Dogecoin Price Prediction: DOGE bullish failure could cause a 20%-to-40% correction

- Dogecoin price has dipped under support at $0.055, opening up the possibility of a steeper correction.

- Transactional data shows investors who purchased 20.70 billion DOGE from $0.050 to $0.055 are underwater.

- A breakdown of the critical support barrier extending $0.048 and $0.043 will lead to a 10%-to-45% correction.

Dogecoin price shows a failure to hold above the bull flag’s breakout point at $0.055. This lack of buying pressure has caused a pullback into the consolidation zone. Now, DOGE faces a bearish outlook that could result in a steep correction.

Dogecoin price fakeout leaves a lot of investors underwater

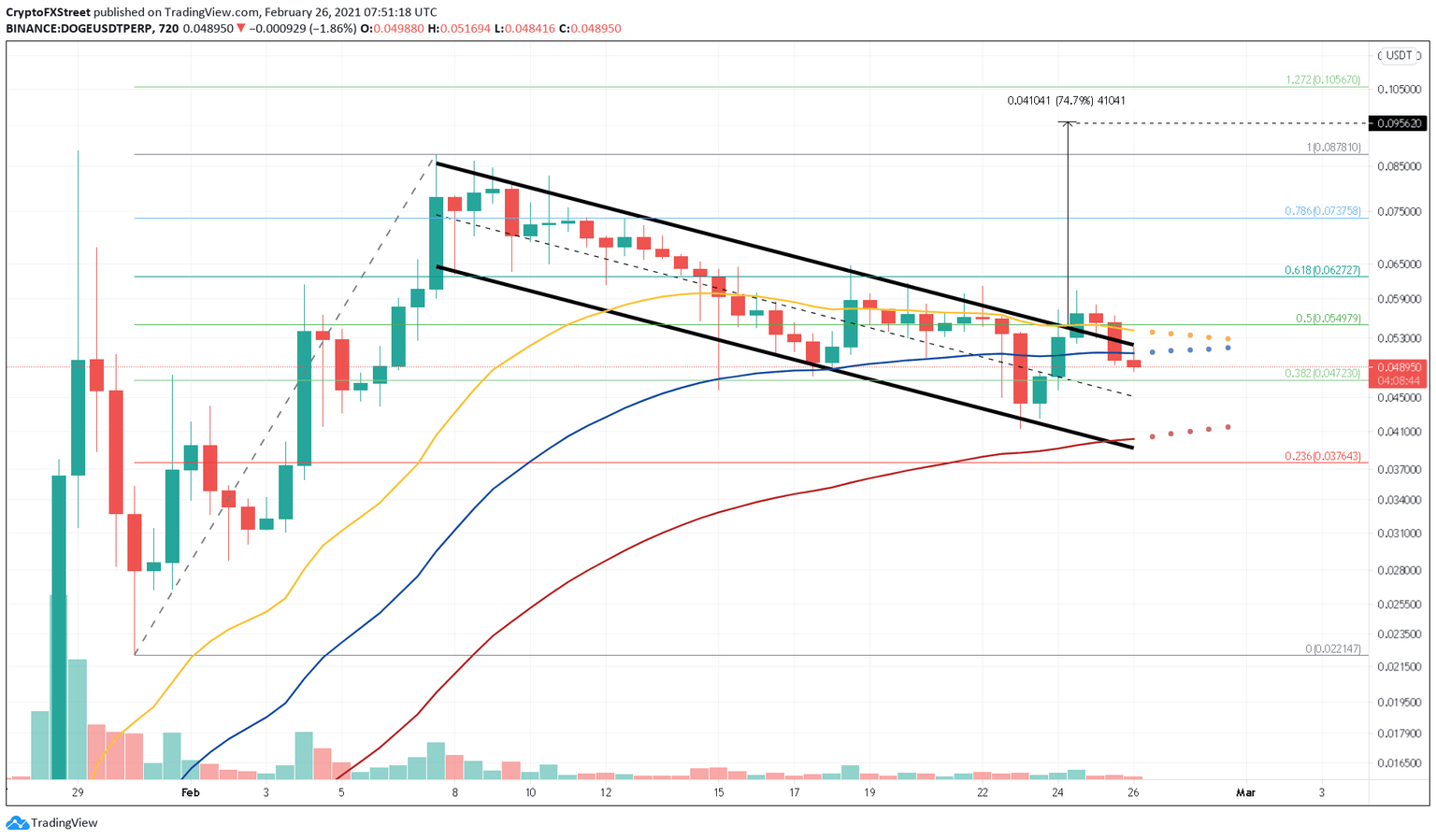

Dogecoin price surged nearly 300% in less than ten days from January 30 to February 7. After which, DOGE consolidated, forming a series of lower highs and lower lows. The meme coin’s price action from January 30 to February 24 is known as a bull-flag pattern.

