Cryptocurrencies retreating after strong Bitcoin rally that called for the return of the bull market

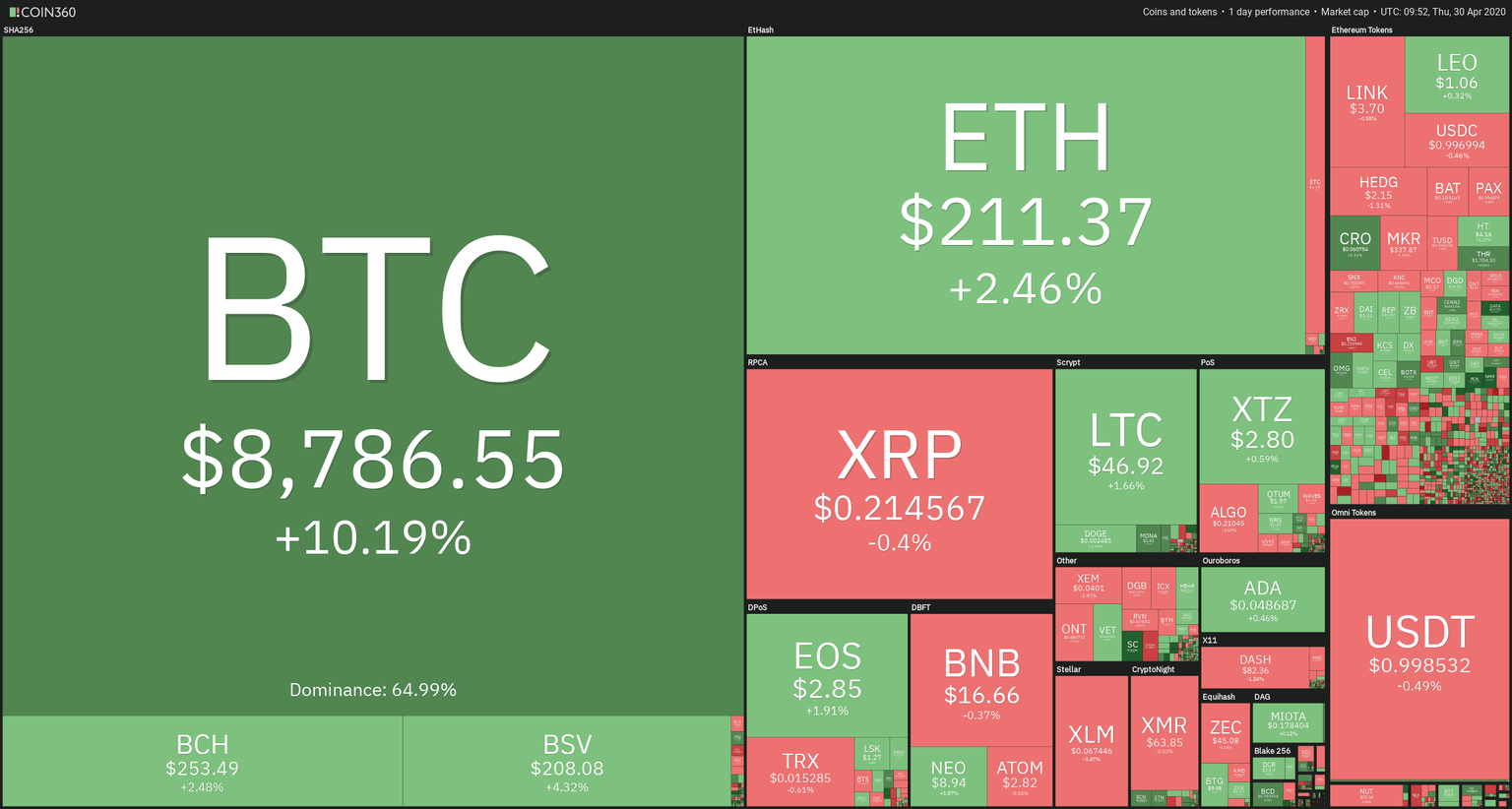

Cryptocurrencies are finally retracing in the last hours, after a strong rally led by Bitcoin (+10.2%) that made a 20 percent move at its top, which led it to achieve the $9,450 level. Also, Ethereum(+2.64%), Bitcoin Cash (+2.48%), Bitcoin SV 8+4.32%), Ripple (-0.4%), and Litecoin (+1.66%) followed the movement, although right now are suffering the selling action of profit-takers. In the Ethereum token sector, OMG (+11%) THR( +10.02%) and CRO (+5.21%) lead the gains among the main tokens.

