Dogecoin Price Forecast: DOGE under a lot of selling pressure as Elon Musk will be investigated by the SEC

- Dogecoin price could fall even lower as key indicator is about to present a sell signal.

- DOGE bulls face a lot of resistance to the upside while support remains weak.

- The interest in the digital asset has been slowly fading away.

Dogecoin price suffered a major 52% correction from its all-time high of $0.0875. On February 25, the SEC announced that it will open investigations into Tesla’s Chief Executive Elon Musk because of his tweets about DogeCoin. Musk has said in the past that he does not respect the Securities Exchange Commission.

Dogecoin price on the verge of a collapse

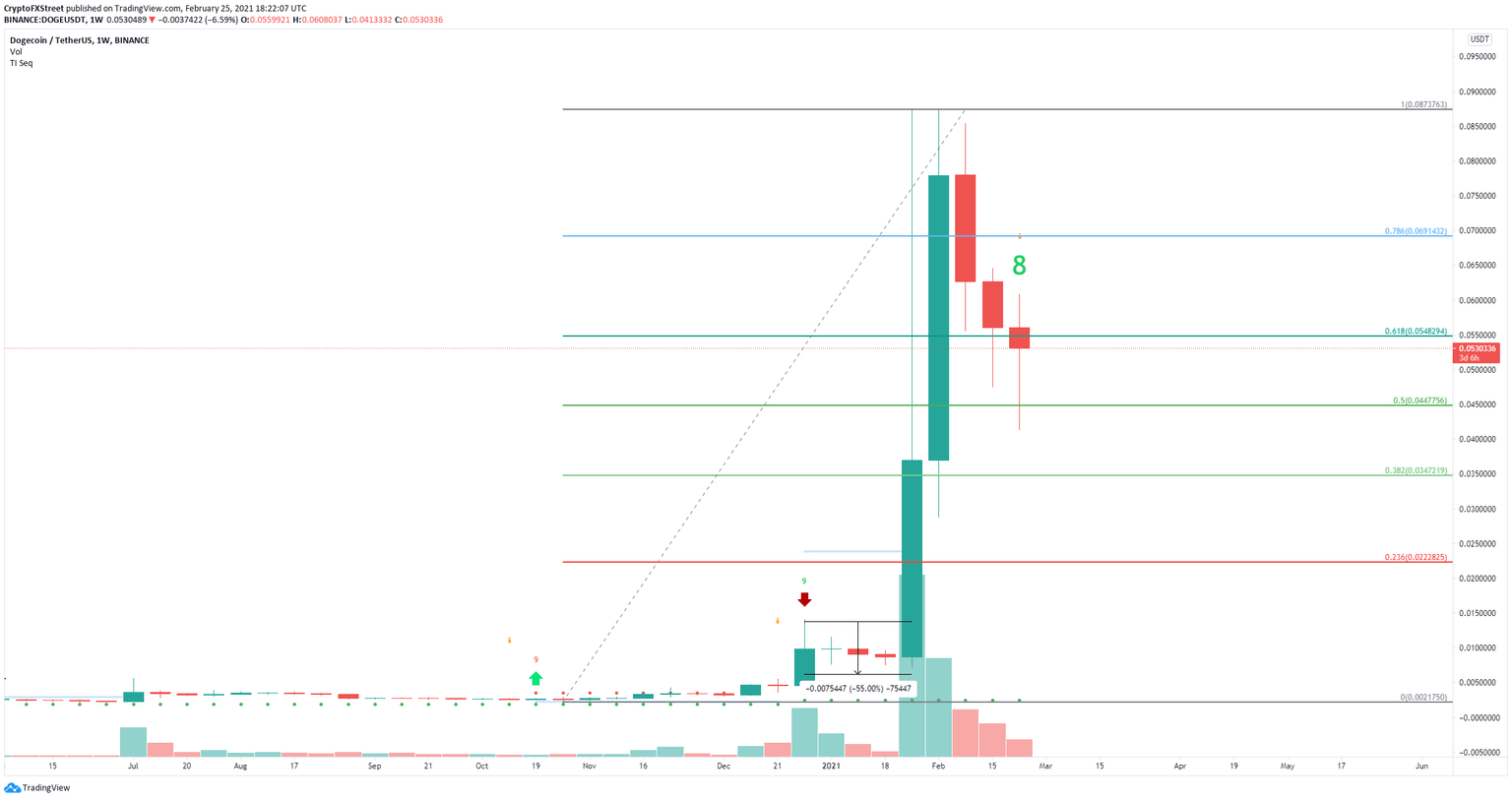

On the weekly chart, the TD Sequential indicator has presented a green ‘8’ candlestick which is usually transformed into a sell signal. The last signal presented on December 2020 had a ton of bearish continuation driving Dogecoin price down by 55%.

