Compound Price Analysis: COMP at risk of losing critical support level and falling lower

- Compound was one of the most successful DeFi projects reaching a market capitalization of $804 million.

- COMP quickly retraced and lost around 50% of its initial value one month after its listing.

No one can deny the initial success of Compound. The DeFi superpower had one of the best listings in the crypto world, reaching more than $300 within a few days.

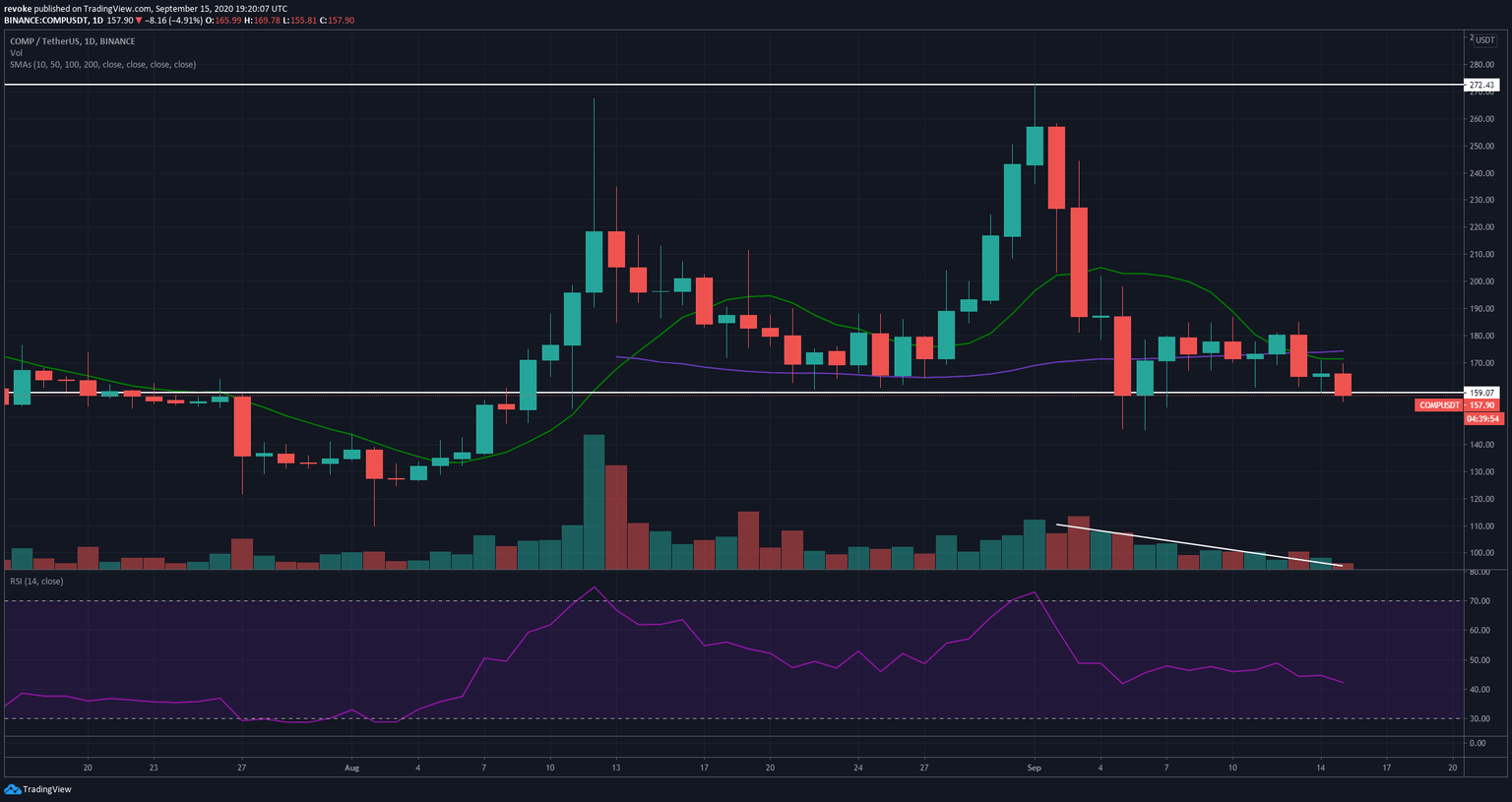

COMP/USD daily chart

COMP bulls have been holding a crucial support area around $159 for quite some time. The price has poked through the support level a few times, but bulls have always managed to push it back up.

