Dogecoin Price Forecast: DOGE on the verge of a 75% lift-off

- Dogecoin price breaks out of a bull flag pattern after surging 20%.

- DOGE could surge 75% to $0.095 if it bounces from the 50% Fibonacci retracement level at $0.055.

- A bearish outcome could evolve if the price re-enters the “flag” and starts consolidation.

Dogecoin price has been lull ever since the local top on February 7. However, a 20% surge due to Elon Musk’s recent endorsement has led to a breakout from a bull flag pattern. Now, the meme coin could surge 75% to record levels soon.

Dogecoin price poised for a leg up

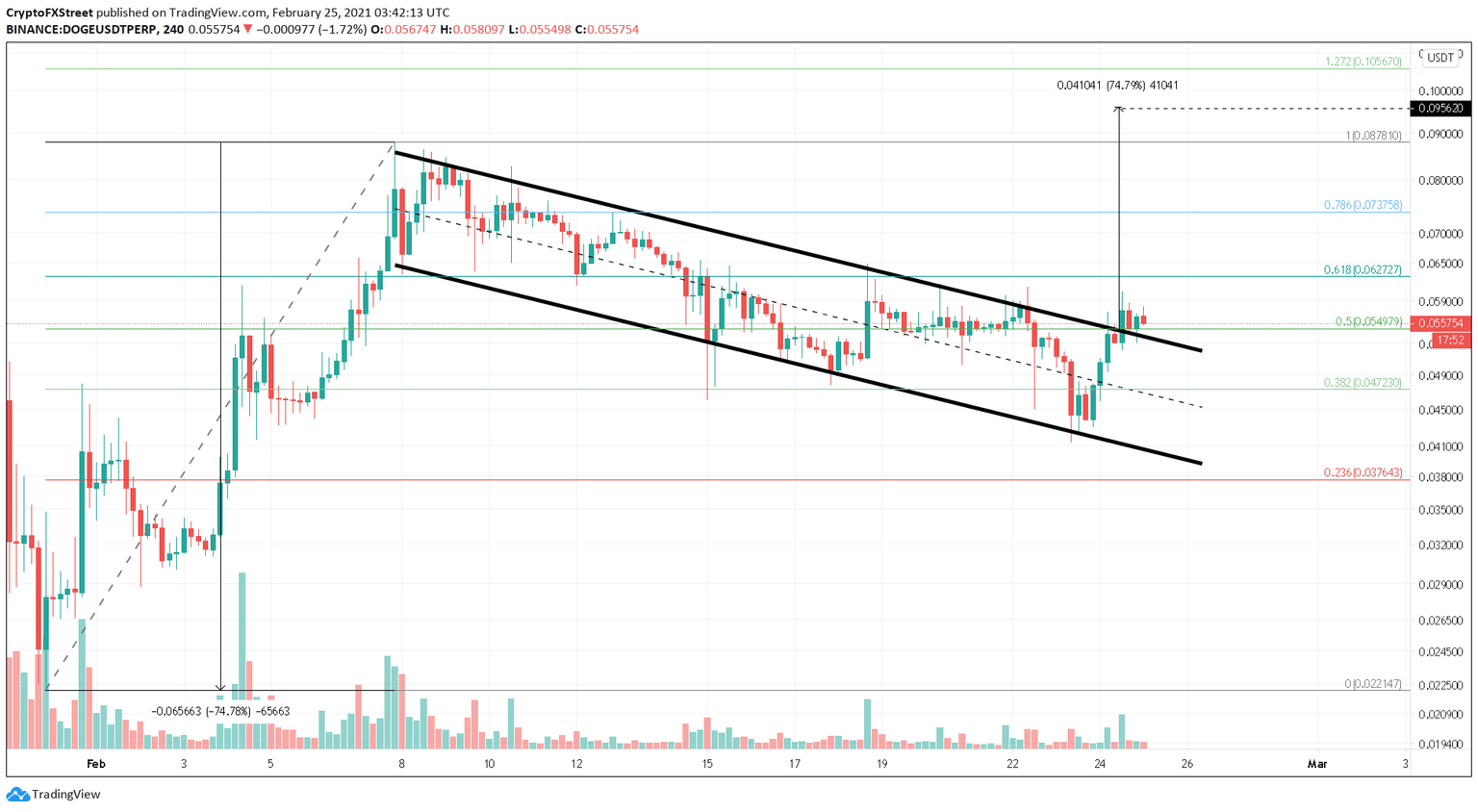

Dogecoin price attempted to breach its all-time high as it surged 300% between January 30 and February 7. This bull rally formed the “flag pole,” a basis for the bull flag pattern. The consolidation that followed the explosive rally resulted in a “flag.”