Fig 1 - 24H Crypto Sector Heat Map

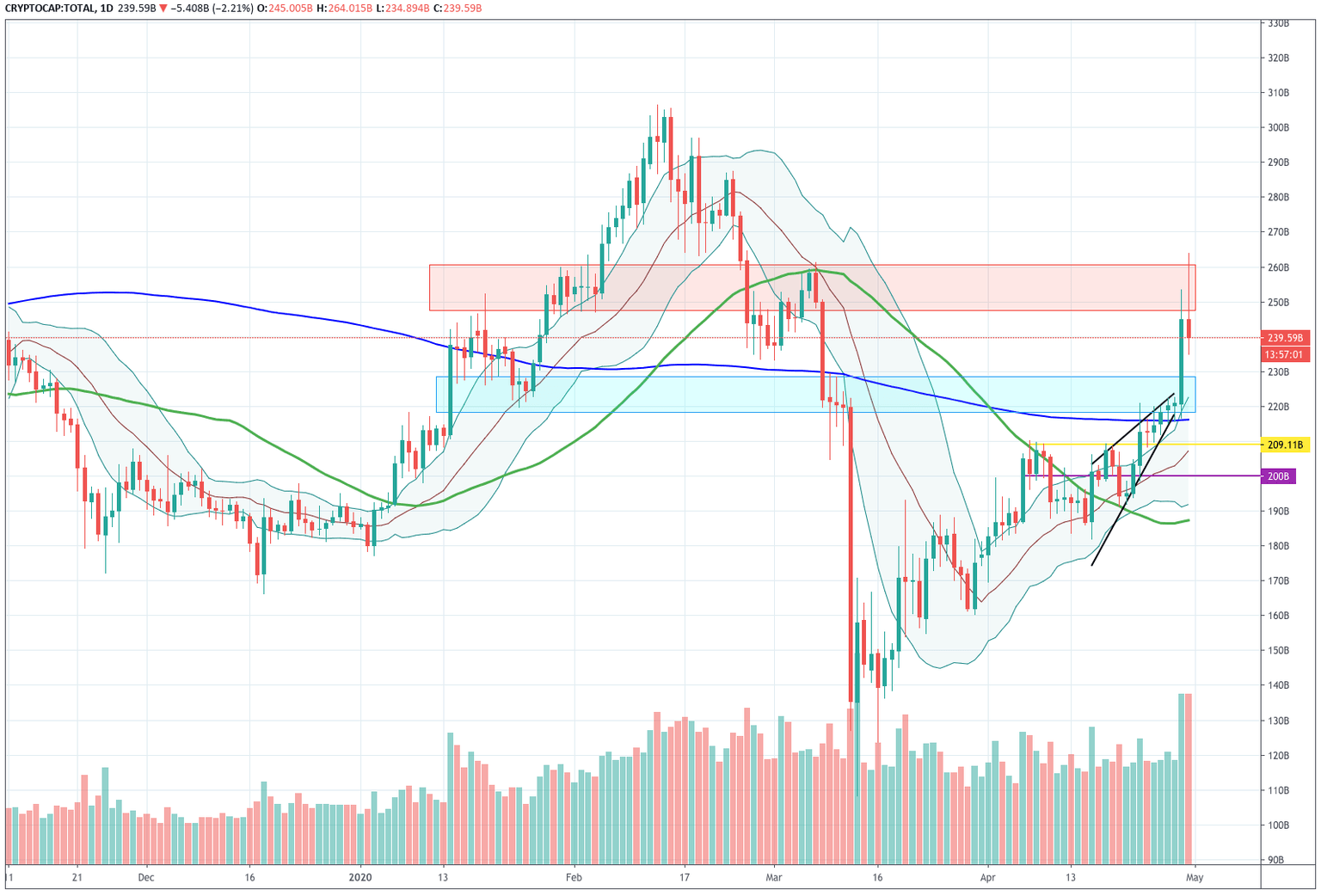

After this bullish move, the total market cap went as high as $264 billion, although, currently, it is at $241 billion, as it tries to consolidate after the bounce off the topping area. The traded volume in the last 24 hours was quite high, at $85.540 billion, a 145% increment from the previous 24H figure. The Bitcoin dominance went up almost one point and currently is 64.99%.

Fig 2 - 24H Crypto Total Market Daily Chart

Hot News

-

These are the headlines of the current news related to the sector.

-

Federal Reserve Chair Says "We Won't Run Out of Money," as Bitcoin gains 20% in 24 Hours.

-

Bitcoin Doubles Gold's YTD Rate of Return in 1 Day as Gains Top 27%.

-

Italian Town Creates New Currency to Cope With COVID-19.

-

Alibaba Patents Blockchain System That Spots Music Copycats.

-

Telegram delays the launch of its blockchain by one more year and is ready to return investor's money.

-

160 Million USDT Tokens were Minted During Bitcoin's Rise to $9K.

-

Swiss-based Capital Markets and Technology Association Issues New Common Standards for Crypto Custody.

-

CZ: Charity and Stablecoins Drive Meaningful Crypto Adoption.

-

BTC Tops $9,000, Recovery Leaves Stock Market in the Dust.

-

Chinese tech-giant Tencent launches blockchain accelerator.

