CFTC Chair proposes strengthening Digital Commodities bill citing FTX collapse

- Commodity Futures Trading Commission's Chairman Rostin Behnam demanded broader authority over crypto exchanges.

- Rostin Behnam also suggested revisiting Digital Commodities Consumer Protection Act (DCCPA) bill to ensure no loopholes.

- Bitcoin price slipped to $16,972, preparing to reclaiming $17,577 as the support floor.

The Chairman of the Commodity Futures Trading Commission (CFTC), Rostin Behnam, testified in the Congressional hearings against FTX on Thursday. Benham made some significant statements regarding regulation and authority, as well as the need to take another look at the Senate bill.

CFTC asks for more power

CFTC's Rostin Behnam stated to the Senate Agriculture Committee that his agency could not have prevented FTX's downfall. He defended this by saying that since FTX was not regulated by the CFTC, it had no power over the exchange.

Consequently, during the Congressional hearing, Behnam asked for more authority over spot cash market exchanges. If granted, this would make CFTC the first federal agency to regulate this space.

He further stated that regardless, a crisis such as FTX's collapse could have been avoided had the Digital Commodities Consumer Protection Act (DCCPA) been turned into a law. This bill would look to ban the commingling of funds, which was the primary reason behind FTX's breakdown.

Not only this, but Benham also suggested that before the bill is passed, it would be wise to revisit it once again. This would give the agency a second look to ensure that the bill does not have gaps or holes in it. He said,

"Where the bill may be strengthened [is] disclosures around financial information of the entity, the crypto entity and conflicts of interest, obviously an issue that many members have talked about today, given the brazen conflicts that occurred at the non-regulated entity."

Regardless, Benham intended to gain much more authority over other crypto industry players. He demanded the opportunity to oversight spot markets and suggested passing the bill as he stated,

"We need to move forward as soon as possible. We don't want this to happen again in the next few months and have the risk of customers losing money because of these gaps."

Bitcoin price nears recovery

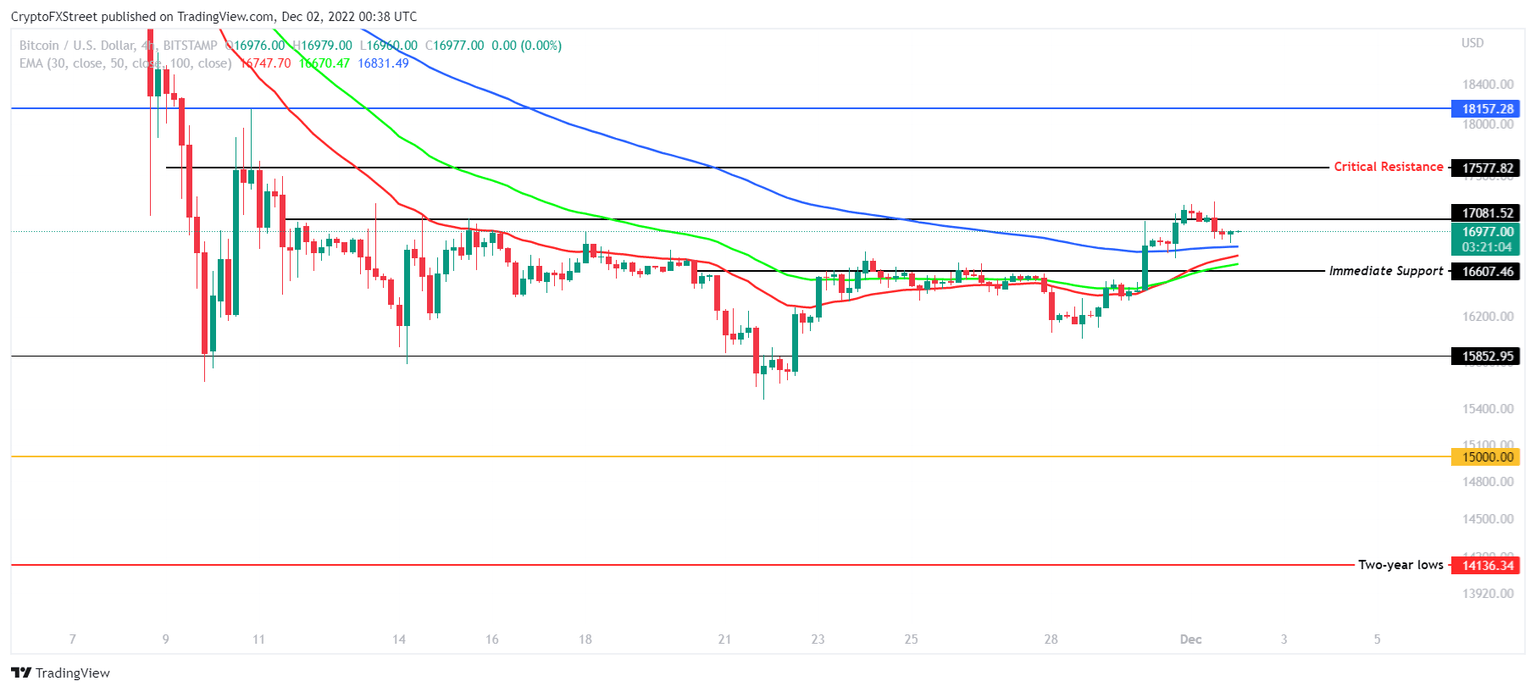

Bitcoin price declined to trade at $16,977 at the time of writing. Over the last 24 hours, BTC has breached through and lost the support of $17,081 and is looking to initiate another rise towards $17,577.

Currently, the cryptocurrency is showing positive signs, with the 30, 50, and 100-day Exponential Moving Averages (EMA) acting as support levels. If BTC reflips $17,081 into support, it could receive some buying pressure from traders. This will allow Bitcoin Price to reinitiate the surprise run-up towards $17,577 and extend it to $18,157.

BTC/USD 4-hour chart

On the other hand, a drawdown in price will push BTC to tag the immediate support at $16,607. The next critical support for the cryptocurrency is at $15,852. A daily candlestick close below this level would invalidate the bullish thesis, leading to Bitcoin price tagging the psychological support at $15,000.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.