Chainlink primed for a short squeeze that catapults LINK to $26

- Chainlink price has suffered major retracements since the middle of November.

- LINK has suffered losses in excess of 60% from the November high.

- A mean reversion test to $26 is highly probable.

-637336005550289133_XtraLarge.jpg)

Chainlink price action, like the majority of the cryptocurrency market, has suffered some intense sell-offs and moves into possible bear market territory. However, buyers have been able to stave off a clear bear market level within the Ichimoku system – and this has developed a possible early entry on the Point and Figure chart.

Chainlink price develops aggressive, bullish buy opportunity

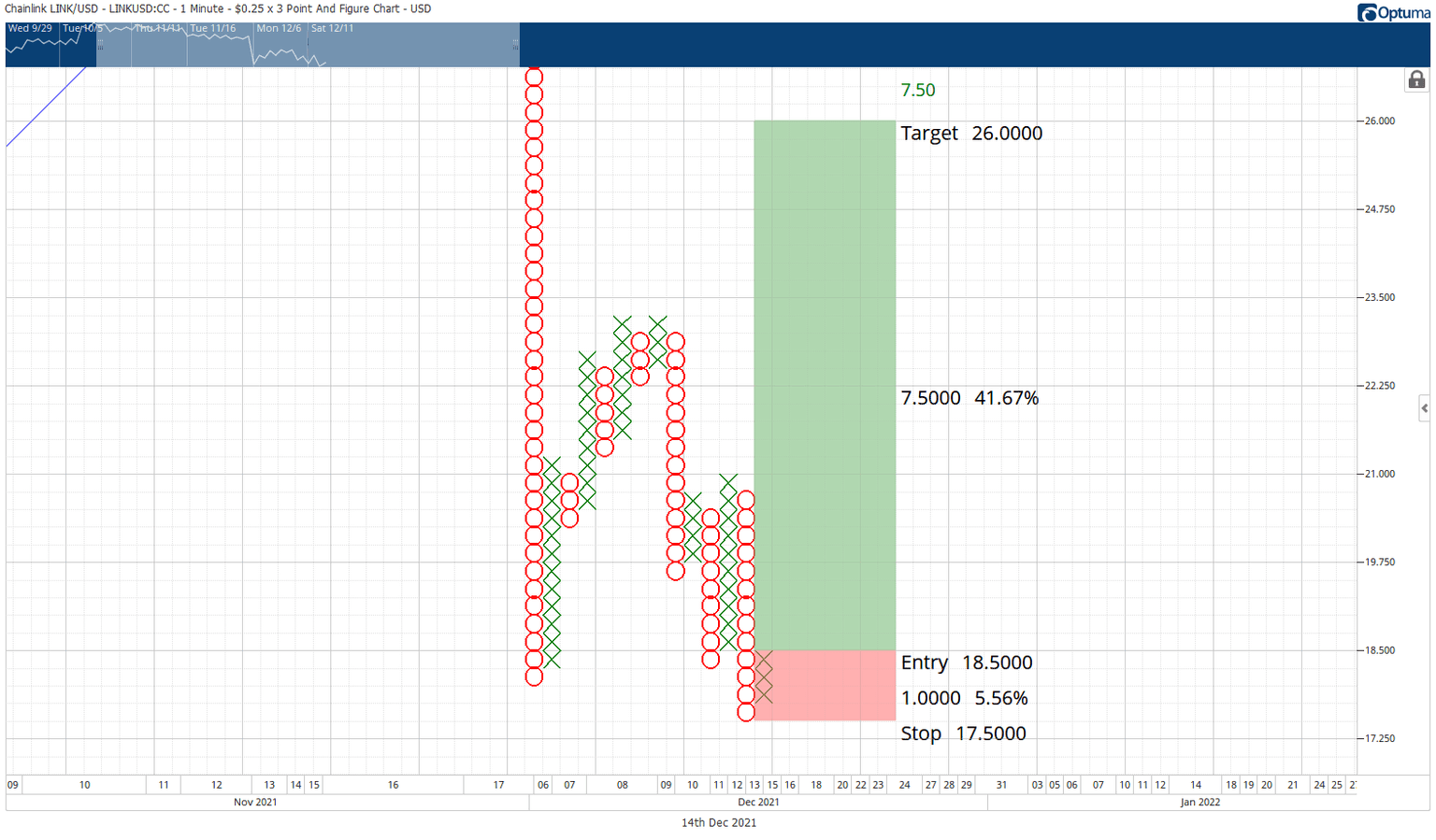

Chainlink price could be poised to regain its mantle of a leader and outperformer of the cryptocurrency market. Its $0.25/3-box Reversal Point and Figure chart has developed one of the most potent bullish reversal patterns in Point and Figure analysis: the Bullish Shakeout.

The Bullish Shakeout is only valid if the broader market has been in an uptrend (which Chainlink has been in). The Bullish Shakeout is also a progenitor of new rallies and bullish continuations – they are often where the exact major or minor swing lows appear.

The hypothetical long entry idea for Chainlink price is a buy stop order at $18.50, a stop loss at $17.50, and a profit target at $26.00. This trade represents a 7.50:1 reward for the risk. The profit target is derived from the Vertical Profit Target Method in Point and Figure Analysis. A trailing stop of two to three boxes would help protect any implied profit post entry.

The profit target coincides with a massive confluence of resistance zones on the weekly Ichimoku chart. Between the $25.50 and $29.00 price ranges are the 50% Fibonacci retracement ($25.50), the weekly Kijun-Sen ($25.88), the weekly Tenkan-Sen ($26.86), Senkou Span B ($28.46), and the 38.2% Fibonacci retracement ($29.00). Therefore, for Chainlink price to return to a clear bull market, it will need to close at or above the $35 value area.

LINK/USDT $0.25/3-box Reversal Point and Figure Chart

To invalidate the expected bullish bounce, Chainlink price would need to have a daily or weekly close below last week’s low of $15.30. In that event, a new flash-crash to the 2021 low at $10.30 is highly probable.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.