Cryptocurrencies Price Prediction: Polkadot, Dogecoin & Fantom — Asian Wrap 4 May

Why Polkadot price needs to crash more before triggering an explosive rally

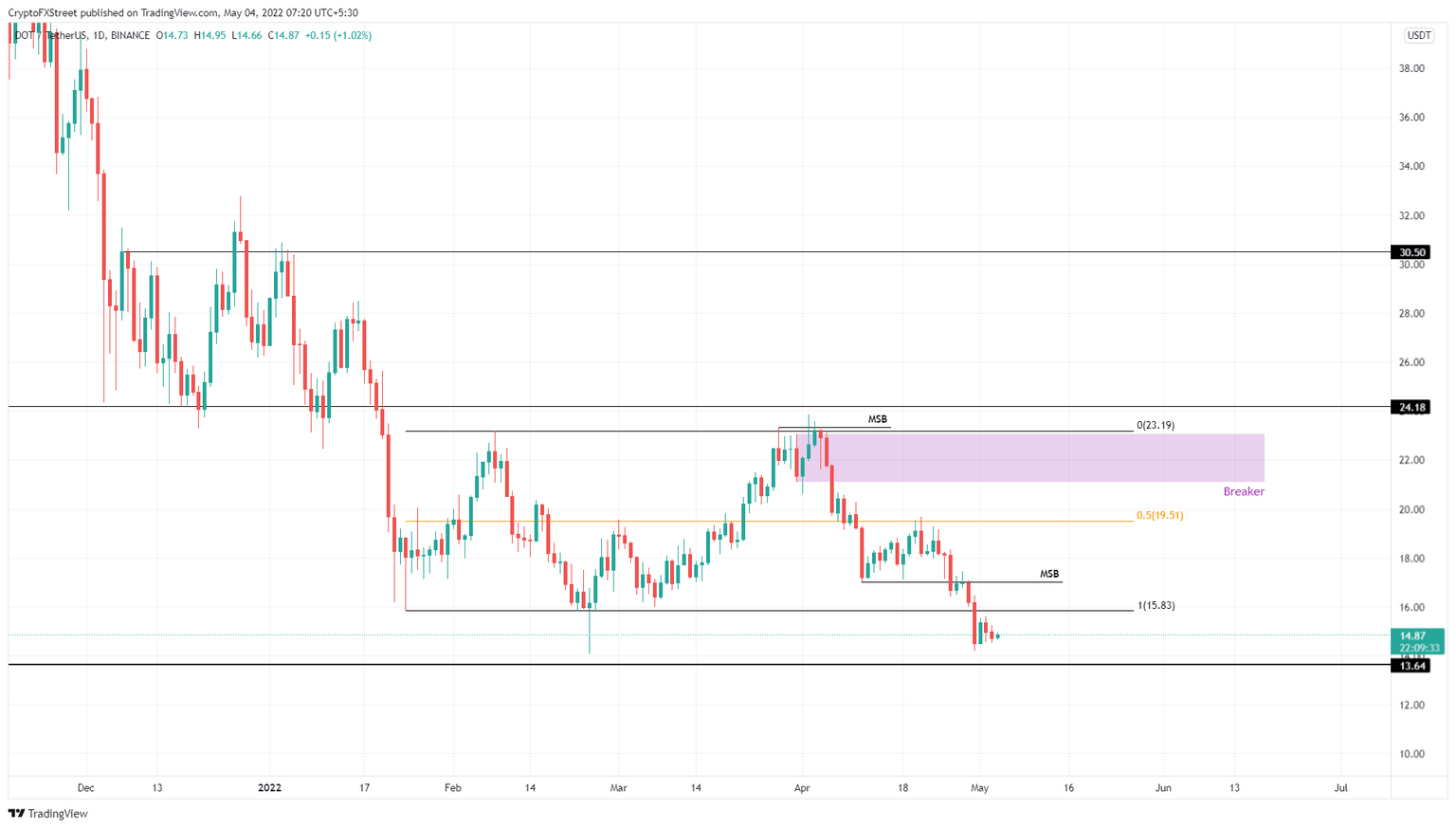

Polkadot price is in a tough spot after breaching a significant support level. This development is likely to trigger a further descent before finding a stable support floor. Here, DOT bulls are likely to make a comeback and trigger a new run-up.

Polkadot price formed a double top at roughly $23.27 on February 6 and April 1. Since the second local top, DOT has crashed 40%, flipped the $15.97 support level into a resistance barrier and is currently hovering around $14.89.

Dogecoin price could fall to $0.11 as the crypto world anticipates the upcoming FOMC meeting

Dogecoin price is looking dangerously bearish as the price is failing to cover the $0.13 level. If market conditions persist, traders should expect a breach of $0.11 in the coming days.

