Cardano witnessed strength at $1 support as ADA awaits move to $1.42

- Cardano price has held the $1 value area with significant strength and buying.

- ‘Smart money’ positions have more than doubled their ADA holdings.

- A bullish rise seems imminent.

Cardano price continues to hold on to the $1 value area as its primary support zone. A massive amount of buying within that value area has occurred over the past ten days, with more accumulation occurring every day. The net result of this buying behavior is an anticipated rally.

Cardano price action eyes a return to $1.42 as bulls maintain intense buying pressure at $1

Cardano price could soon see a nice rally coming soon. The current trading range is one of the most constricted Cardano has traded over the past few years. It is anticipated that a bullish breakout will be at least three times as high as the consolidation zone was long.

One of the primary reasons for anticipating a bullish break is a recent alert from Santiment, highlighting the accumulation of ADA at the $1 value area. Santiment Tweeted, “… large addresses hodling between $10k and 1M $ADA, own 113% more in their collective bags since the drop on January 17th, accumulating $53.6M in tokens.”

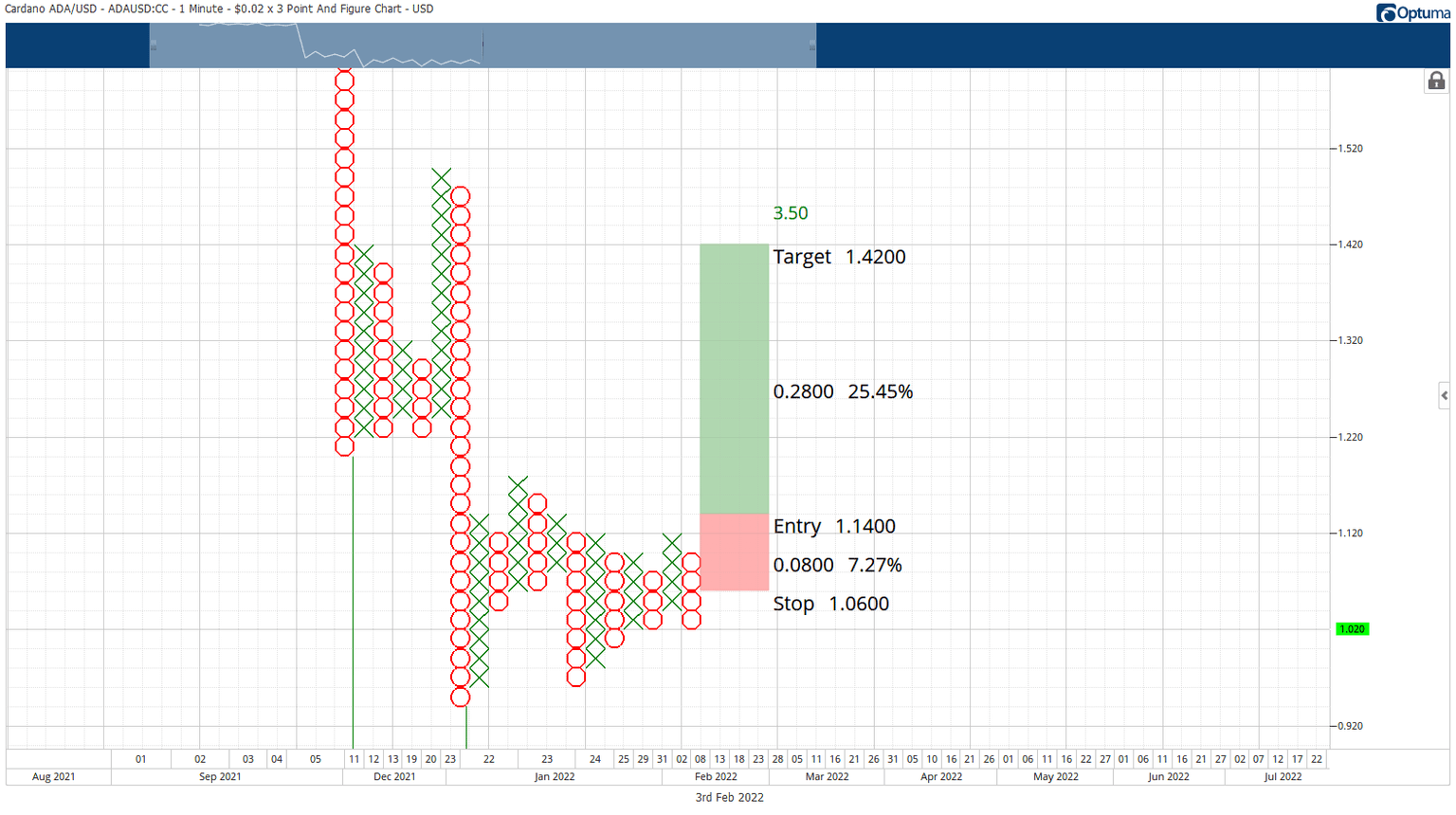

A hypothetical long entry now exists on the Point and Figure chart of Cardano price. The entry is a buy stop order at $1.14, a stop loss at $1.06, and a profit target at $1.42. In addition, the entry is based on an Ascending Triple Top pattern, where the entry coincides with a breakout above the upper part of the ten-day trading range.

Ideally, the current O-column would drop another box, creating an opportunity to develop a Bear Trap pattern along with the Ascending Triple Top pattern. Unfortunately, the hypothetical long entry is invalidated if Cardano price drops below $0.96.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.