Dogecoin Price Prediction: DOGE is ready for new all-time highs after crucial rebound

- Dogecoin price needs to reconquer a critical support level to aim for a rebound.

- The digital asset faces only one big resistance level before a potential breakout to $0.09.

- However, the interest in Dogecoin has significantly declined in the past few weeks.

It seems that Elon Musk might actually end up endorsing Dogecoin as the concentration of whales isn't as bad as previously believed. The biggest whale is Robinhood which purchased Dogecoin to offer trading to its users in 2018.

In his last tweet, Elon Musk stated that he will fully support Dogecoin if the concentration of whales diminishes. However, since there aren't that many large individual holders, perhaps Musk is closer than expected to endorse the digital asset.

Dogecoin price aims for a rebound to $0.09

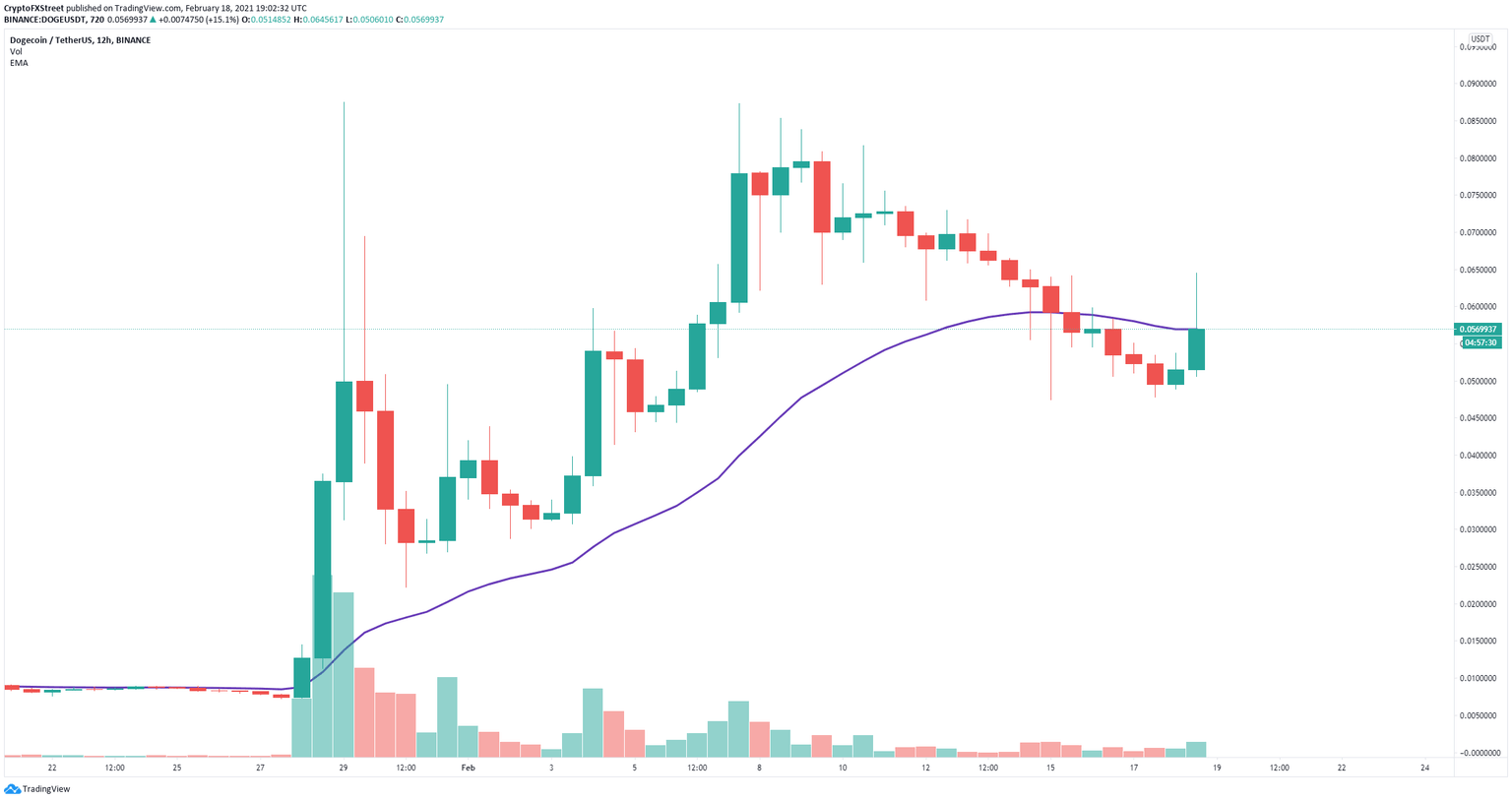

On the 12-hour chart, Dogecoin bulls are fighting to push the digital asset above the 26-EMA resistance level. A rebound from this point at $0.057 would be significant.

