Cronos price on scary trajectory that could spell 15% loss this Friday for CRO bulls

- Cronos price sell-off accelerates into a steep decline.

- CRO chart shaping up like a falling knife.

- Expect to see a quick leg lower to $0.054 that flirts with a fresh low for 2023.

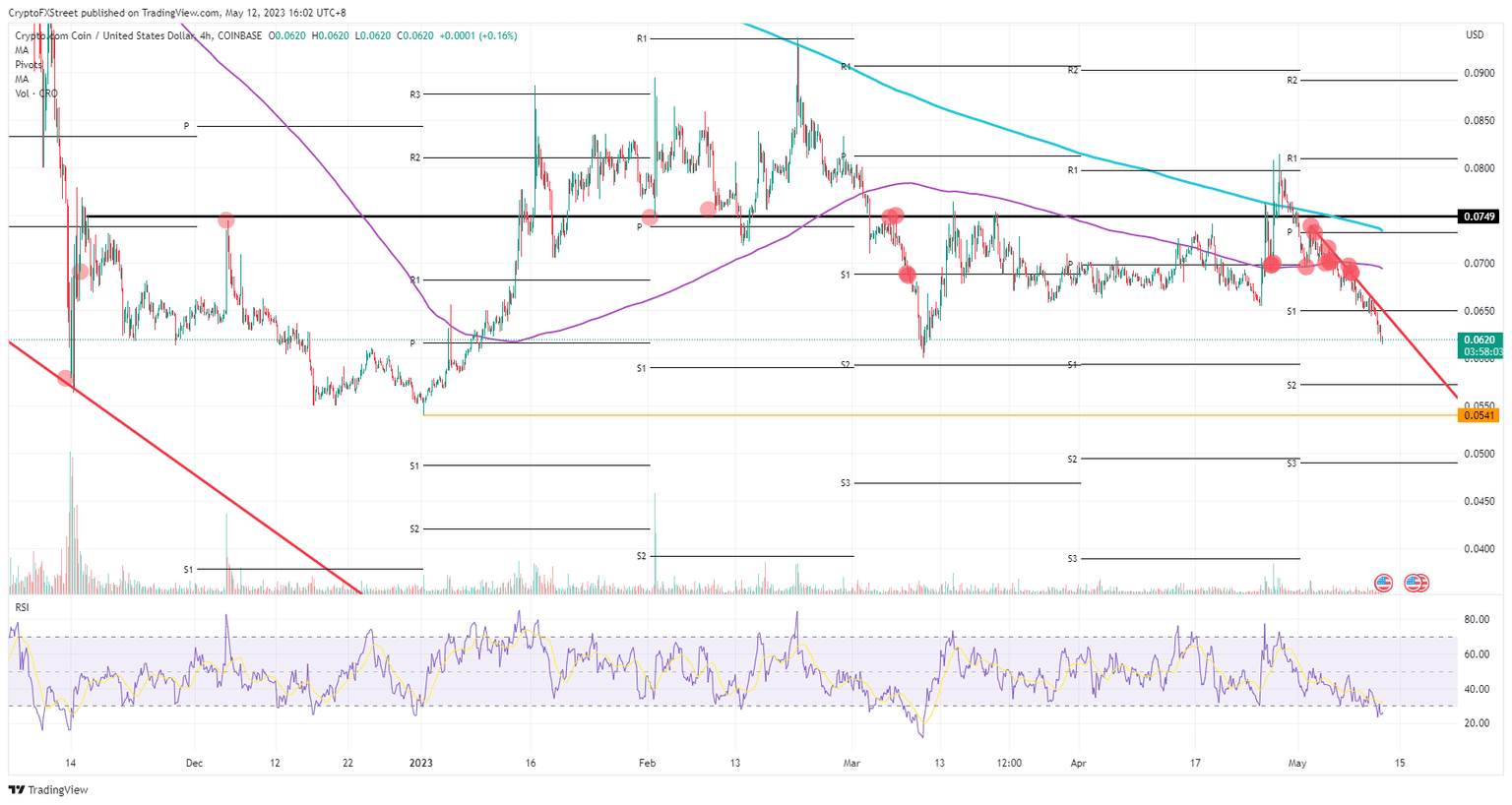

Cronos (CRO) price sees a pickup in selling pressure after the ASIA PAC session was unable to hold its head above $0.065 on Friday. As the monthly S1 support level is being breached, more downside potential is in the pipeline. Bears are no longer sticking to the script and are moving away from the red descending trendline in order to steepen the decline and head for a 15% sell-off this Friday alone.

Cronos price action could erase all 2023 gains

Cronos price is setting itself up for a complete erasure of all incurred gains for 2023. There were a few telling signs along the way that could have warned bulls of what was to come. The false break out of the red descending trend line followed by a topside rejection against the 55-day Simple Moving Average on Monday was the moment where the sell-off got triggered.

CRO has been stacking a 12% loss thus far for the weekly performance and is set to double that amount at least. Bears are moving away from that red descending trendline and are set to make a final firm push that could see a 15% additional loss in just one trading session. Expect to see Cronos's price stall around $0.054 with bears flipping a coin on whether the low for 2023 will get broken before the weekend.

CRO/USD 4H-chart

Traders will have noticed that the tank with selling power is empty and needs to be refueled. That is one way to look at the Relative Strength Index, which has stretched far into oversold territory. Bears will start to diminish the selling pressure and provide some room for CRO to head back to $0.065 with chances of breaking above the red descending trendline again.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.