Bitcoin, Ethereum and Ripple price crashes, liquidations hit nearly $500 million as XRP hype dissipates

- XRP, XLM and other altcoins enjoyed massive gains after Ripple’s partial win against the SEC.

- The weekend, however, looks bleak, with liquidations in the past 48 hours reaching as much as $473 million.

- As the bearish momentum declines, investors on major exchanges turn bearish.

Bitcoin (BTC) price showed weakness late on July 14, causing it slip below $31,000. This move from the pioneer crypto dampened the bullish momentum that arose on July 13 after the judge ruled partially in favor of Ripple in the long-standing United States Securities and Exchange Commission (SEC) vs. Ripple lawsuit. While Ripple’s XRP more than doubled, its competitor Stellar (XLM) token, shot up 107% in under 24 hours. Other altcoins like Cardano (ADA) also saw massive gains. But as the weekend rears its head, the optimism seems to be dissipating.

More Ripple/XRP coverage

XRP update: Ripple win in landmark SEC case likely puts XRP and crypto market in jeopardy for these reasons

Can XRP price hit $1? Watch these levels next

Breaking: Ripple records landmark win against the SEC as court rules XRP is not a security except...

Crypto markets bleed as bulls disappear

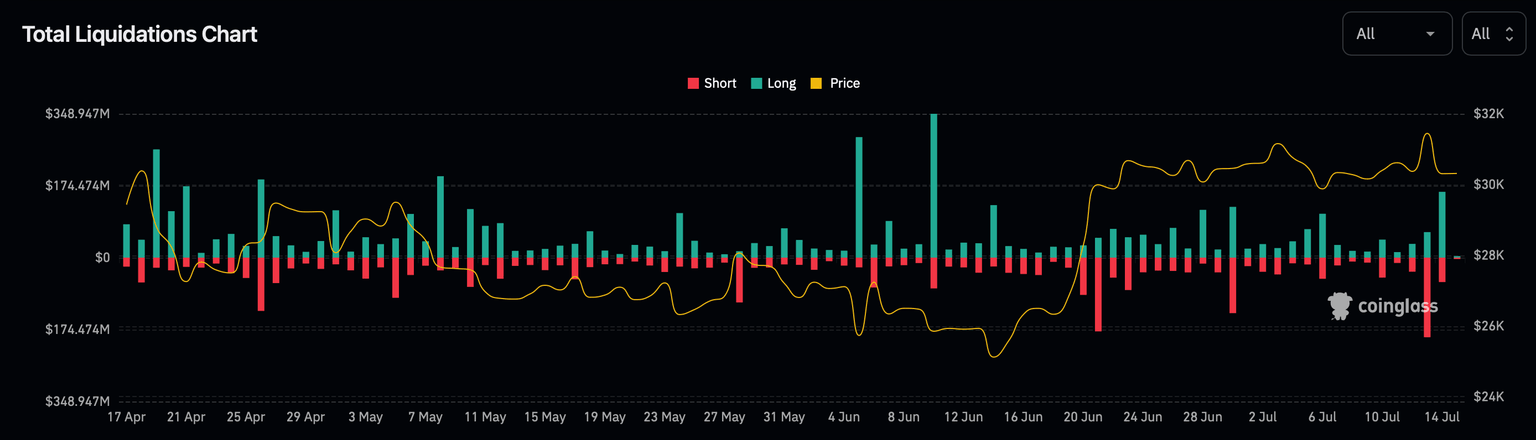

From the announcement of Ripple’s partial win against the SEC on July 13 to date, $473 million worth of positions have been liquidated, according to data from CoinGlass. As seen in the chart below, there are massive short and long liquidations on July 13 and 14, respectively. The last time a liquidation event of this magnitude occurred was between June 5 to 10.

Total Liquidations chart

XRP price, which exploded from $0.469 to $0.938 on July 13, has since dropped 22% and currently trades at $0.726.

Ripple’s close competitor, XLM price went from $0.0953 to $0.197 and has since shed a whopping 32% and currently auctions at $0.133.

Why the sudden shift in market sentiment?

The stark shift in the mood of investors could be attributed to three reasons:

- An inherently bearish market outlook before the announcement of the SEC vs. Ripple lawsuit decision.

- More commentary on the lawsuit started surfacing after the initial announcement, which allows the SEC to contest the decision in the second circuit court of appeals. Moreover, the decision is partly a win for the commission as well since XRP sold to institutions constitutes security.

- Mean reversion; markets often revert to mean after the hype or frenzy dissipates, and the ongoing pullback could be just that.

Due to the aforementioned reasons, the crypto markets seem to be returning to the mean, undoing recent gains. A sign of this can be seen as investors on exchanges have flipped their narrative to bearish.

Read more: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Weekend price swings to kick in

Like this article? Help us with some feedback by answering this survey:

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.