Chainlink Price Prediction: LINK edges closer to 37% breakout

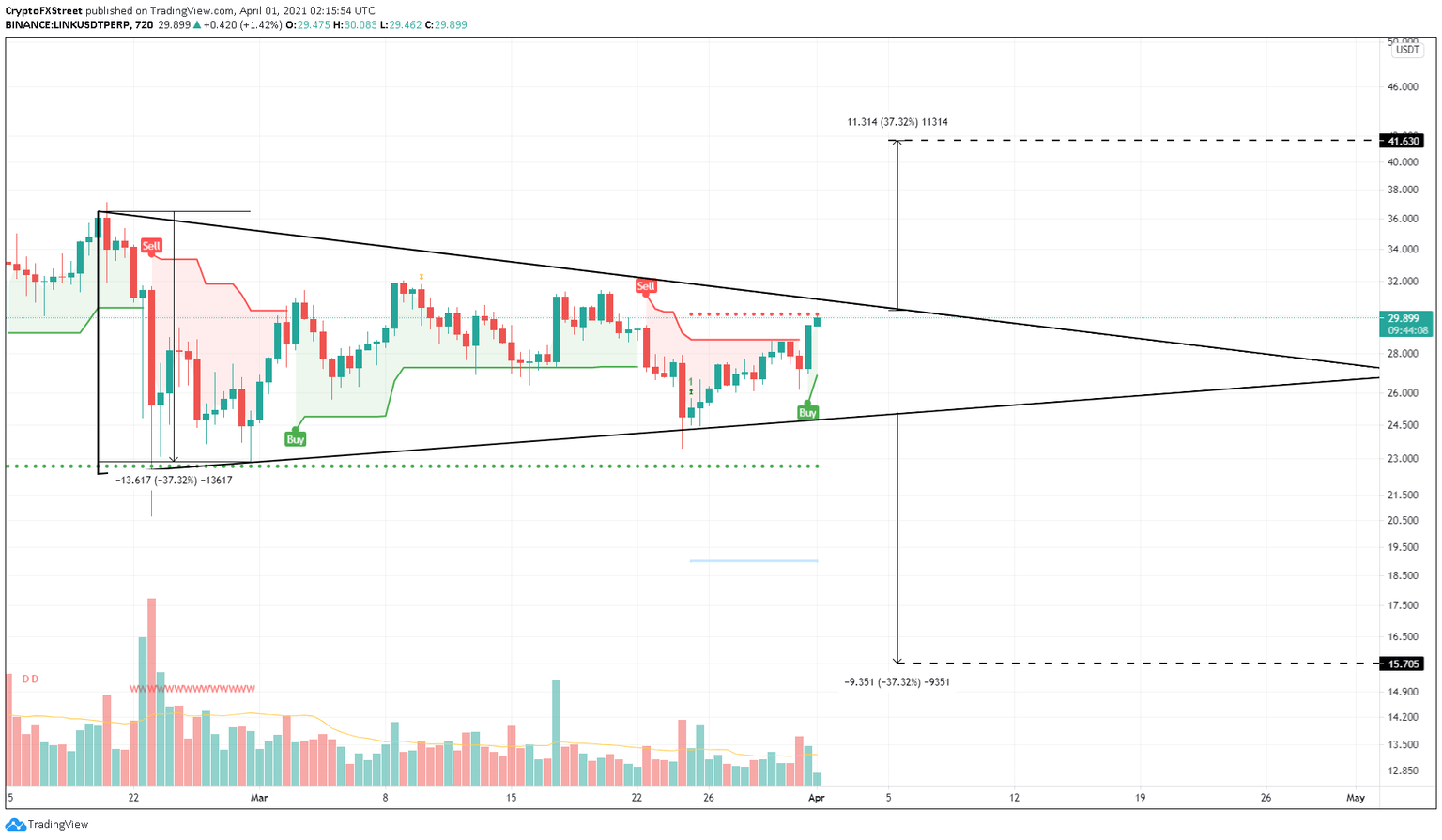

- Chainlink price has been range-bound inside a symmetrical triangle pattern.

- The recent 11% pump has brought LINK closer to the upper boundary, hinting at a bullish trajectory.

- SuperTrend indicator adds credence to the optimistic outlook for the oracle token.

-637336005550289133_XtraLarge.jpg)

The Chainlink price ranges closer toward the symmetrical triangle pattern’s upper trend line, suggesting a breakout could be possible shortly.

Chainlink price eyes higher high

The Chainlink price has created multiple lower highs and higher lows since February 20 on the 12-hour chart. When the swing highs and lows are connected using trend lines, LINK shows that it is consolidating in a symmetrical triangle pattern.

This technical formation has no inherent bias and results from aggressive camps on both sides trying to take control of the asset. Hence, a breakout confirmation arrives after the Chainlink price slices through either of the trend lines.

Regardless, the setup forecasts a 37% move, determined by measuring the distance between the pivot high and low at the broadest part of the pattern. Adding this distance to the breakout point reveals the target.

A bullish breakout above $30.3 could push LINK to $41.6, but a breakdown of the lower trend line at $25 might result in a sell-off to $15.7.

If the recently flashed buy signal from the SuperTrend indicator pushes the oracle token above $30.3, an upward breakout seems likely. Creating a higher high at $32 will provide a decisive confirmation for the upward move and serve as a foothold for the climb toward $41.6.

LINK/USDT 12-hour chart

A spike in selling pressure leading to a rejection at the upper trend line and a subsequent close below $25 will trigger a bearish outcome for LINK.

In that case, the Chainlink price might drop toward the Momentum Reversal Indicator’s State Trend Support at $22.7. A breakdown of this level will invalidate the bullish outlook, resulting in a 16% sell-off to the next demand barrier at $19.

If the bearish momentum persists, sellers might even push LINK toward $15.70.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.