Cryptocurrencies Price Prediction: Cronos, Lido DAO & Ethereum – European Wrap 12 May

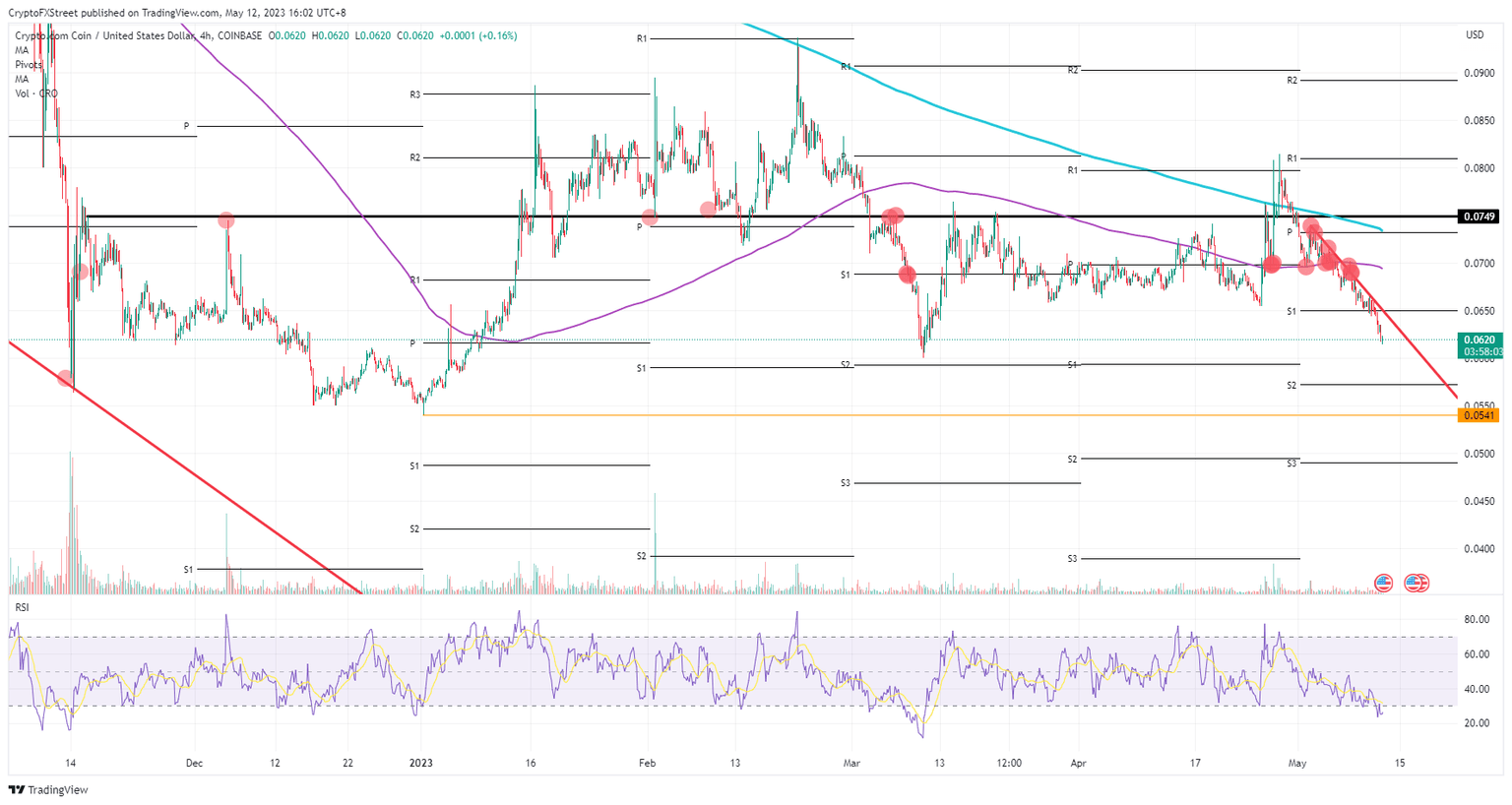

Cronos price on scary trajectory that could spell 15% loss this Friday for CRO bulls

Cronos (CRO) price sees a pickup in selling pressure after the ASIA PAC session was unable to hold its head above $0.065 on Friday. As the monthly S1 support level is being breached, more downside potential is in the pipeline. Bears are no longer sticking to the script and are moving away from the red descending trendline in order to steepen the decline and head for a 15% sell-off this Friday alone.

