Cardano price upside capped at $1.26 as ADA recovers recent losses

- Cardano price is seeing a good recovery rate as it rallied 20% over the past ten days.

- Technical and transaction data show that the upside for ADA is capped at $1.26.

- A daily candlestick close below $1 will invalidate the bullish thesis and trigger further losses.

Cardano price shows signs of a bullish outlook but the resulting uptrend is likely to be capped due to multiple hurdles present in its path. Therefore, investors need to exercise caution around ADA and its upcoming rally.

Cardano price continues to move forward

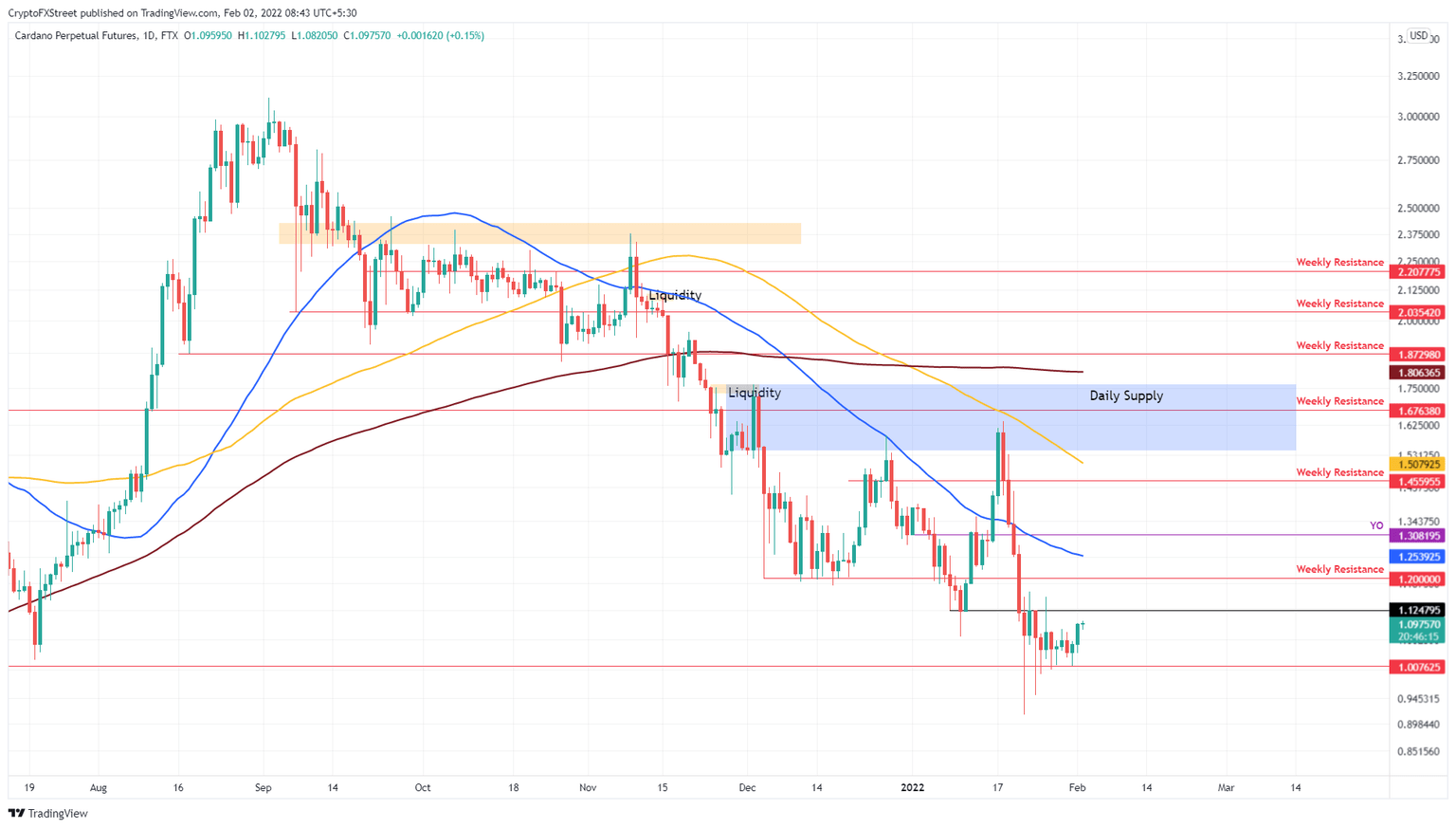

Cardano price saw a 45% flash crash between January 20 and January 22 as a result of a similar occurrence in Bitcoin. Although ADA