Justin Sun is boosting the value of Tron making use of the DeFi craze

- Justin Sun, the founder of TRON, has recently announced the launch of SUN genesis mining.

- TronFi is a decentralized development platform focused on the success of TRX.

The launch of SUN Genesis Mining had a significant impact on the price of TRX. The foundation calls it a 'meme' coin and states that its purpose is to focus on TRON's decentralized finance potential.

(1/5) I am glad to announce that we have decided to launch $SUN Genesis #Mining. ⛏️

— Justin Sun (@justinsuntron) August 31, 2020

#SUN, manifesting total #community self-governance, is a living demonstration in the coalescence of encryption with artistic expression.https://t.co/F7HNajPfQc

We understand that a series of self-governance communities such as MakerDAO, Compound, AAVE, YFI, etc. have emerged on Ethereum. We hope to use SUN to promote the vigorous development and possibilities of TRON's DeFi self-governance community.

Even more recently, 1inch's Mooniswap announced the integration with the TRON blockchain, which aims to allow liquidity providers to increase their earnings further and slow down volatile price movements.

Tron has been outperforming the market thanks to Justin Sun

Back on September 3, when the entire crypto market was collapsing, Tron broke out with a 45% price move. TRX did eventually drop but has been able to bounce back harder thanks to other developments.

TronFi, a decentralized development platform for Tron launched Pearl Finance, a classic farming platform that allowed users to farm PEARLs using USDJ, the Tron stablecoin, and JUST (JST). Additionally, the platform also launched SalmonSwap, which allowed users to farm SAL using TRX liquidity pairs, further boosting Tron's price.

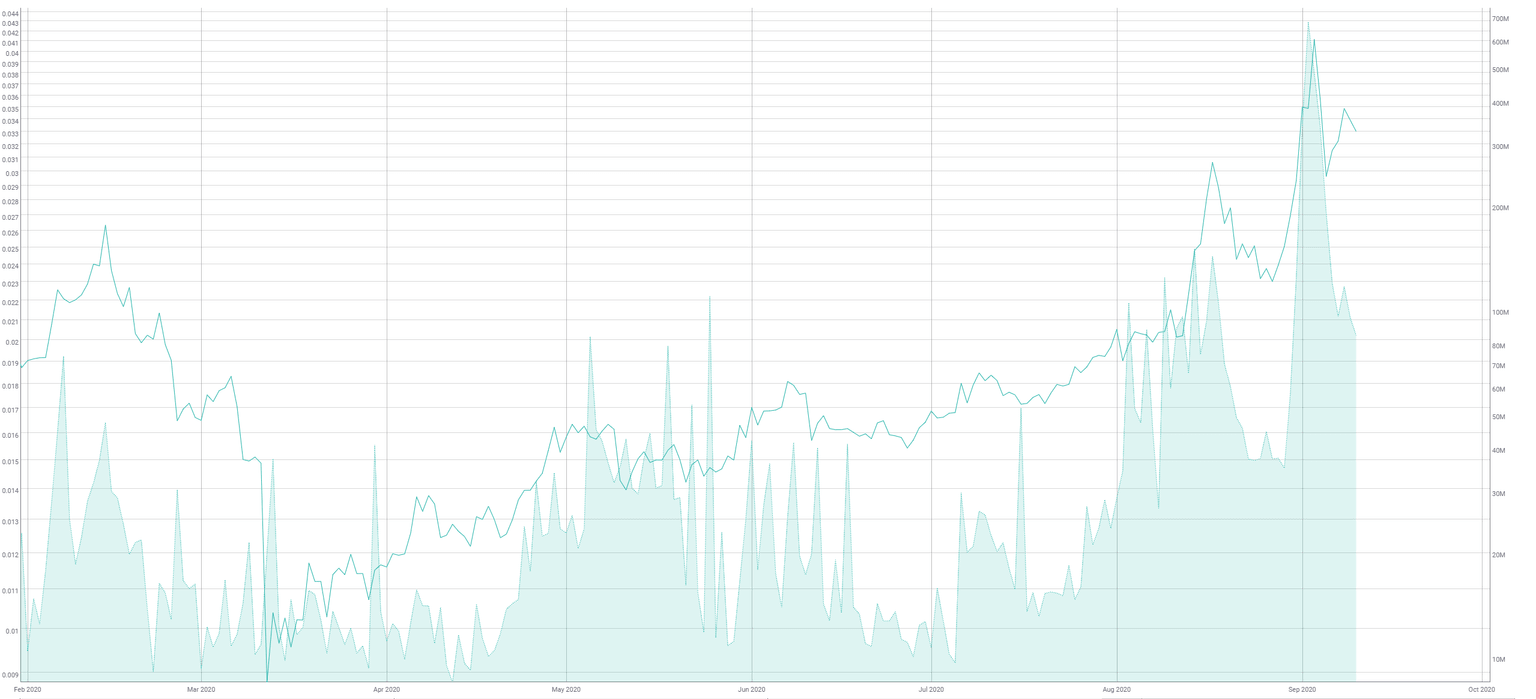

TRX/USD daily chart

The price of TRX has created a clear equilibrium pattern with a lower high and a higher low. Bulls would need to crack $0.0359, the lower high to break out from the pattern towards $0.05 again. The total number of transactions performed by Tron users has increased significantly after the recent price spike indicating that the move is not artificial, giving the bulls a better chance to see a breakout.

The bearish scenario would be Tron slipping below $0.027 straight into the 50-MA at $0.025. The next support level will be $0.022, followed by the 100-MA at $0.021.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637354454819987395.png&w=1536&q=95)