Cronos price is setting itself up for a complete erasure of all incurred gains for 2023. There were a few telling signs along the way that could have warned bulls of what was to come. The false break out of the red descending trend line followed by a topside rejection against the 55-day Simple Moving Average on Monday was the moment where the sell-off got triggered.

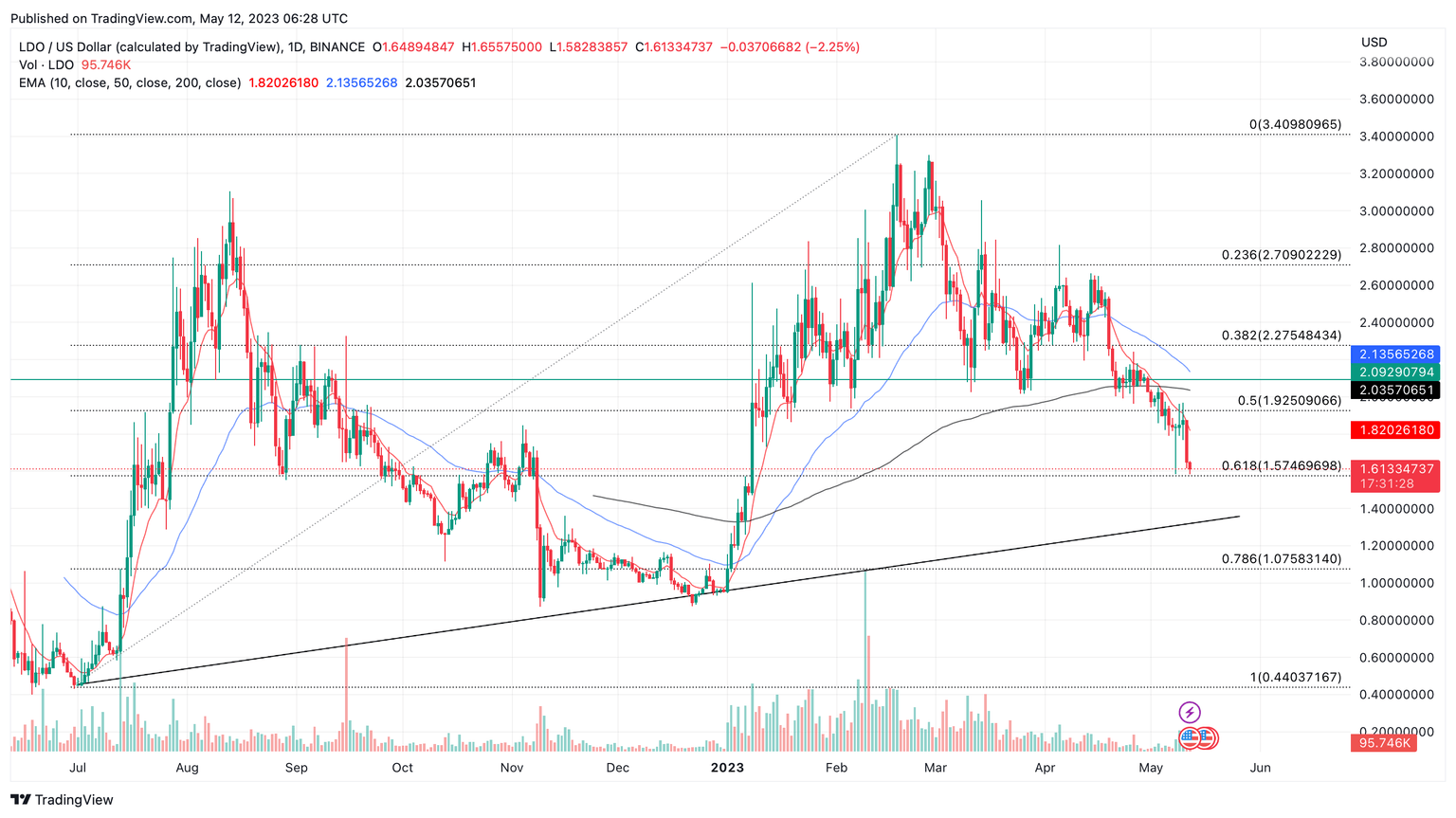

Lido DAO could begin its recovery as staking yield of stETH hits historical high

Lido Finance, a liquid staking solution for Ethereum, currently offers the highest staking yield on stETH, a record high of 8%. The spike in the staking yield of Ether tokens is attributable to the recent surge in popularity of meme coins, according to a data panel.

