DOGE holders refuse to concede to the bear market even as Dogecoin price nears September 2022 lows

- Dogecoin price is currently trading at $0.0612, inching closer to hitting a nine-month low.

- DOGE investors are still growing significantly, adding nearly 110k new addresses over the last month.

- Although the fear in the crypto market has subsided since last week, bearishness still persists in the case of DOGE.

Dogecoin price dipped lower over the weekend as Bitcoin price slipped to trade at $28,500. The crypto market was looking to recover at the beginning of the month, but 12 days into June, the situation seems to be getting dire for investors. However, DOGE holders’ resilience is observing no bounds as they continue to grow even now.

Dogecoin price reaches new low

Dogecoin price marked a new 2023 low on June 10 after charting a 10% decline in 24 hours, bringing the meme coin to $0.0618. In the following 48 hours, the cryptocurrency dipped further and, at the time of writing, can be seen trading at $0.0612. DOGE is now closer to registering a nine-month low, and if it declines any further, it will end up falling to September 2022 lows.

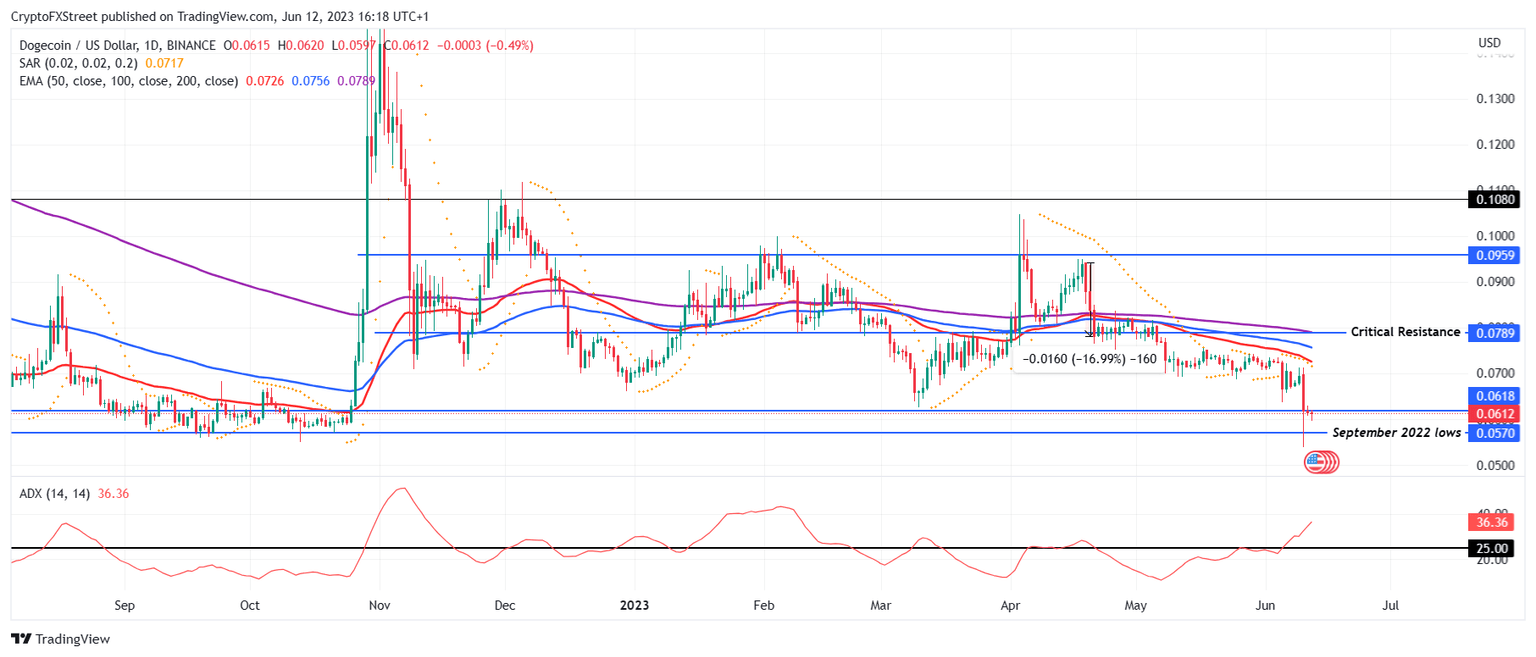

DOGE/USD 1-day chart

As it is, the Parabolic Stop and Reverse (SAR) indicator suggests an active bearish trend. The presence of the dots above the candlesticks is evidence of this bearishness which could intensify further. This is evident thanks to the Average Directional Index (ADX), which is above the 25.0 threshold suggesting the active trend is strong.