Dogecoin price has investors on edge as the bulls have gone missing to start the month of May. Analysts have maintained that the Dogecoin price is likely to print a new low within the $0.11 zone to finalize Wave D within the forming DOGE triangle.

Fantom price presents buying opportunity before FTM returns to $1

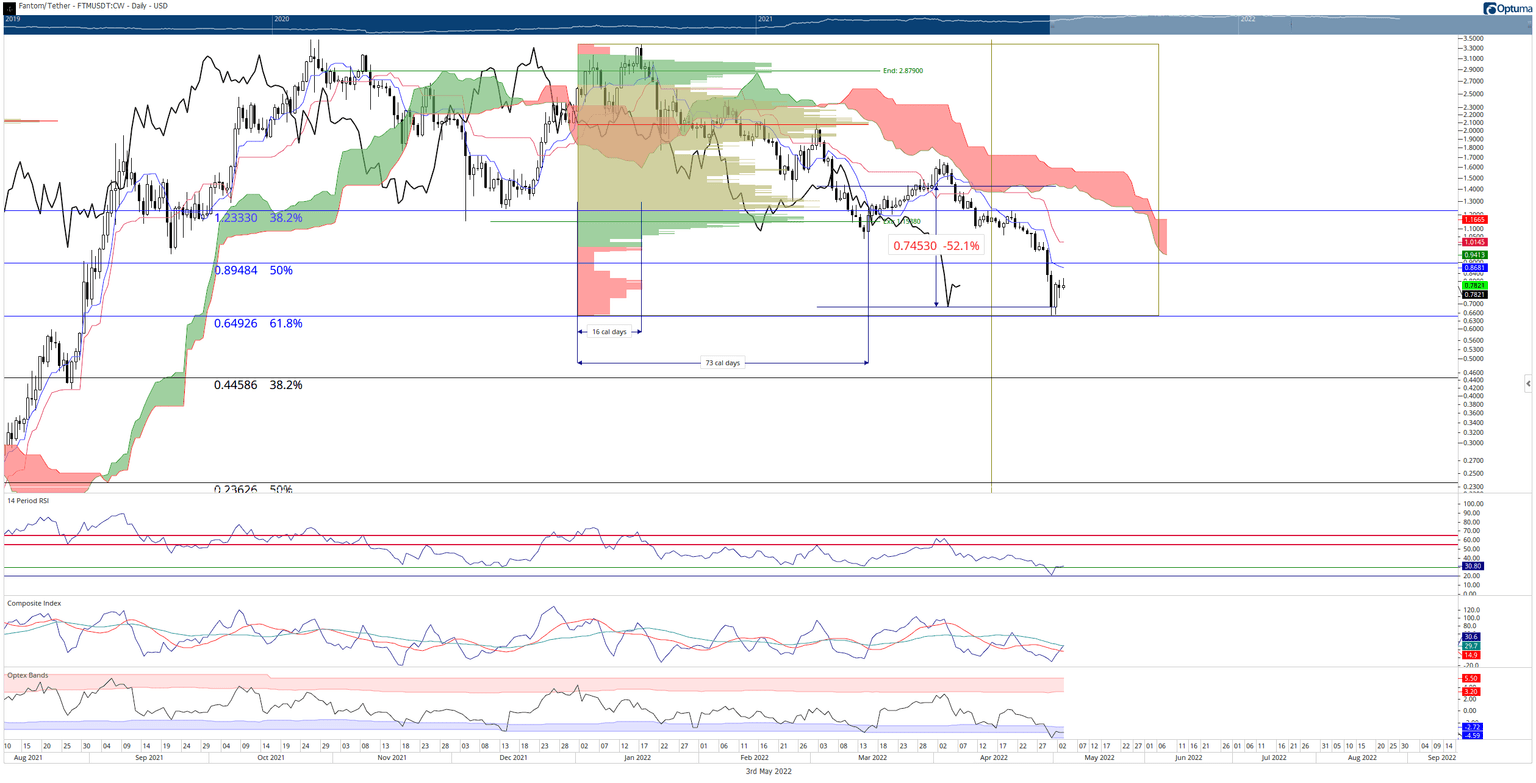

Fantom price action has few peers regarding the massive losses it sustained in April. However, the breadth of the selling has yielded some extreme oversold conditions that point to a likely very powerful mean reversion trade setup.

Fantom price action in April was a slaughter fest. In just thirty days, Fantom fell from the April 1 open of $1.43 to the April 30 close at $0.6847 - a loss of 52%. Since then, FTM has had a marginal recovery to $0.78.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.