Accumulation of $1 billion worth of ETH prevents Ethereum price from falling below this key level

- Ethereum price is trading at $1,800 after averting a potential decline to the critical support level of $1,700.

- Throughout May, more than 600,000 ETH has been accrued by the investors, which has helped offset the price drop.

- Whales, however, seem to be reluctant to bear any losses, shedding more than $1.7 billion worth of ETH in the last 12 days.

Ethereum price has been setting the path for most of the major and minor altcoins in the market, just as ETH investors are doing for it. The mixed behavior from different cohorts suggests that there is still some uncertainty regarding where the market could go. However, investors are doing their best to prevent a downfall.

Ethereum price hovers around monthly lows

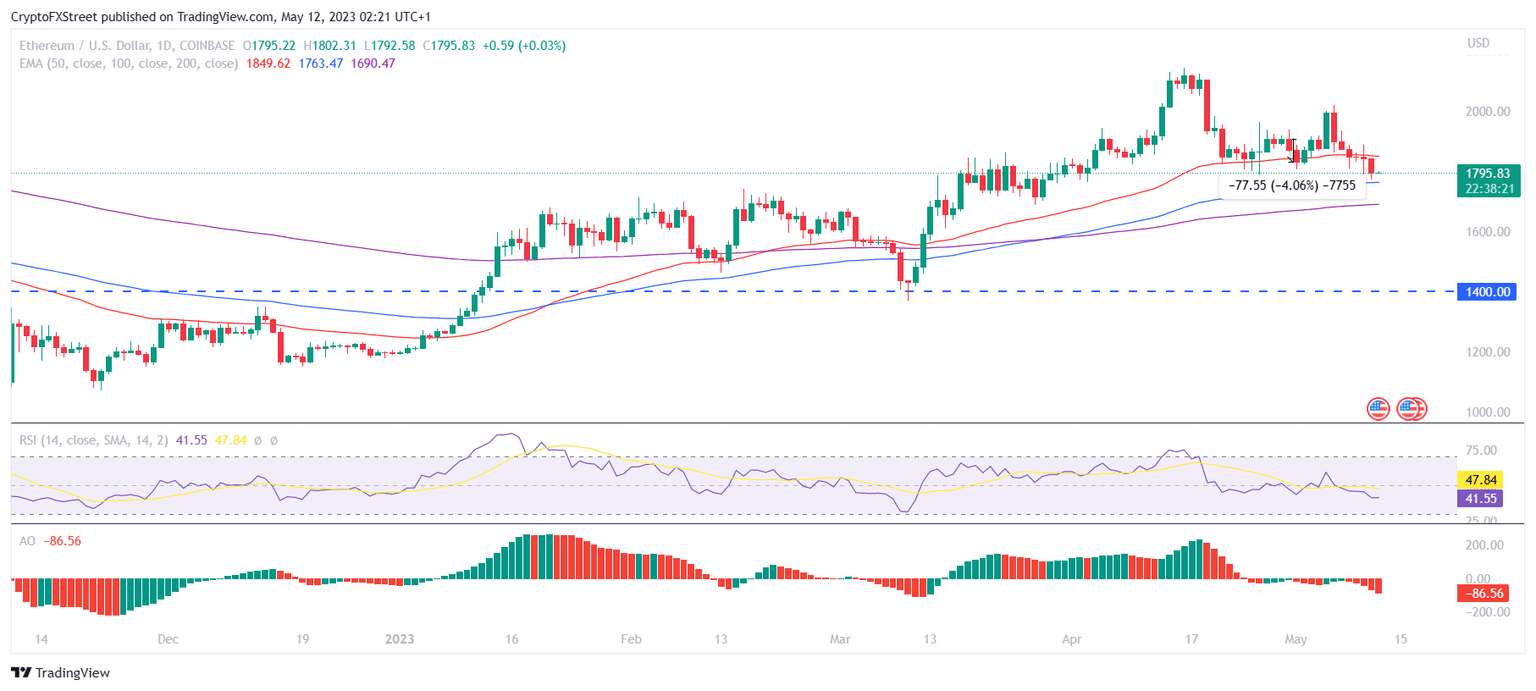

Ethereum price trading at $1,795 is currently at a monthly low, following a decline of more than 10% in the last few days. The concern of losses among the investors could have actually driven the price down further, but the optimism outweighed the fear, preventing a drastic drawdown.

Most of this fear was visible only in the large wallet holders who seemed to have bolted at the first sign of a potential decline. The addresses holding between 100,000 to 1 million ETH shed their balance by almost 1 million ETH worth $1.7 billion since the beginning of May, bringing it to 20.6 million ETH. Similarly, the cohort with a balance of 1 million to 10 million ETH in their wallet sold off over 200 million ETH in the same duration.

Ethereum whales’ balance

This selling began first after Ethereum price posted two back-to-back red candles towards the end of April, noting a 4% drop, which could’ve convinced these cohorts that a decline was on the way. This resulted in the selling noted above. However, some others saw it as an opportunity to churn some gains and accumulated ETH before the market recovered. (ref. ETH/USD 1-day chart)

As per the total supply present on cryptocurrency exchanges, at the beginning of the month, exchange wallets held about 13 million ETH. However, at the time of writing, this supply came down to 12.4 million ETH, suggesting about 600,00 ETH worth $1.07 billion was picked up by investors.

Ethereum supply on exchanges

Interestingly, intentional or not, this accumulation ended up preventing a further decline in Ethereum price. Although the second-generation cryptocurrency is slightly below the $1,800 mark, it is still holding its own, keeping above $1,700.

This price level coincides with the 200-day Exponential Moving Average (EMA), which acts as the critical resistance for the cryptocurrency. Although it cannot be said with absolute certainty, looking at the market, there is a chance that ETH might recover before falling further.

ETH/USD 1-day chart

Nevertheless, a decline to the $1,700 mark only warrants a 5.5% drawdown and losing this level could result in the Ethereum price falling to March lows of $1,430. As it is, the Relative Strength Index (RSI) is in the bearish zone below the 50.0 neutral mark, further increasing the odds of a decline.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B06.51.03%2C%252012%2520May%2C%25202023%5D-638194549569079451.png&w=1536&q=95)

%2520%5B06.51.14%2C%252012%2520May%2C%25202023%5D-638194549859371902.png&w=1536&q=95)