Technical Analysis - Bitcoin

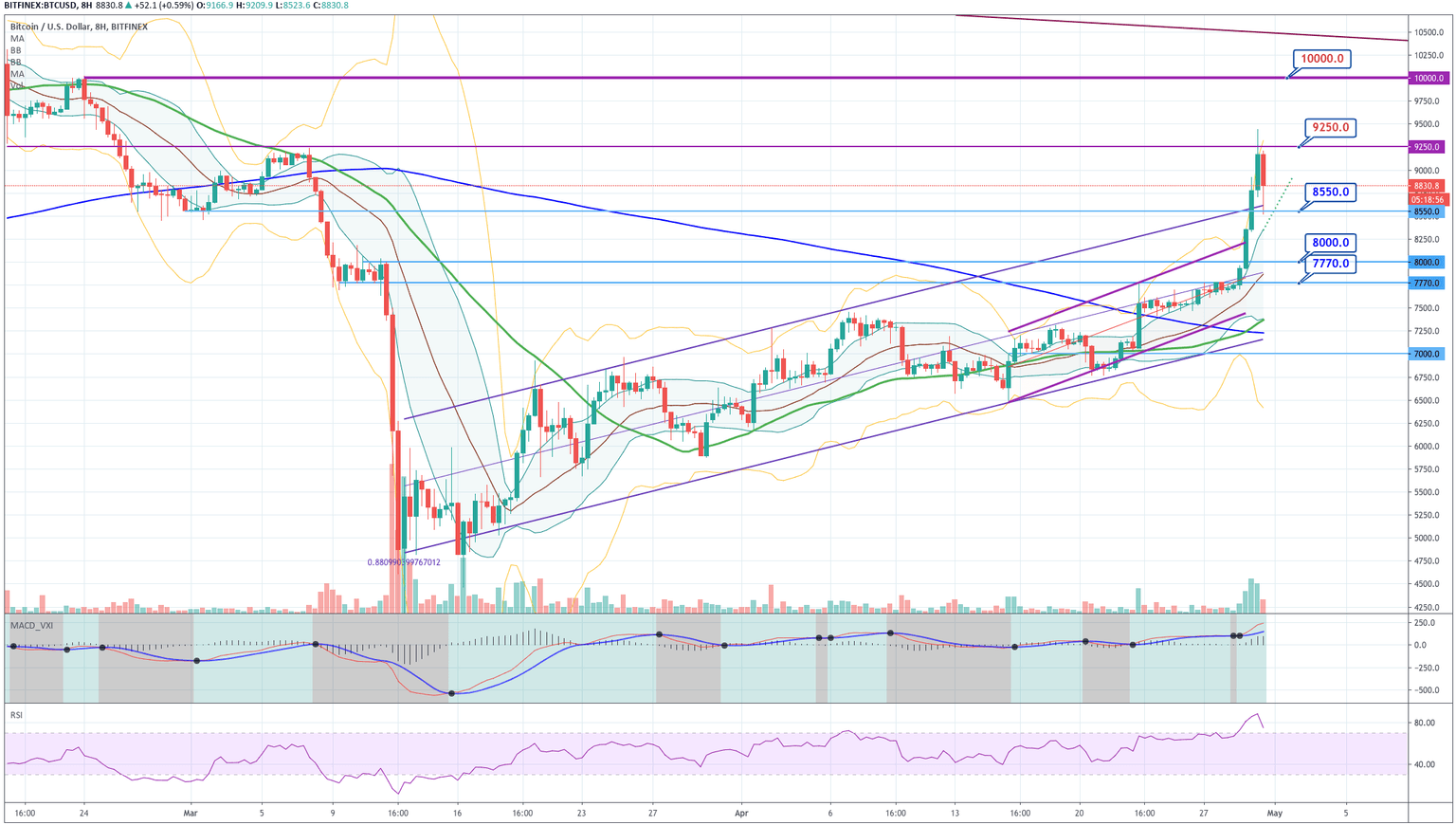

Fig 3 - Bitcoin 8H Chart

Bitcoin's bullishness created a 24H 20% movement that brought the digital asset to its top at $9,442, its best top since February 25. After this incredible move, the sellers and profit takers came in and drove the price below the 9k. On the technical side, we see on the chart that the price moved past its +3 SD Bollinger line (amber) before retreating. Now, it is about two standard deviations from the Bollinger mean. We also see the RSI descending from the 90 level, but still in the overbought area. We conclude that the trend is bullish, but the asset is making a consolidation move before continuing its ascent.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,052 |