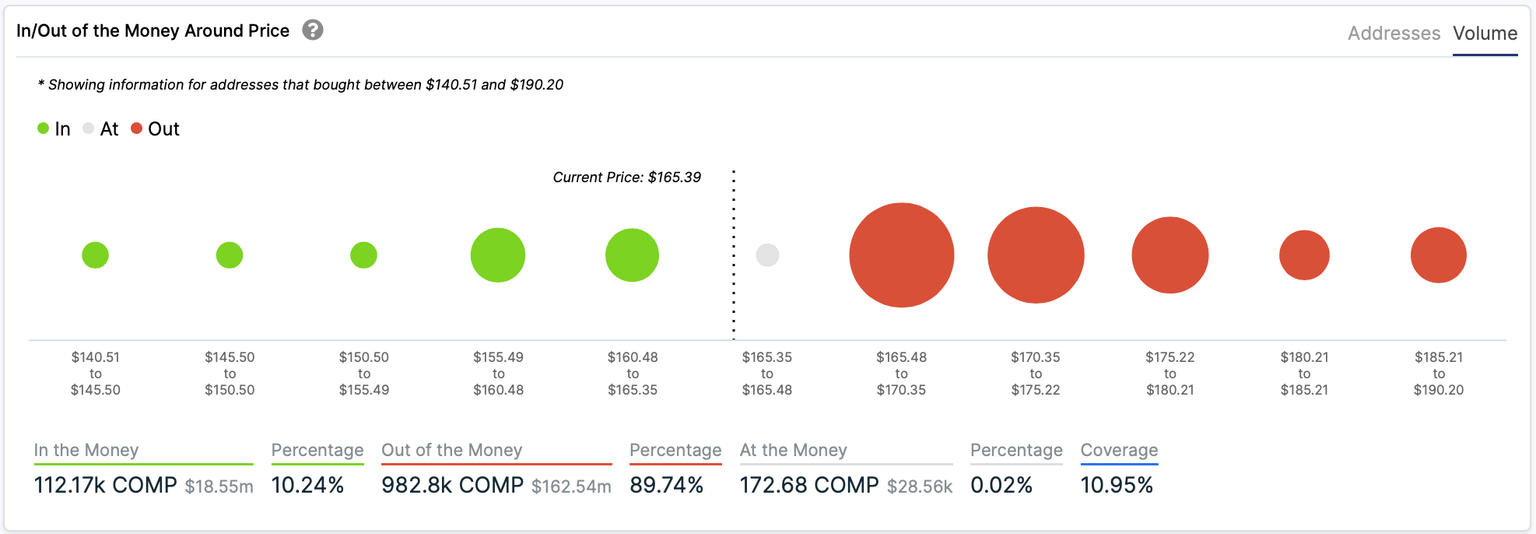

COMP IOMAP chart

Looking at the IOMAP chart, we can see the biggest support area is around $159; however, resistance and selling pressure is clearly far stronger and indicates COMP is at risk of quickly dropping below $159.

On the other hand, the pullback from $272 was accompanied by a slow decrease in trading volume, indicating a lack of strength by the bears. The 10-SMA and the 50-SMA are both acting as resistance levels. A bounce from $159 could push the digital asset towards $170.

