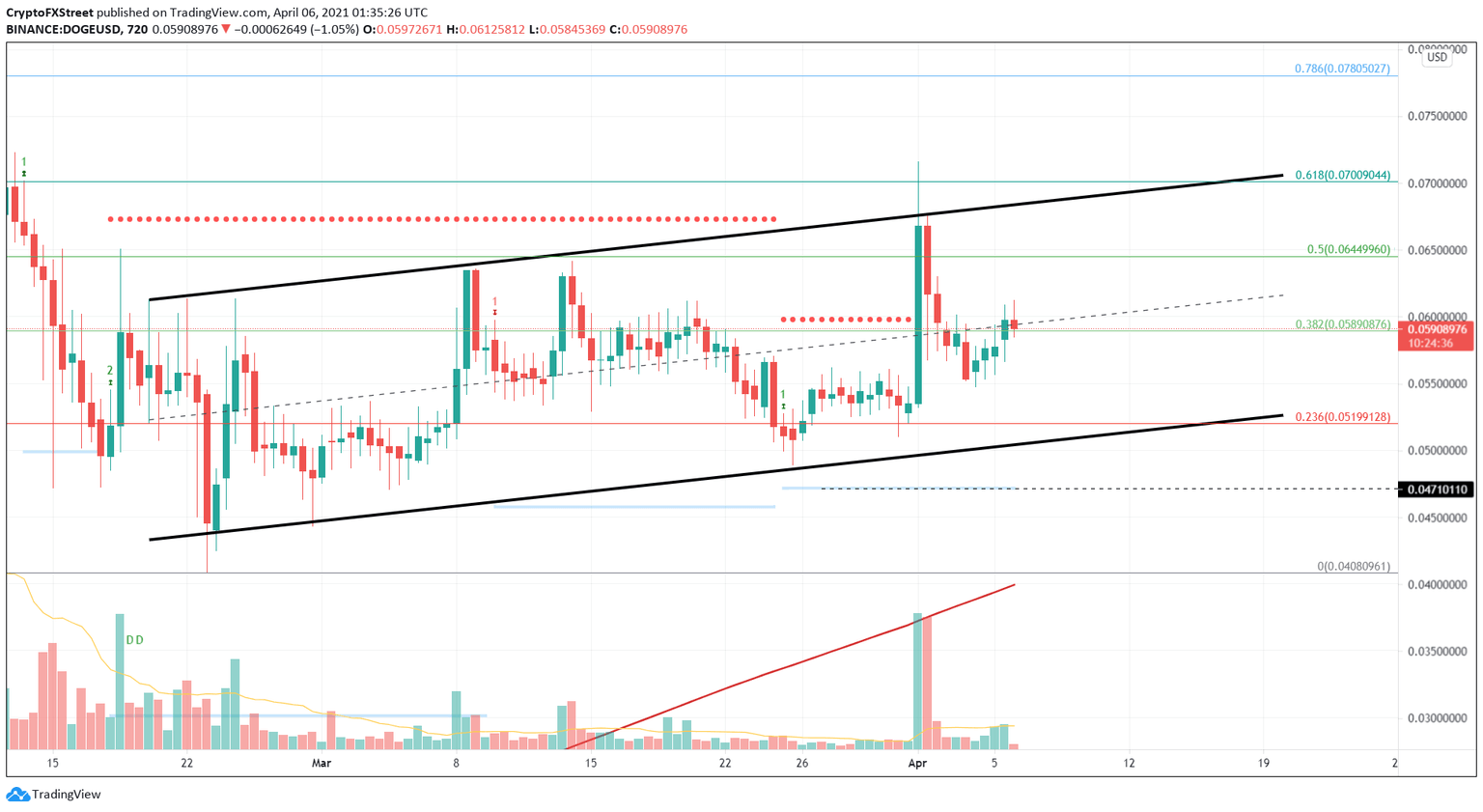

- Dogecoin price is trading inside an ascending parallel channel.

- The MRI’s State Trend Resistance coinciding with the setup’s middle line at $0.060 will deter any upside move.

- Transactional data reveals that a breakdown of the $0.056 demand barrier will help the bearish outlook.

The Dogecoin price is stuck between two crucial barriers that have prevented it from establishing a clear trend.

Dogecoin price awaits spike in momentum

The Dogecoin price has set up three higher highs and higher lows since February 20. An ascending parallel channel forms when these swing points are joined using trend lines. As long as DOGE trades within the technical formation confines, a bearish outlook can be avoided.