DOGE/USD 12-hour chart

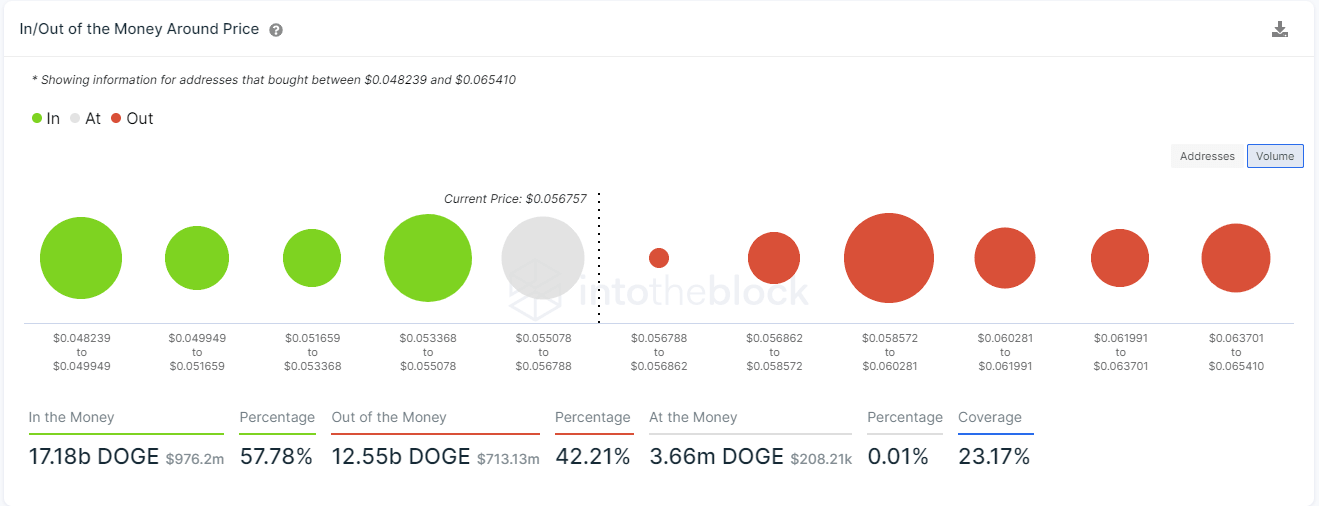

The In/Out of the Money Around Price (IOMAP) chart shows that the strongest resistance area is located between $0.058 and $0.06. If Dogecoin price can climb above this point, it can quickly reach $0.09 again.