slid below the $1 psychological level, it did not produce a candlestick close below it. The recovery above this level was quick and so far, ADA has rallied 20% from the bottom and shows signs that this trend will continue.

While the upswing is impressive, it is going to face multiple hurdles in its path. Moreover, this run-up seems to be capped around the $1.26 barrier due to the presence of the 50-day Simple Moving Average (SMA).

ADA/USDT 1-day chart

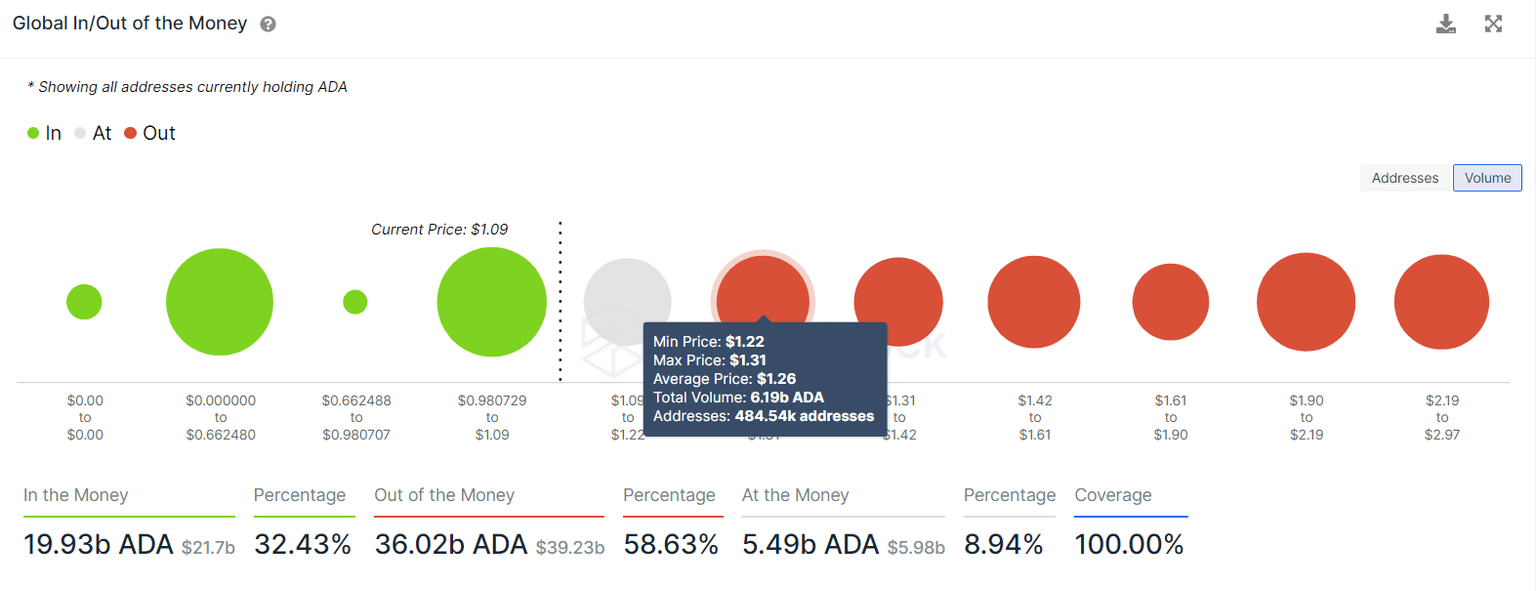

Supporting this ceiling thesis for Cardano price is the transaction data obtained from IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index shows that roughly 484,540 addresses that purchased nearly 6.2 billion ADA at an average price of $1.26 are “Out of the Money.”

