Cardano price sell-off could extend with bearish on-chain metrics

- Cardano network’s active addresses and new addresses reveal bearish divergence.

- ADA traders are likely to sell the altcoin as potential profits increase, as seen in the MVRV metric.

- Cardano price erased its weekly gains, dropping to $0.3617, early on Tuesday.

Cardano holders brace for the possibility of a correction in ADA price as on-chain metrics of the smart contract blockchain token turn bearish. ADA price could decline in the short-term as traders engage in profit-taking.

Also read: Cardano could face downward correction as whale activity signals increasing selling pressure

Cardano price at risk of correcting lower

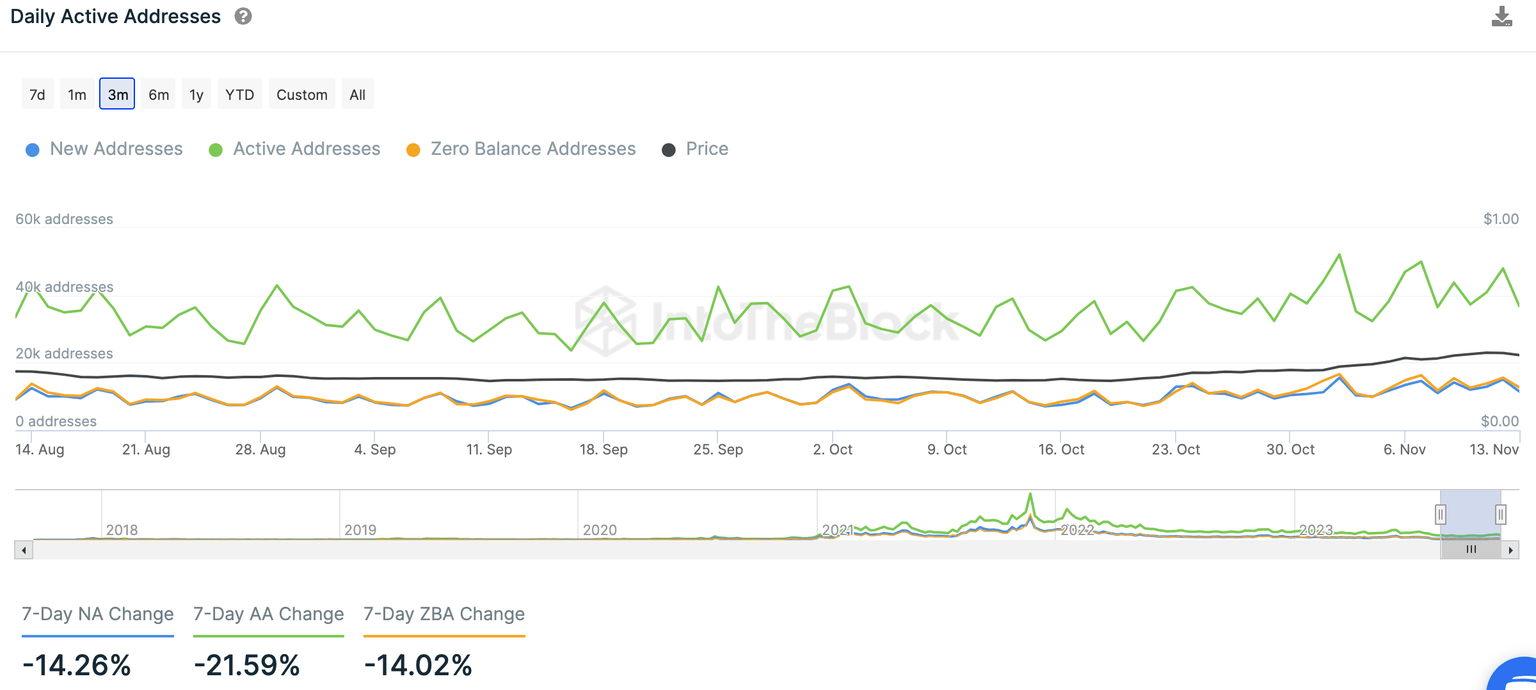

The Cardano price trend’s evolution can be illuminated by examining on-chain metrics. The bullish/ bearish outlook is evident from metrics like Active Addresses and Market Value to Realized Value (MVRV), among others.

For Cardano, while ADA price climbed between November 2 and 11, the Active Addresses and New Addresses were on the decline. This is an example of a bearish divergence, as seen in the chart below. Data from Santiment supports a bearish thesis for Cardano price.

