JUP price primed for a liftoff as Jupiter Exchange introduces LFG round 3 candidates

- Jupiter Exchange’s round 3 vote for the next projects to launch on the platform has started.

- deBridge, Divvy.Bet, and Exchange Art to feature on LFG Round 3 vote slated for May 22.

- Sanctum, UpRock merited to debut on the DEX after 64% and 20% votes, totaling over 230 million staked JUP tokens.

- Second launchpad vote on April 22 had catapulted JUP token price 5%.

After a successful second round in May, the Jupiter Exchange has introduced candidates for its third launchpad (LFG). The Solana-based decentralized exchange (DEX) has been holding LFG votes to identify projects that will debut on its platform.

Also Read: Jupiter DEX second Launchpad vote concludes, JUP price rises 5%

Jupiter DEX’s round 3 LFG commences

The Jupiter DEX revealed participants for its third series LFG vote on Monday, with three projects, deBridge, Divvy.Bet, and Exchange Art feature, meriting the list of contenders for the next ecosystems to launch on the Jupiter platform.

Introducing the candidates for LFG Round 3: @deBridgeFinance, @DivvyBet, & @ExchgART

— Jupiter (@JupiterExchange) May 13, 2024

They're going to be answering your questions, sharing their plans, and trying to win your support over the next 9 days

Then, on May 22nd, it's time to vote!

More about each team below pic.twitter.com/Srkq5Va9qs

In the previous series, the record voter turnout saw Sanctum and UpRock ascend, with votes recording up to 230 million in staked JUP in Votes. This comprised 64% (146,758,089) votes in favor of Sanctum while 20% (45,463,495) went to UpRock.

deBridge is a high-performance and secure interoperability layer for Web3, enabling decentralized transfers of arbitrary messages and value between blockchains. The validation of cross-chain transactions is performed by a network of independent validators who are elected by and work for deBridge governance.

Divvy.Bet (DVY) is a gaming and casino project on Solana, advertised as being able to deliver a “Frictionless betting experience…Pioneering in the BetFi revolution.”

Exchange Art feature digital fine art marketplace on Solana, powering the creator economy in the digital world.

According to @0xSkeleton on X, the vote is “going to be close between deBridgeFInance and Exchange Art,” with their bets going for the former.

As the vote continues, JUP holders could experience some price volatility. Amid the competition, the future of the LFG program looks even brighter.

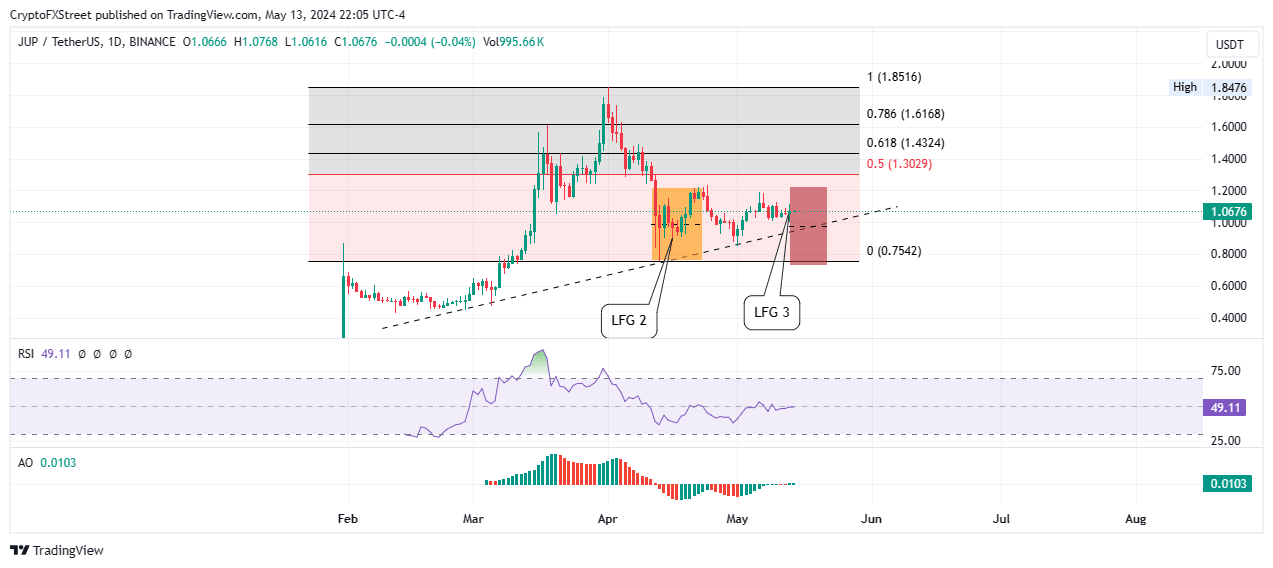

At the time of writing, JUP token is trading for $1.0676, holding well above an ascending trendline. As part of a typical ‘buy the rumor’ situation, the DEX token’s market value could rise ahead of May 22 before a ‘sell the news’ event wipes out the ground covered.

JUP/USDT 1-day chart

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.