Therefore, any short-term buying pressure that pushes Cardano price into this area will experience massive sell-side pressure.

ADA GIOM

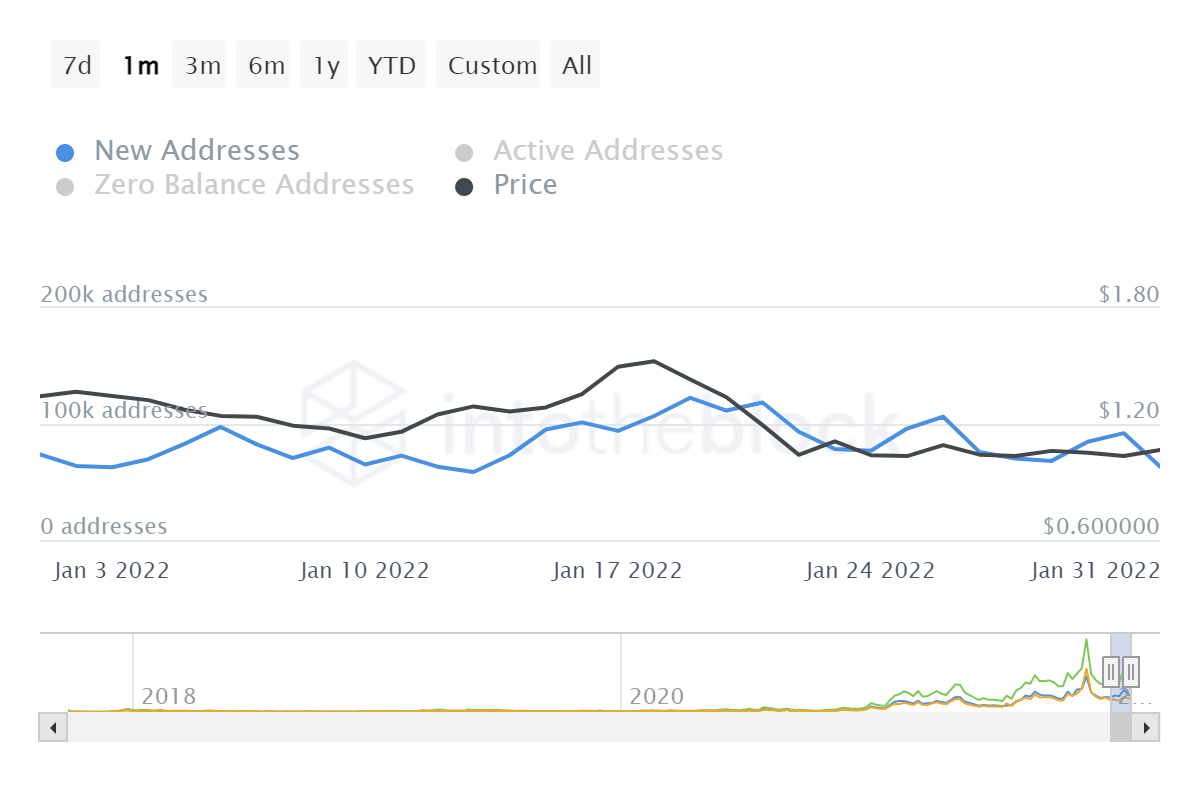

Further suggesting this uptrend will be short-lived is the decline in the number of new addresses joining the Cardano blockchain from 73,780 to 63,310 over the past month. This 14% decline indicates that ADA investors are not interested in the prices at the current levels.

ADA new addresses

Regardless of the bullish outlook, Cardano price faces multiple barriers, rejection at either of these levels could send the altcoin sliding lower to $1. A daily candlestick close below this barrier will create a lower low, invalidating the bullish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.