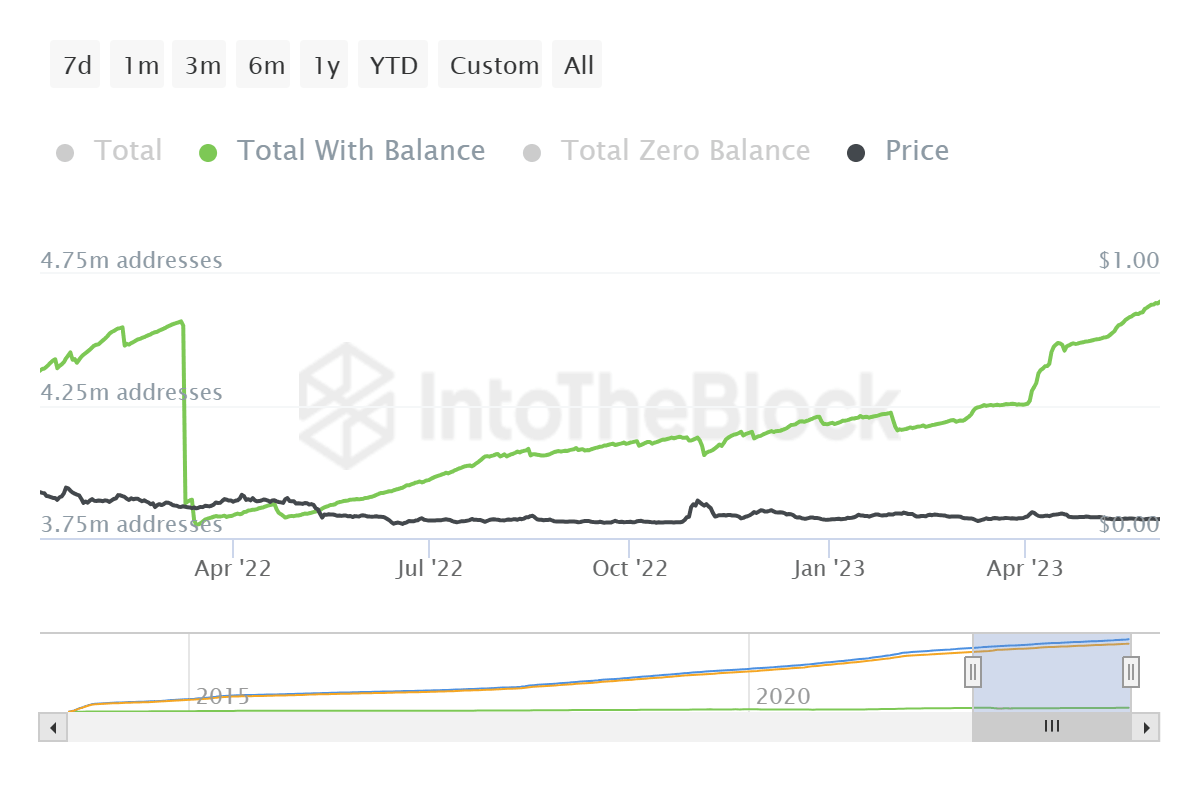

But looking at the on-chain activity, it does not look like Dogecoin investors care much about this bearishness. Their growth in Q3 2023 has been exceptional and continues to remain that way, adding almost 110k new addresses in the last month, bringing the total DOGE holders to 4.65 million.