DOGE IOMAP chart

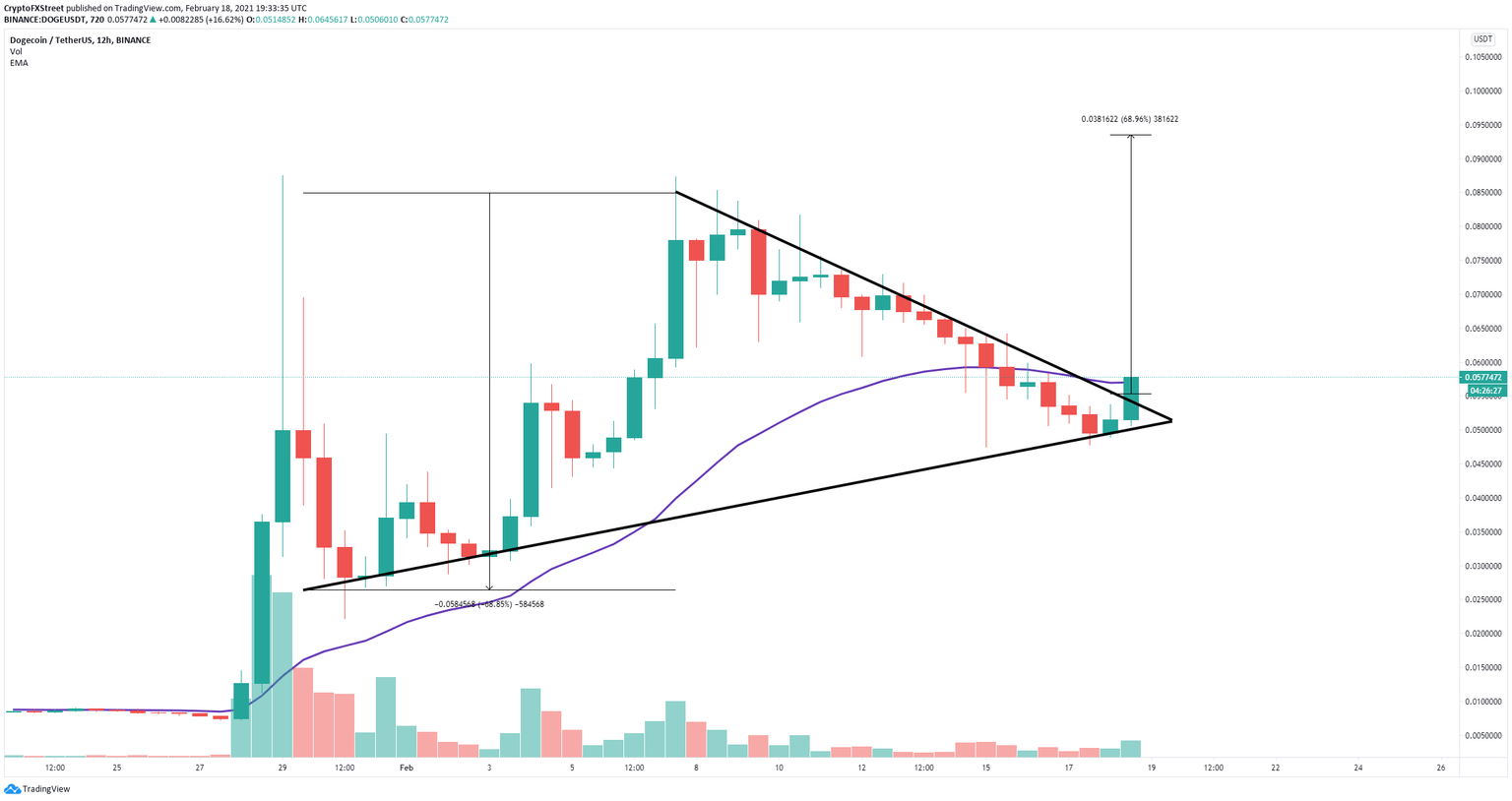

Additionally, there is a symmetrical triangle pattern formed on the 12-hour chart that broke bullish. A candlestick close above $0.055 would confirm it. The price target is around $0.094, a new all-time high for Dogecoin.

However, the IOMAP model also shows that losing the key support area between $0.0533 and $0.055 would be devastating and could likely send Dogecoin price down to $0.048.

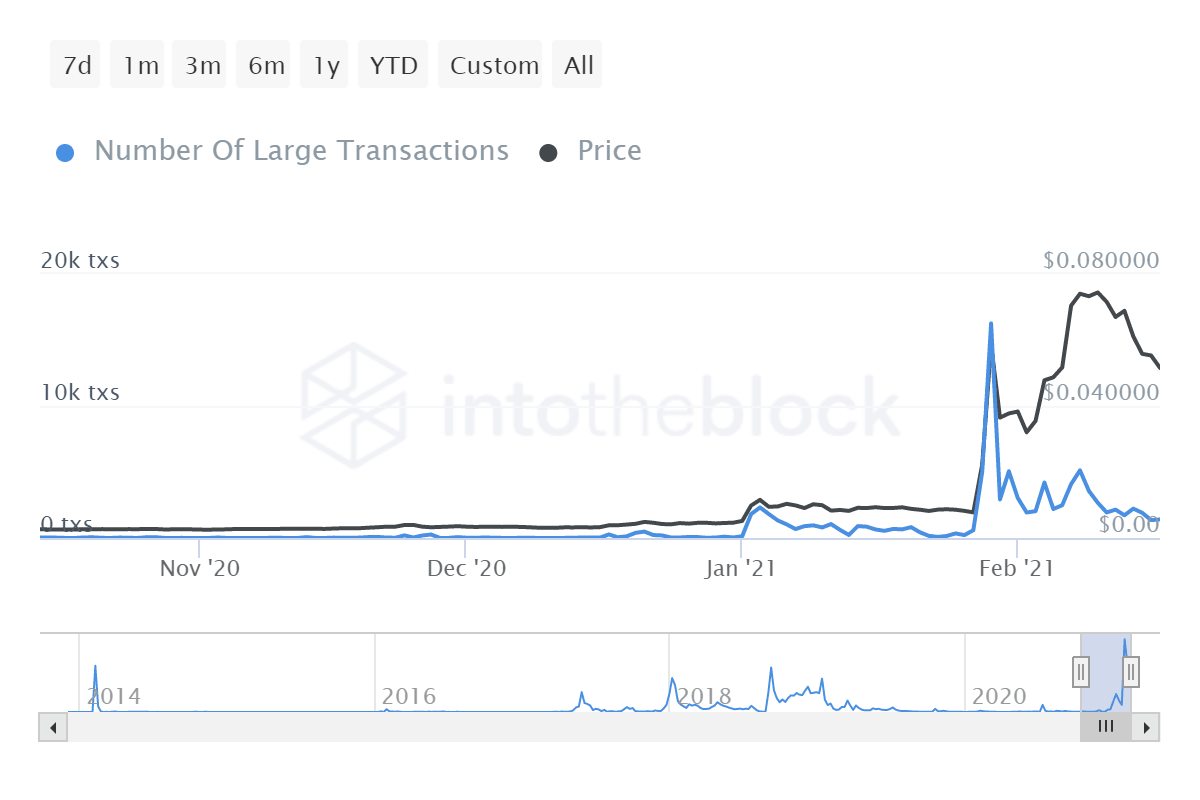

DOGE transactions

Clearly, the interest in Dogecoin has faded away. The number of large transactions has significantly decreased in the past two weeks from a peak of 16,260 per day on January 29 to only 1,400 currently.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.