Cosmos price sees bulls playing a dangerous game as failed bear trap could turn into a nasty sell-off

- Cosmos price sees bulls abandoning control of the price action.

- ATOM is trading further away from the important moving average on the topside.

- Although it looks like bulls want to try and make a bear trap, the plan could blow up in their face.

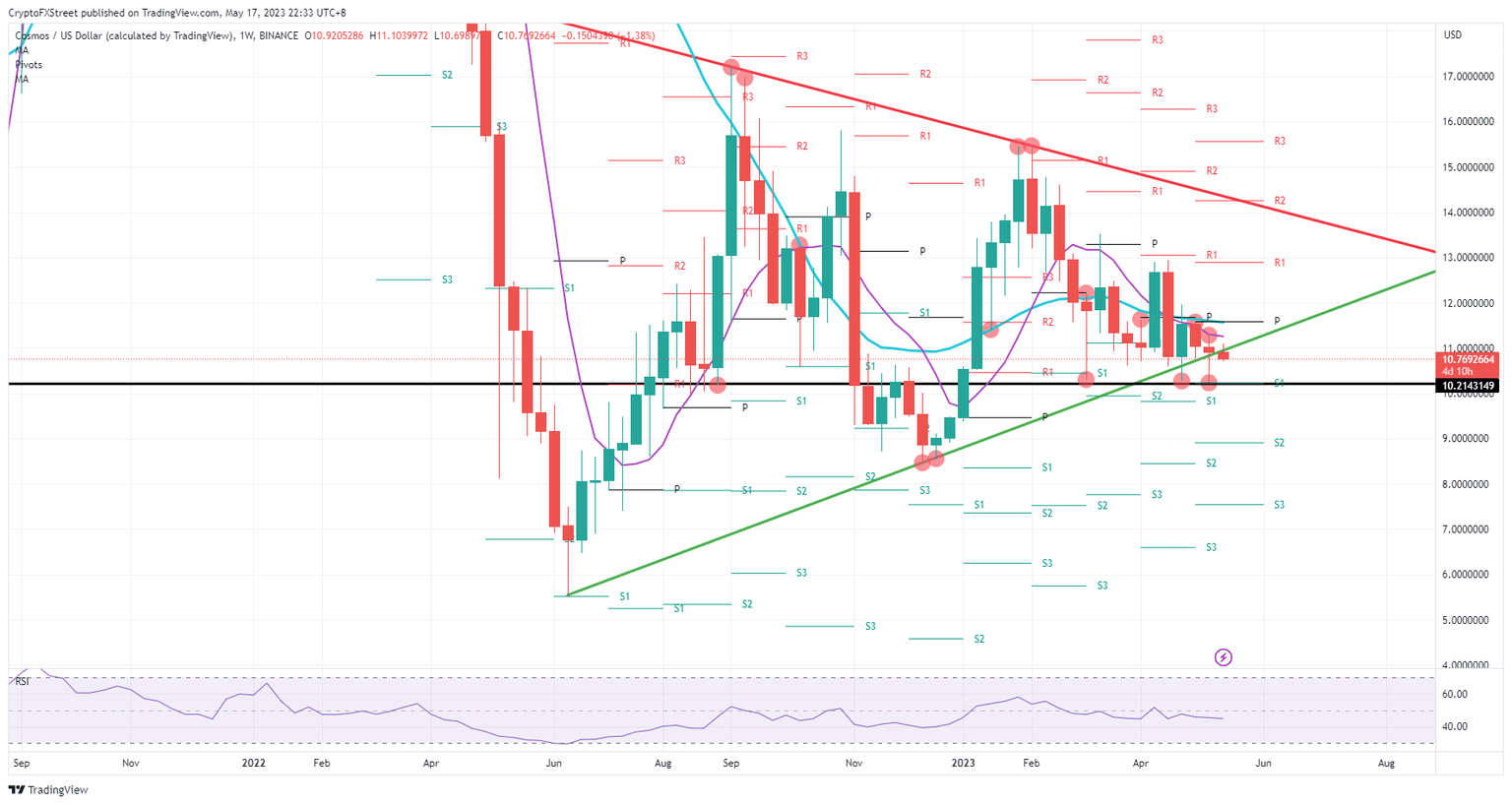

Cosmos (ATOM) price is heading further away from the important 55-day Simple Moving Average (SMA), which has acted as quite a good guideline in the past few weeks and months. As that happens, price action is as well trading outside the pennant that has been going on since 2022. Although this looks like a bear trap, bulls could end up being the ones that get pushed out of their position with ATOM dropping 20%.

Cosmos price sees bulls playing with fire

Cosmos price has been stuck in a pennant formation for the most part of 2022 and 2023, and that same pennant is showing cracks. Already during these past few weeks there were brief breakouts with pullbacks back in the pennant’s barriers. This time could be different as bulls could go for a bear trap here.

ATOM though could be playing a whole other ball game this time as the 55-day SMA is starting to steepen to the downside, and the 200-day SMA is starting to show signs of a Death Cross formation. This means that price action could drop back to $10.21 and breach it this time. The end result will be a falling knife to $8.43 that brings a 20% loss with it.

ATOM/USD weekly chart

Bulls could still be victorious and pull the price action back into the pennant however. Should they be able to break back above both the 55-day and the 200-day SMA, the road would be open to cross to the topside and head toward $14 with a nice 30% price adjustment.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.