However, if bulls fail to slice through the immediate resistance at $0.060, a 13% downswing toward the lower trend line at $0.051 seems likely. Interestingly, this level coincides with the 23.6% Fibonacci retracement level.

The Dogecoin price will be in trouble if it breaches the Momentum Reversal Indicator’s (MRI) breakout line at $0.047. In this case, a 13% correction toward the demand barrier at $0.040 is possible.

DOGE/USDT 12-hour chart

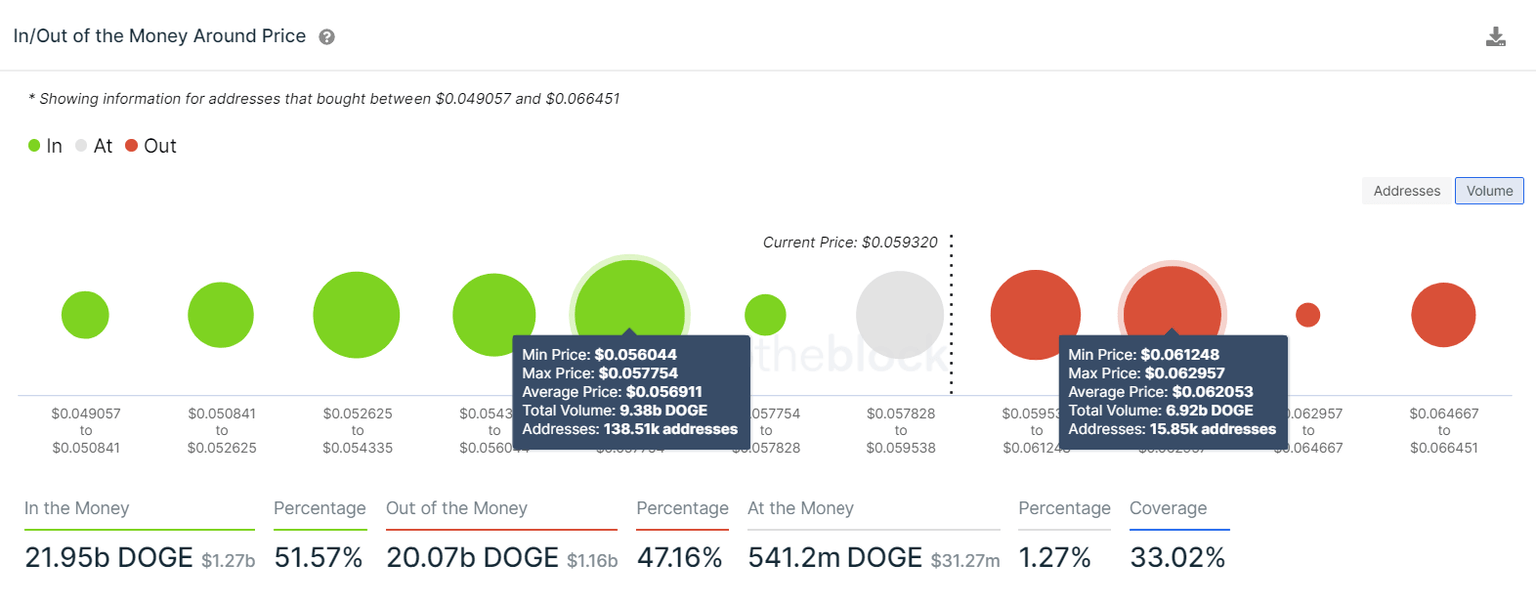

Based on IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, 140,000 addresses that hold roughly 9.4 billion DOGE tokens at $0.056 will cushion short-term bearish momentum.

Therefore, the bears need to summon a massive spike in selling pressure that will lead to a breakdown of this level to have any chances of heading toward the lower boundary of the ascending parallel channel at $0.051.

Dogecoin IOMAP chart

IOMAP cohorts reveal that 16,000 addresses that purchased nearly 7 billion DOGE at an average price of $0.062 are “Out of the Money” and will deter upward moves. However, a decisive close above this level will result in a 13% upswing to MRI’s State Trend Resistance at $0.067.

The bearish thesis will face invalidation if the 61.8% Fibonacci retracement level at $0.070 is conquered. This move will open up the Dogecoin price for further upswings.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.