Cardano Active Addresses and Price

Cardano New Addresses and Price

MVRV, the on-chain metric that helps determine the average profit/loss of investors who purchased ADA over the past month, climbed to a local peak of 18.61% on November 10. MVRV is 8.68% on November 14. It can be concluded that ADA traders who acquired the asset within the past thirty days have sold and realized their profits, the metric therefore fuels a bearish outlook for Cardano price.

MVRV Ratio (30 days) and price

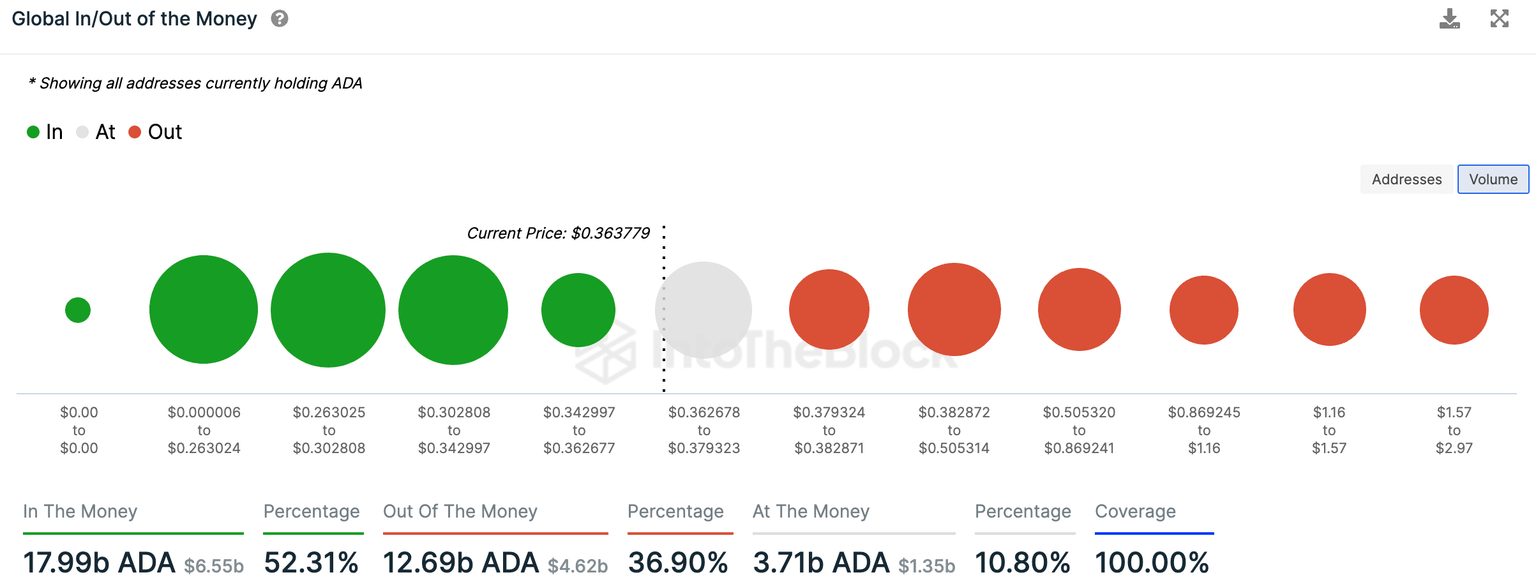

According to data from IntoTheBlock’s Global In/Out of the Money (GIOM) indicator, which shows the volume of buyers at different price levels, 52.31% addresses holding 17.99 billion ADA tokens are currently in profit.

Cardano price is likely to find support between the $0.34 and $0.36 levels, where 203,390 addresses scooped up 1.79 billion ADA tokens.

ADA price faces resistance between $0.36 to $0.37. Once the $0.37 level has been flipped into support, the next resistance is between $0.37 and $0.38, where 53,610 addresses acquired 2.2 billion ADA tokens, as seen in the chart below.

Global In/Out of the Money indicator

At the time of writing, Cardano price is $0.36, on Binance. ADA price is up 2.24% on the day, and remained nearly unmoved over the past week.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B11.27.58%2C%252014%2520Nov%2C%25202023%5D-638355453919765499.png&w=1536&q=95)

%2520%5B11.27.20%2C%252014%2520Nov%2C%25202023%5D-638355454726999837.png&w=1536&q=95)