7,410 |

8,060 |

|

6,405 |

8,420 | |

|

6,040 |

9,065 |

Ethereum

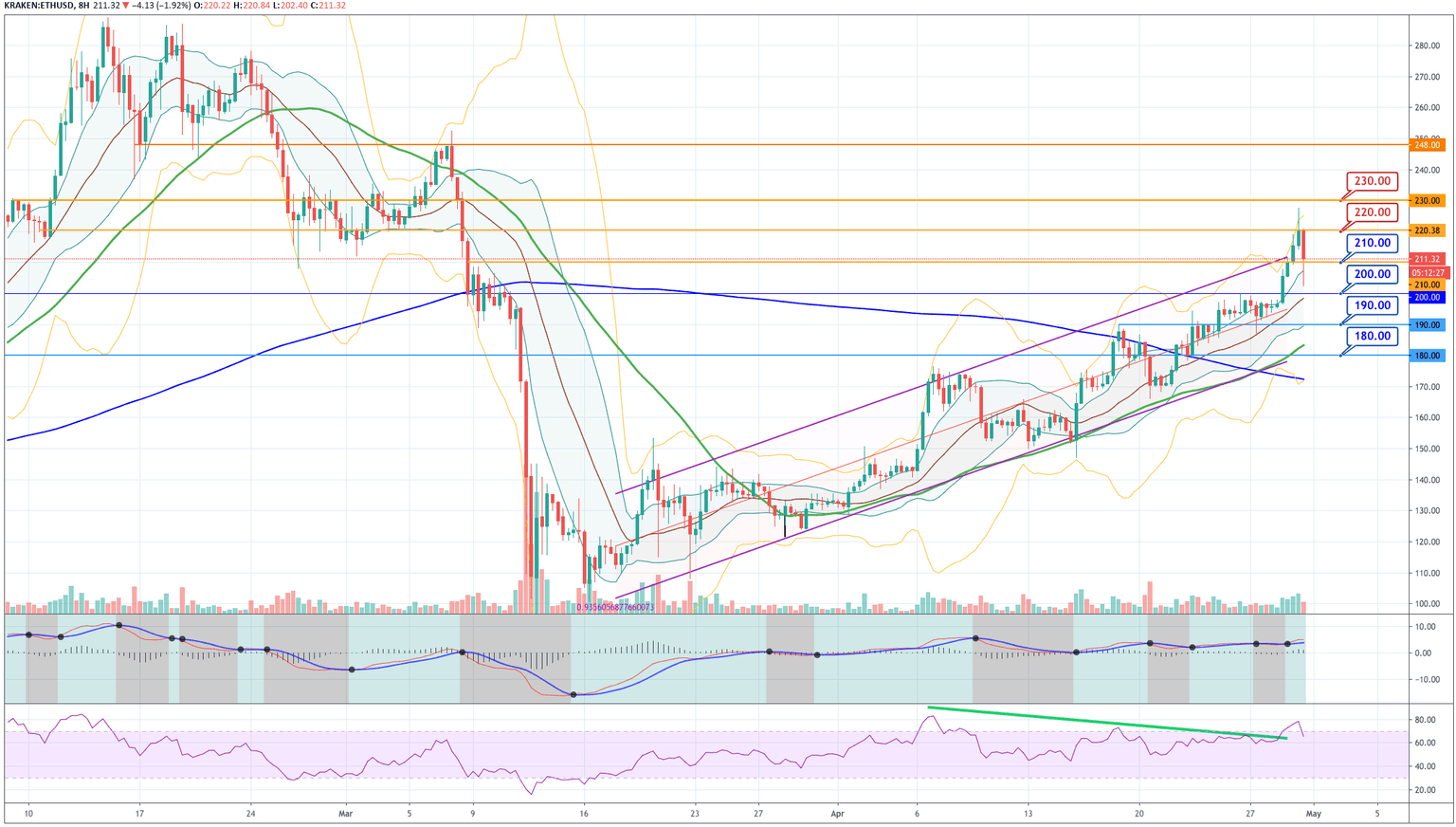

Fig 4 - Ethereum 8H Chart

Ethereum also made a strong upward movement that carried its price beyond the +2 standard deviation edge of its linear regression channel in which it was advancing. The price was halted near the $227 level, as the RSI went into overbought territory, and the price exceeded the +3SD line ( amber). As is the case of Bitcoin, Ethereum's underlying trend continues to be bullish, but this overextended move needs to be digested by investors and traders. Thus, profit-taking and short position orders tend to create a consolidation leg. A break above $220 will surely attract more buyers, and we see also that near $ 200 buyers came in and push the price upwards.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