Dogecoin total addresses

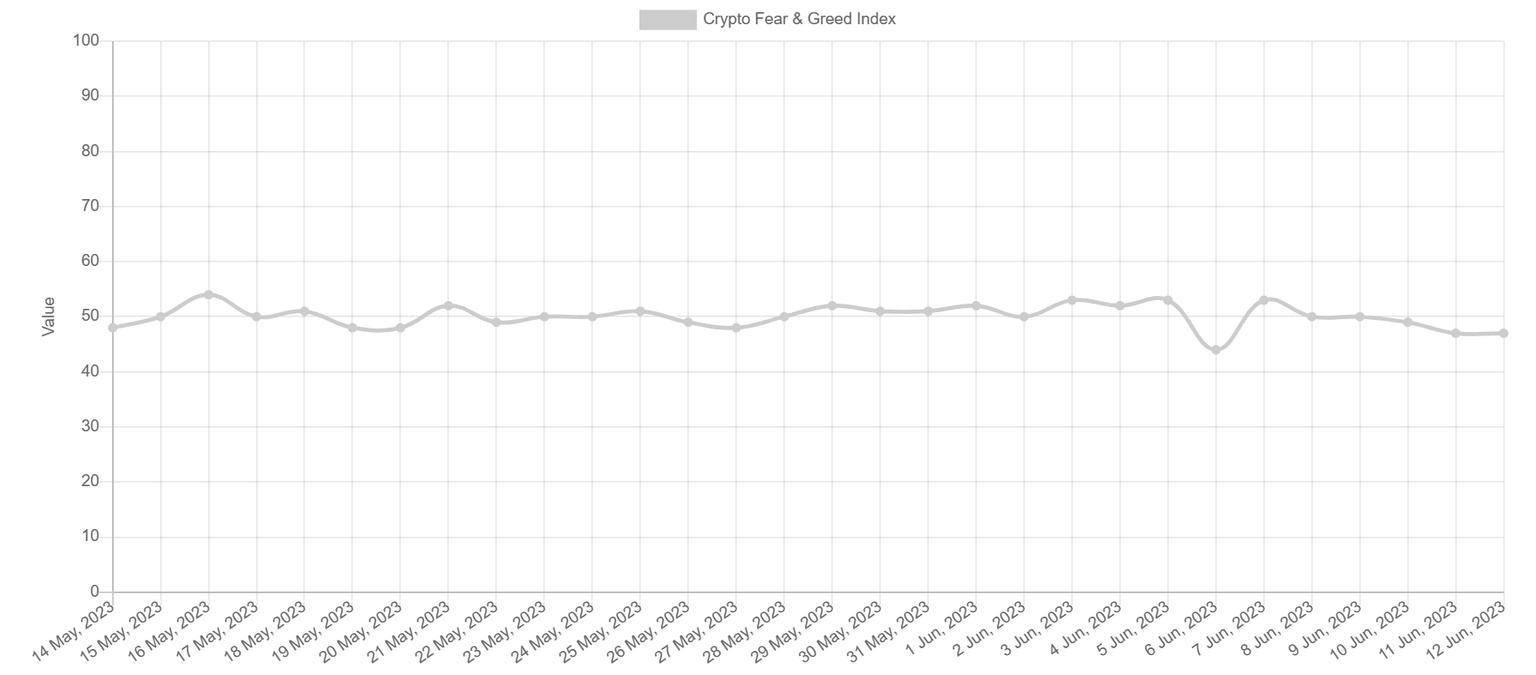

One of the biggest reasons behind this is the lack of fear in the crypto market since investors are looking at this as an opportunity to accumulate supply. The Crypto Fear and Greed Index is indicating a neutral sentiment in the market, recovering from the Fear of last week.

Crypto Fear and Greed index

However, there is still some possibility that DOGE investors might also pull back soon since the DOGE market is heavily bearish at the moment. The weighted sentiment in the case of Dogecoin is at a historical high, suggesting pessimism among investors.

Dogecoin weighted sentiment

If this pessimism spreads, the cryptocurrency might experience some setbacks in terms of the support it is receiving from its investors.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B20.51.11%2C%252012%2520Jun%2C%25202023%5D-638221846806473040.png&w=1536&q=95)