This technical formation projects a 75% surge, determined by adding the flag pole’s length to the breakout point at $0.055 or the 50% Fibonacci retracement level. This target puts DOGE at $0.095.

Dogecoin price breached this resistance barrier on February 24, 12:00 UTC. Since then, DOGE is hugging closely to this line, building up bullish momentum for the next rally.

DOGE/USDT 4-hour chart

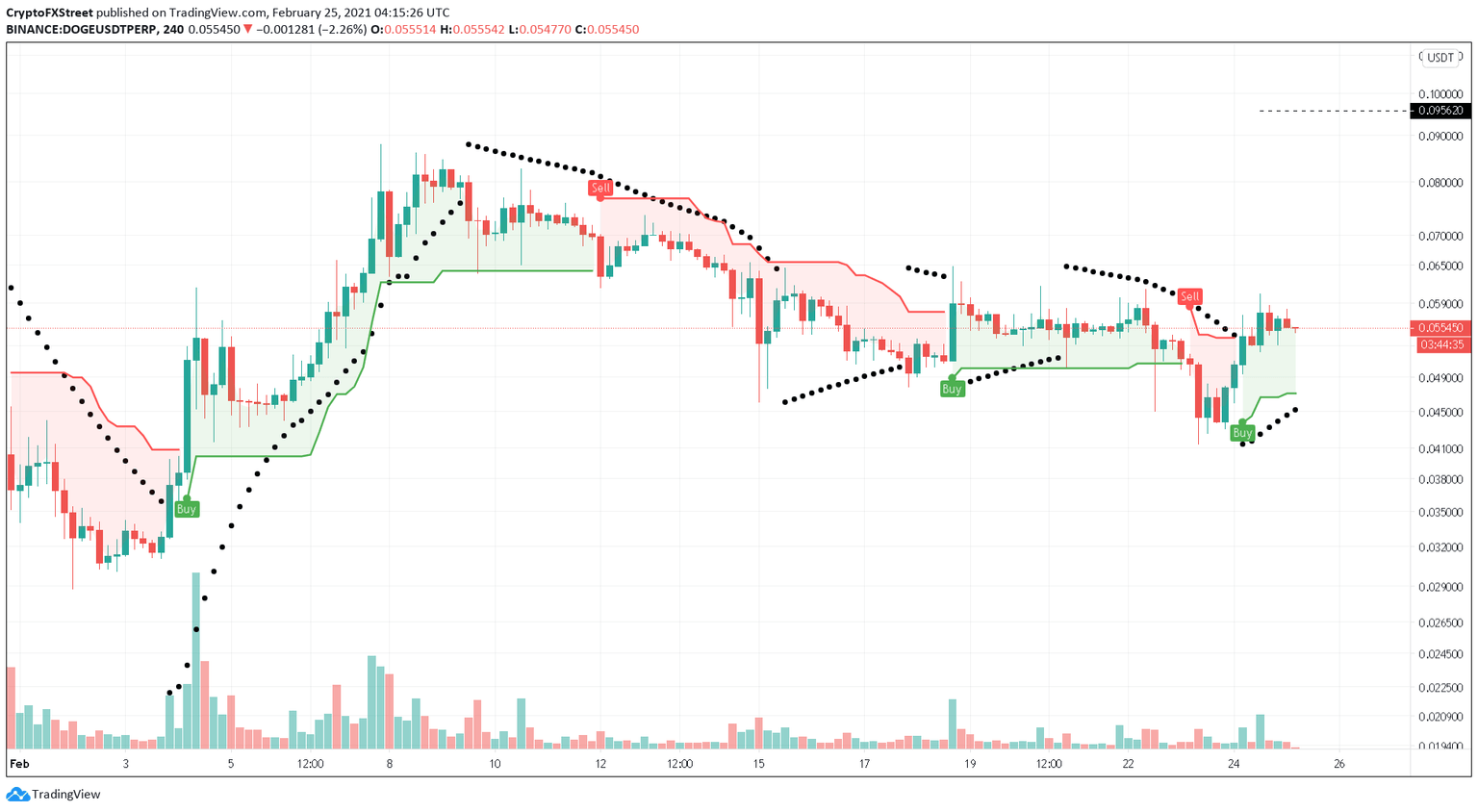

Adding credence to DOGE’s bullish thesis is the SuperTrend and the Parabolic SAR indicator, both of which have flashed a buy signal on February 24.

DOGE/USDT 4-hour chart

While everything seems to be bullish, Dogecoin price needs to hold the support at $0.055. A failure to do so will result in a 15% pullback to $0.047 or the 38.2% Fibonacci retracement level.

A further spike in selling pressure could extend the downswing by 20% to $0.037.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.