This technical formation is a continuation pattern and forecasts a 75% upswing, which is the flag pole’s height added to the breakout point at $0.055.

On February 24, Dogecoin price signalled a bullish breakout from this setup after a 12-hour candlestick closed above $0.055. However, the volume didn’t align with the breakout. The sellers seized the opportunity and strong-armed DOGE back into the consolidation, which has resulted in a flipped bullish scenario on its head.

Adding credence to this bearish outlook is the price dip below the short and mid-length exponential moving average (EMA), ranging from $0.041 to $0.043.

DOGE/USDT 12-hour chat

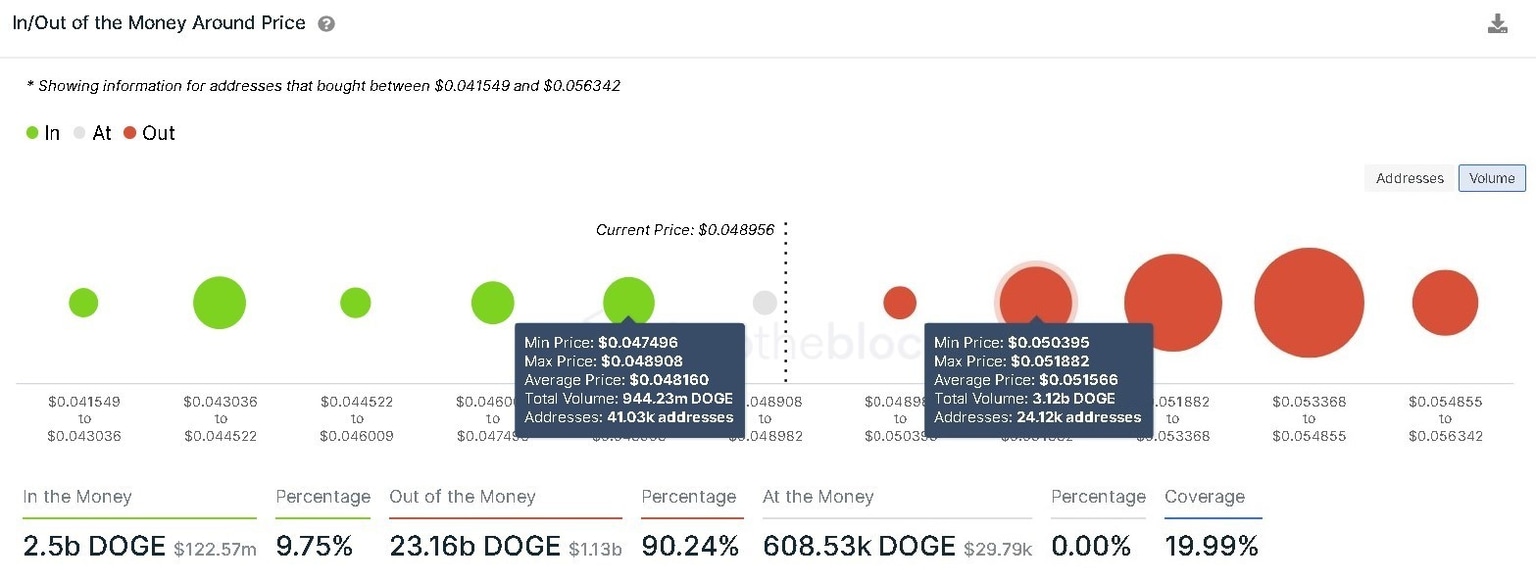

IntotheBlock’s In/Out of the Money Around Price (IOMAP) model shows that nearly 86,500 addresses purchased a whopping 20.70 billion DOGE between $0.050 to $0.055. Due to the fakeout, these investors are “Out of the Money.” So, any bullish momentum will be absorbed by these market participants who want to break even.

IOMAP cohorts show relatively feeble support at $0.0481, where nearly 41,000 addresses purchased roughly 944 million DOGE. If Dogecoin price manages to slice through this demand barrier, a 20% pullback to 23.6% Fibonacci retracement level at $0.037 seems likely.

However, a sudden spike in selling pressure due to unforeseen events causing a 12-hour Dogecoin price candlestick close below $0.037 will spell trouble for the meme coin and result in a 40% crash to $0.022.

Dogecoin IOMAP chart

It is worth noting that a 12-hour candlestick close above the 50% Fibonacci retracement level at $0.055 would reignite the 75% upswing from a bull flag pattern to $0.0956

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.