Dogecoin has had a rough ride, but DOGE looks ready to jump to $0.35

- Dogecoin had a solid recovery after the sell-off in major cryptocurrencies.

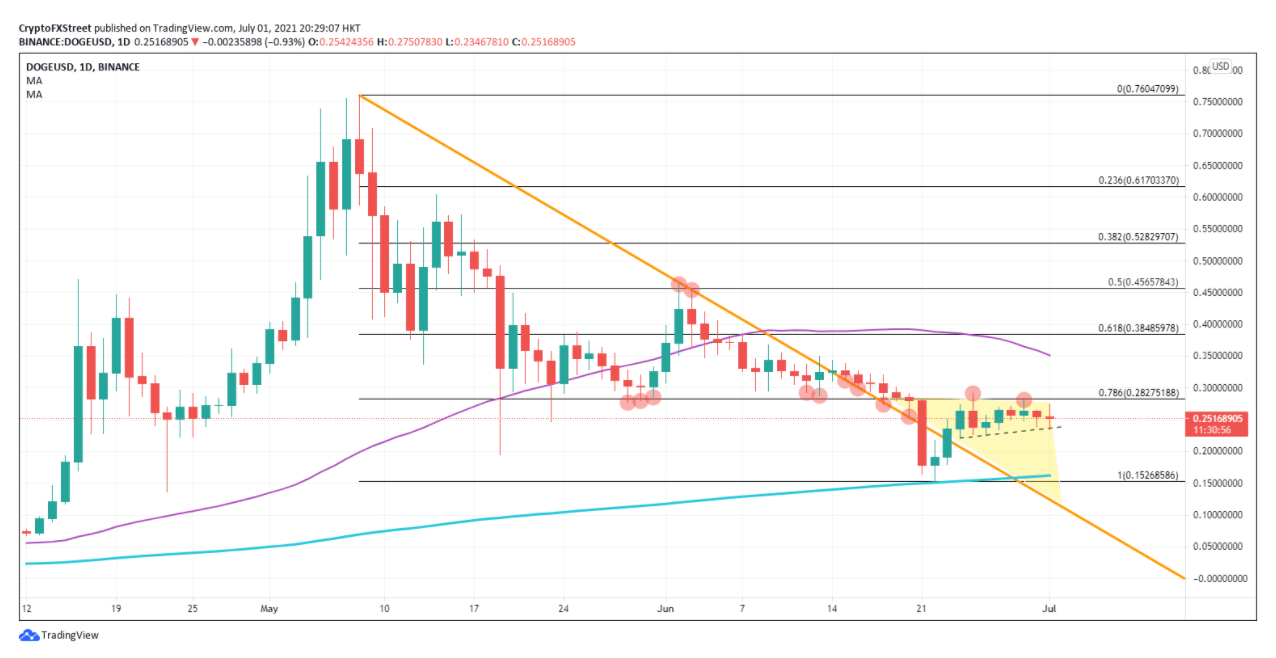

- Although Dogecoin previously broke a crucial bearish trendline, significant Fibonacci resistance is being tested at $0.28.

- The 55 simple moving average at $0.35 is the next level of resistance.

Dogecoin’s love affair with Elon Musk has cooled down in the past weeks, and that has been priced in. Now, DOGE looks ready for an upside move towards $0.35.

Dogecoin price ready to target a new rally

As the media storm around Dogecoin is softening, it is time to look back again to the upside.

Dogecoin got caught in the eye of the storm in May after Elon Musk rooted support for the cryptocurrency against Bitcoin as he found it was too energy-consuming for mining. In the meantime, the love between Musk and DOGE died down and that as the price faded as well back towards $0.15.

Dogecoin has made a slight recovery in the past few days, testing the $0.28 level a few times unsuccessfully. DOGE has not been able to break above this key resistance, but that doesn’t mean that we need to look to the downside.

DOGE is still making higher lows, which shows a squeeze in play against the 78.6% Fibonacci level. Momentum is building up and looking ready for the pop higher by next week.

DOGE/USD daily chart

Dogecoin looks ready for the jump. Once above the 78.6% Fibonacci level at $0.28, the next resistance is the 55-day simple moving average at $0.35. Further up, bulls will target $0.38, which is the next Fibonacci level.

Should Dogecoin break the minor upward trendline forming the upward squeeze, the main support is around $0.15, right where the 200-day simple moving average, the Fibonacci level and the double bottom coincide and form a strong support for any dips in Dogecoin.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.