DOGE/USD weekly chart

The confirmation of the upcoming sell signal could push Dogecoin price towards $0.044 again, at the 50% Fibonacci Retracement level. Below this point, DOGE has more support at $0.034 which is the 38.2% level, and eventually at $0.022 the 23.6% level.

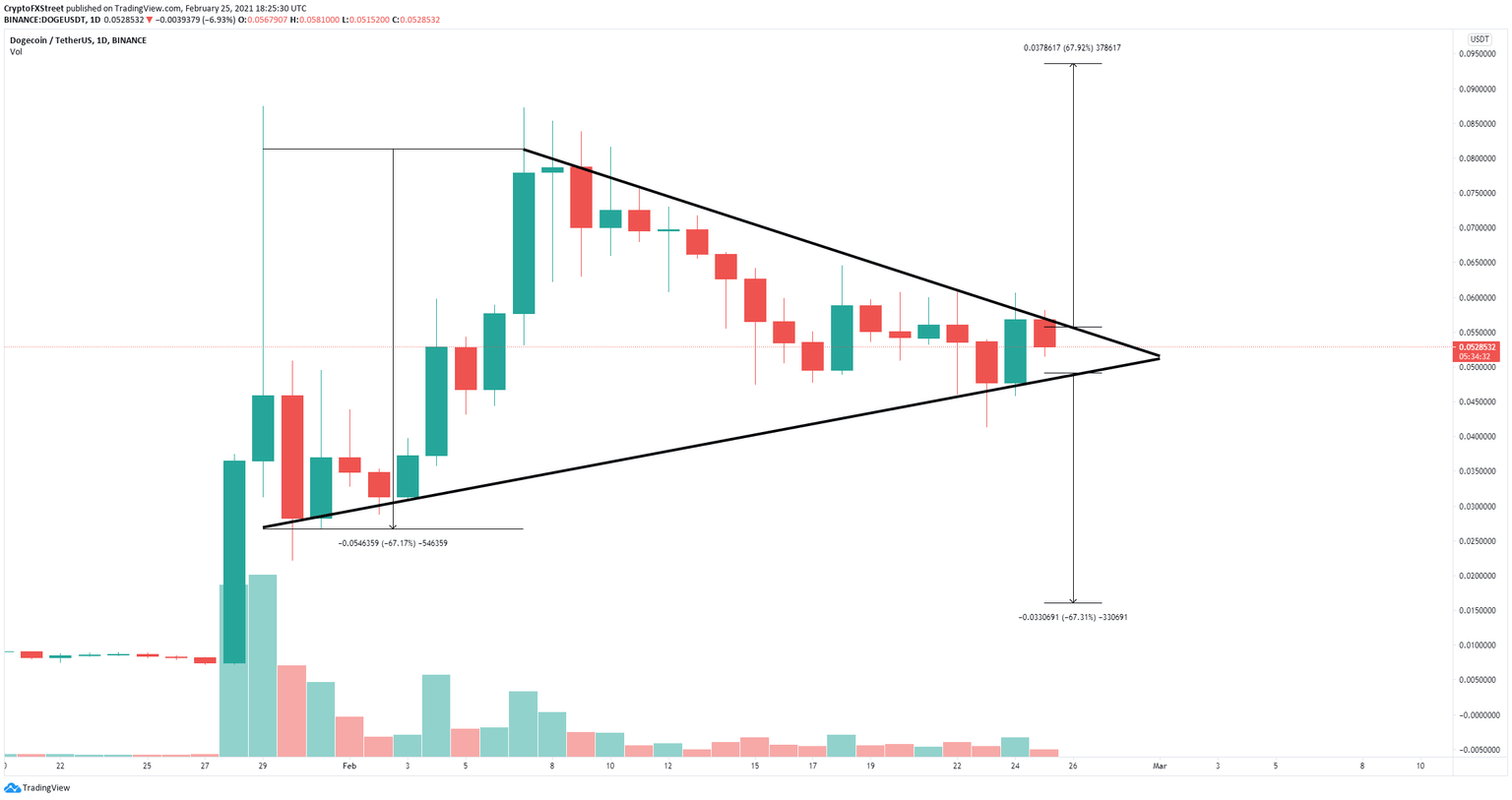

DOGE/USD daily chart

On the daily chart, Dogecoin price has formed a symmetrical triangle pattern. A breakdown below the critical support level at $0.049 will push Dogecoin price towards a low of $0.016 in the long-term.

However, to invalidate the potential bearish outlook, DOGE bulls need to crack the resistance barrier established at $0.057. A breakout above this point should send Dogecoin price to new all-time highs at $0.093.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.