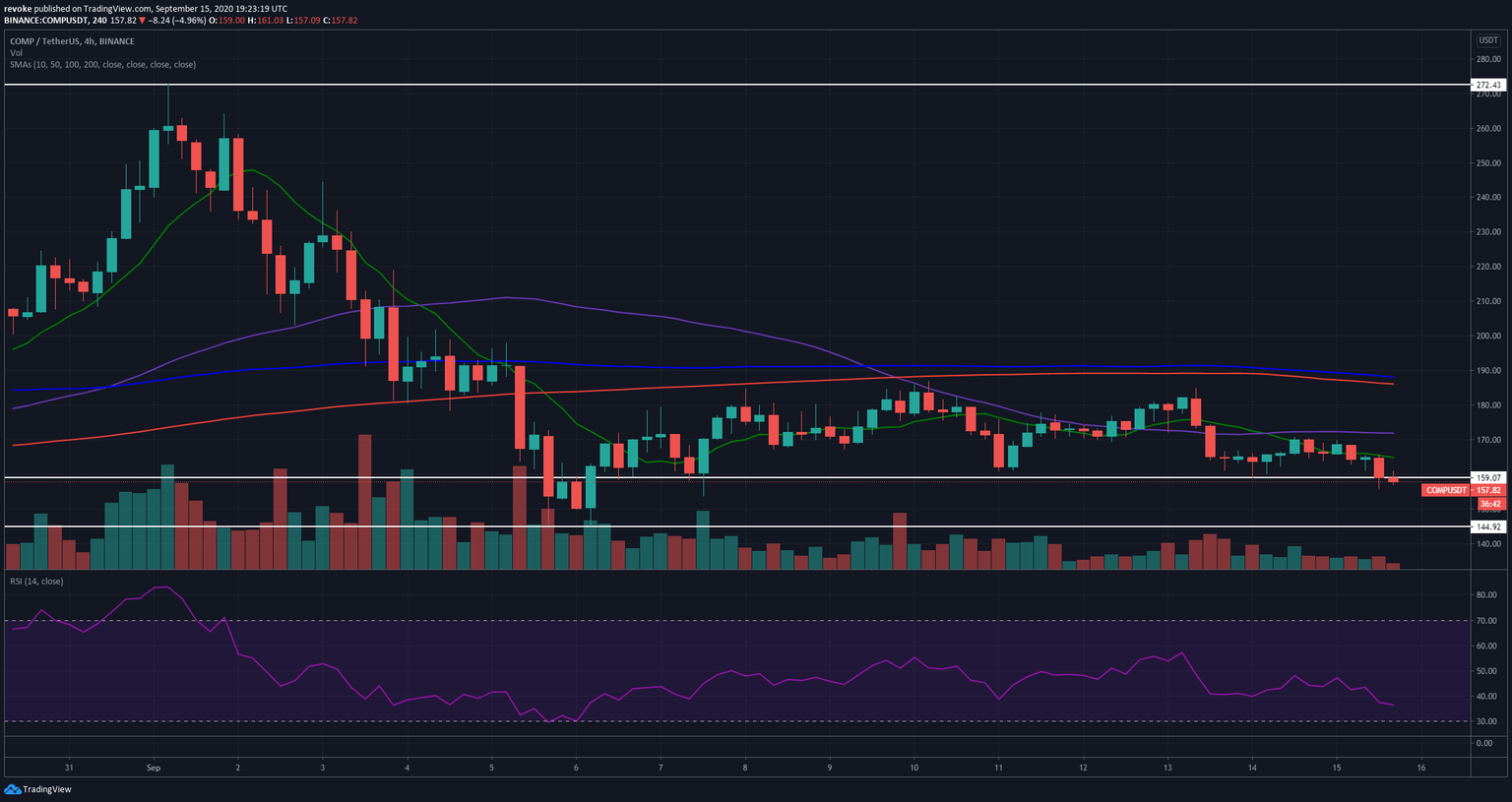

COMP/USD 4-hour chart

Unfortunately, it seems that bears have the upper hand as COMP is currently trading right below $159 and is struggling to recover. The RSI is not yet overextended, and the next support point is down at $153.72, but this is not a healthy support level. A clear break and close below $159 would be catastrophic considering the intense selling pressure and will push COMP to the low of $145 and possibly below.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.