Dogecoin copycat gets rug pulled plummets 99% overnight

- TeddyDOGE, a Dogecoin copycat, got rug pulled and lost 99.5% of its value overnight.

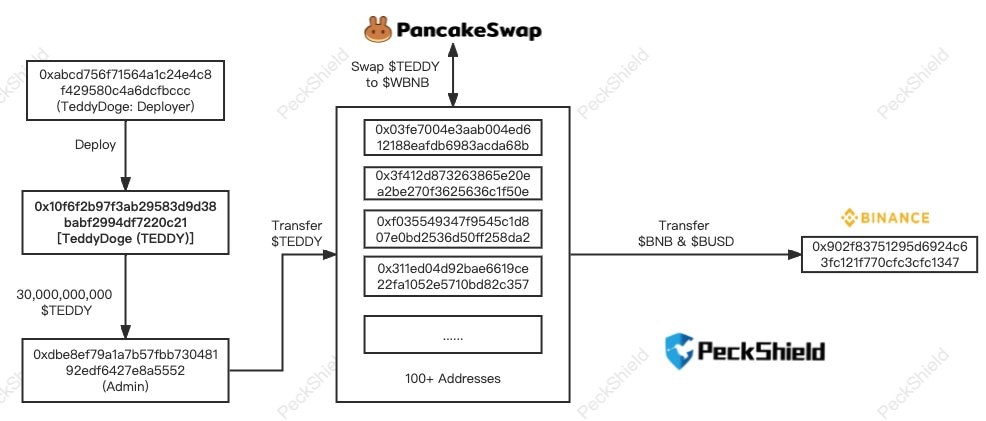

- A blockchain security firm identified the event as a soft rug pull – 10,000 BNB and 2 million BUSD were stolen from the protocol.

- Analysts note that bears are taking control of Dogecoin price, pushing the meme coin lower.

While Dogecoin struggled to recoup its losses, copycat TeddyDOGE got the rug pulled, a type of scam in which developers working on the blockchain drain the liquidity pools from the project. PeckShield, a blockchain security firm, identified a soft rug pull on TeddyDOGE. TEDDY lost 99% of its value overnight.

Also read: Here’s why analysts believe bears are taking control of Dogecoin

Dogecoin copycat TeddyDOGE attacked

PeckShield, a blockchain security firm, identified a rug pull on TeddyDOGE. The Dogecoin impersonator is a multifunctional swap that integrates exchange, transaction, wallet, farm and chart, according to its official website.

The firm identified the event as a soft rug pull, with 10,000 BNB and 2 million BUSD stolen. TEDDY witnessed a 99.5% decline in its value within hours of the event and currently sits at $0.00000047.

#PeckShieldAlert #rugpull TeddyDoge @DRAC_Network is soft rugpull. $Teddy has dropped -99.4%. The assets currently sit in https://t.co/3zu55iZAWX (accumulatively receive ~10k $BNB & 2m $BUSD) and are slowly transferred to @Binance pic.twitter.com/I48dWkLIOE

— PeckShieldAlert (@PeckShieldAlert) July 25, 2022

Soft rug pull on TeddyDOGE

Developers of Dogecoin have warned investors about impersonators of the meme coin. TeddyDOGE is one of the several impersonators; RenDoge, Dogeelon, EtherDoge are the others on the Ethereum network.

Analysts reveal bearish outlook on Dogecoin

Analysts believe bears are in control of Dogecoin price, and the asset is likely to plummet. Analysts have evaluated the possibility of Dogecoin price breaking out of its multi-year trend line. Dogecoin started a declining trend in May 2021; since then, the meme coin has struggled to break out of it, despite several attempts.

$0.082 is a key resistance level for the meme coin on its path to breaking out of the downtrend. Dogecoin needs to recoup its losses from the past two weeks and cross immediate resistance at $0.079 before moving to the next at $0.082. For more information and trends in Dogecoin’s price, check the video below:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.