176.5 |

188 |

210 |

|

155 |

222 | |

|

143 |

243 |

Ripple

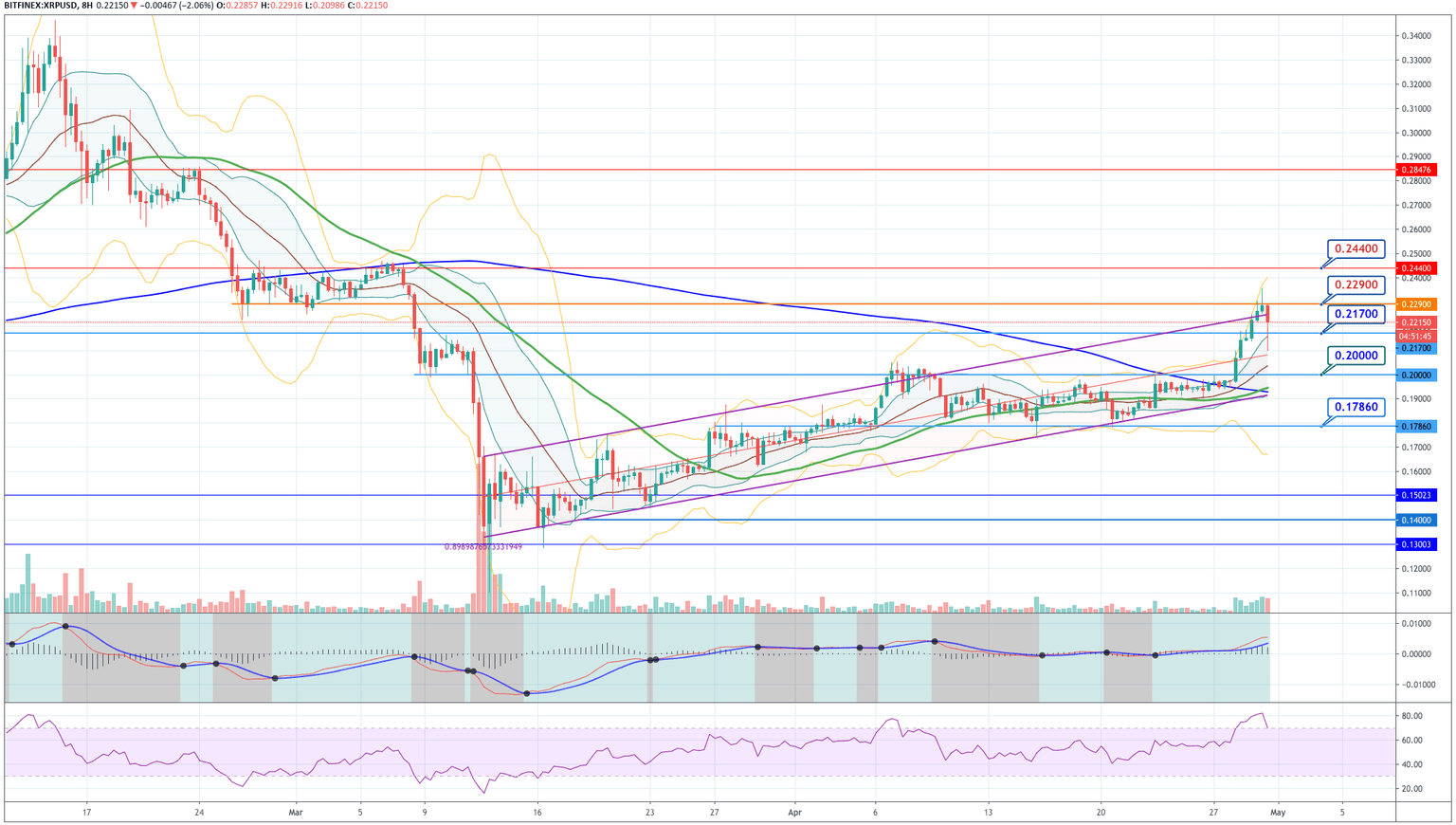

Fig 5 - Ripple 8H Chart

Ripple was the first to call this rally, but in the last 24 hours was the weakest of the top 3 cryptos. The asset found sellers after moving above 0.235 and created a large bearish candle that went to the middle of the linear regression channel, where it found buyers to move its price above the +1SD Bollinger line. We see on the chart that the RSI is curving down and is close to getting out of the overbought zone. Thus, even though this asset is much weaker than the other two top assets, the technical indicators point to a bullish trend that is consolidating its last upward move. The price seems tom find support at $0.21, if the asset moves back to near that level and makes a reversal bar, it can be a right place for entering long trades. Also, a move above 0.23 is a good spot to open long positions.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.1830 |

0.1915 |

0.2050 |

|

0.1695 |

0.2134 | |

|

0.1610 |

0.2270 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and