Based on data from Lido Finance’s analytics on Dune.com, the spike in meme coins has fueled a surge in activity on the blockchain. This rise in on-chain activity has caused an increase of the staking yield of stETH, which reached a record high of 8%.

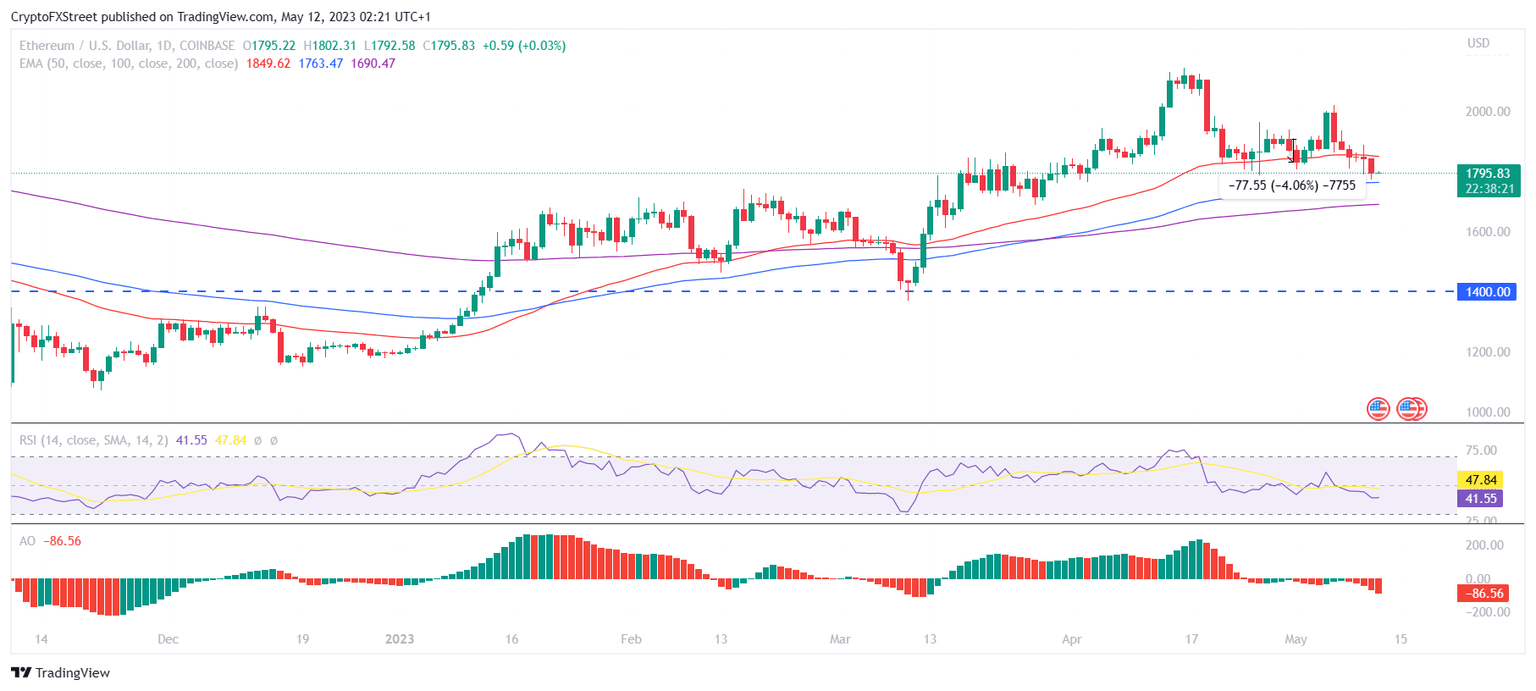

Accumulation of $1 billion worth of ETH prevents Ethereum price from falling below this key level

Ethereum price has been setting the path for most of the major and minor altcoins in the market, just as ETH investors are doing for it. The mixed behavior from different cohorts suggests that there is still some uncertainty regarding where the market could go. However, investors are doing their best to prevent a downfall.

Ethereum price trading at $1,795 is currently at a monthly low, following a decline of more than 10% in the last few days. The concern of losses among the investors could have actually driven the price down further, but the optimism outweighed the fear, preventing a drastic drawdown.

Author

FXStreet Team

FXStreet