Decentraland Price Prediction: Consolidation before the next move

- Decentraland price has lost 7% of market value in the last three days.

- A deeper pullback could occur targeting $0.54.

- A breach above the recent swing high at $0.84 would invalidate the bearish thesis.

Decentralizing prices facing a challenge near the $0.70 zone. A deeper pullback could be on the horizon if market conditions persist.

Decentraland price at a standstill

Decentraland price has seen impressive growth in recent months, with a 145% rally last month alone. However, the crypto asset has faced some cooling off lately, losing 7% of its market value in the last three days. Traders should note that the ongoing consolidation phase could be a sign of bearish sentiment, and a deeper pullback could occur.

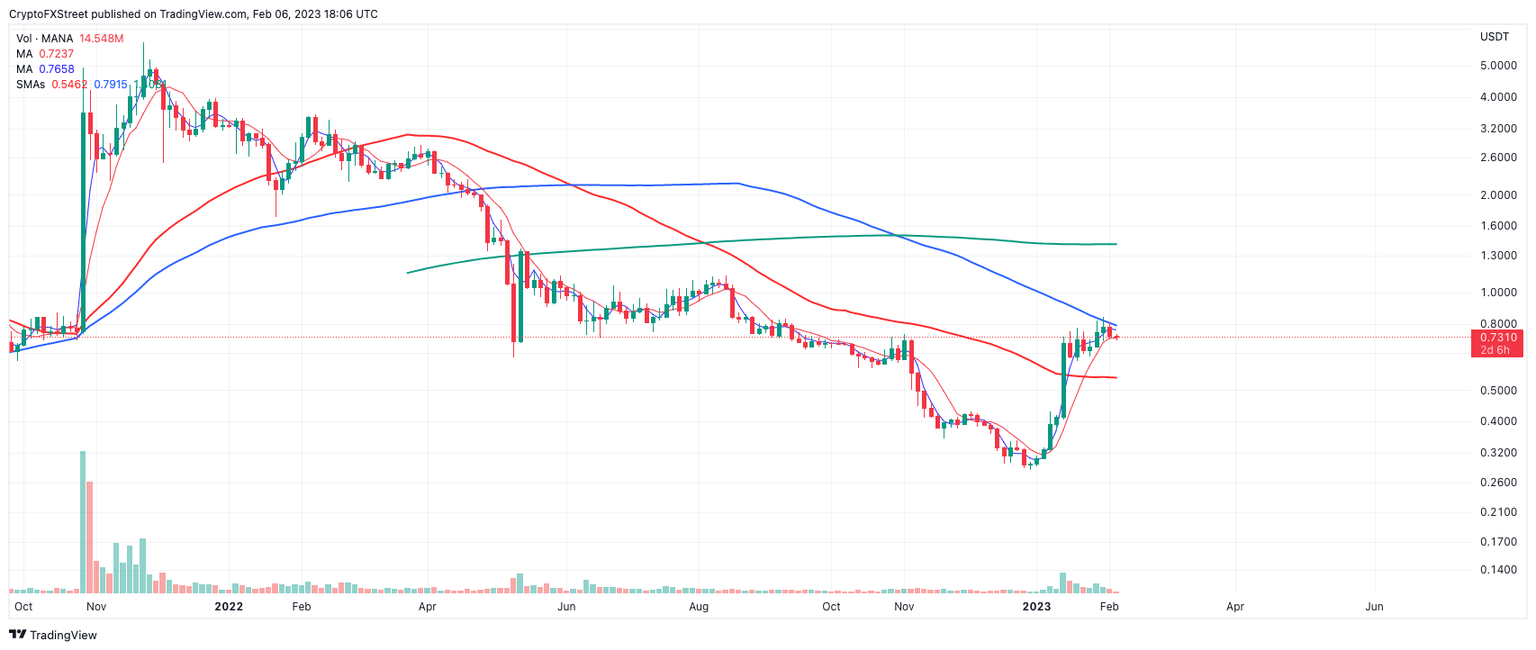

Decentraland price is currently trading at $0.73. As Decentraland hovers above the 21-day simple moving average, traders should keep a close eye on this level for any signs of support or lack thereof. If the support from the 21-day simple moving average fails to hold, the price of Decentraland is likely to experience a much steeper decline.

In addition to the price analysis, the Relative Strength Index (RSI) on the 3-day chart is also providing further insight into the current trend for Decentraland. The RSI measures the strength of price changes, with values above 70 considered overbought and values below 30 considered oversold.

Currently, the RSI has not broken out into overbought territory, indicating that there may still be room for the price to decline. Additionally, a bearish divergence between the recent swing highs at $0.70, $0.73 and $0.84 can be seen, suggesting that the uptrend may be waning. The 50-day simple moving average positioned at $0.54 would be a possible target under the bearish scenario. MANA would decline by 25% if the bears were to succeed.

MANA/USDT 1-Day Chart

Despite these bearish signals, traders and investors should keep in mind that the market can often be volatile and unpredictable. A breach above the recent swing high at $0.84 would invalidate the bearish thesis and could indicate that the market is preparing for another rally. The bulls could re-route north towards untagged liquidity near the $1.00 zone, which would result in a 50% decrease from MANA’s current market value.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.